Hot News Time Value of Money Fintrust Capital Advisors

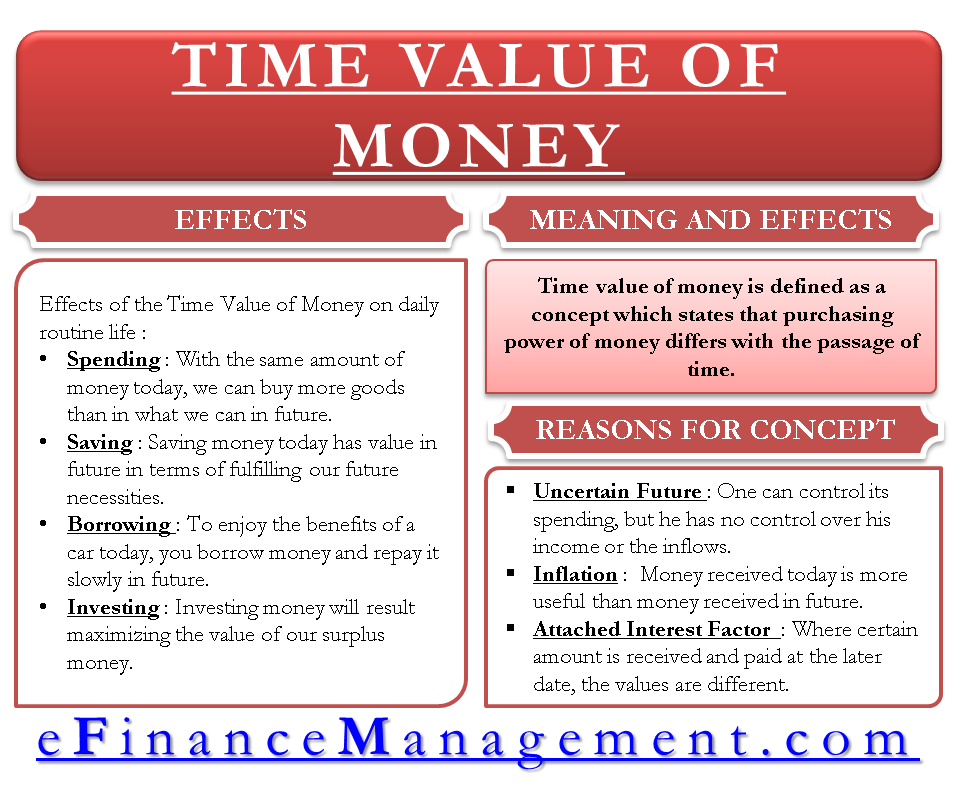

What Is the Time Value of Money? The time value of money (TVM) is a core financial principle that states a sum of money is worth more now than in the future.. In the online course Financial Accounting, Harvard Business School Professor V.G. Narayanan presents three reasons why this is true:. Opportunity cost: Money you have today can be invested and accrue interest, increasing its value.

Time Value Of Money Table Present Value F Wall Decoration

The time value of money is a financial principle that states the value of a dollar today is worth more than the value of a dollar in the future. This philosophy holds true because money today can.

The ultimate guide to the time value of money

PV = $1,100 / (1 + (5% / 1) ^ (1 x 1) = $1,047. The calculation above shows you that, with an available return of 5% annually, you would need to receive $1,047 in the present to equal the future value of $1,100 to be received a year from now. To make things easy for you, there are a number of online calculators to figure the future value or.

What is the time value of money and why is it important? QuickBooks

Time Value of Money Explained. Time Value of Money comprises one of the most significant concepts in finance. The idea focuses on identifying the real value of cash flows Cash Flows Cash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period. It proves to be a prerequisite for analyzing the business's strength, profitability, & scope for betterment.

Image result for present value of an annuity table Annuity, Time value of money, Annuity table

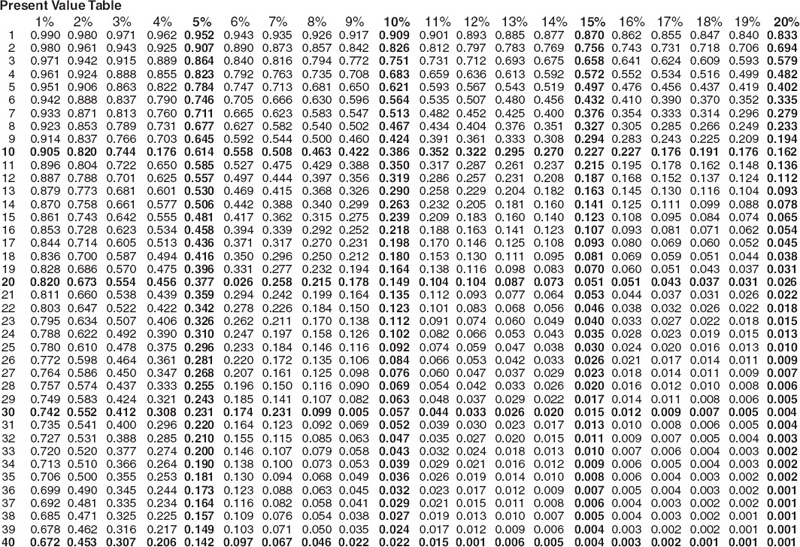

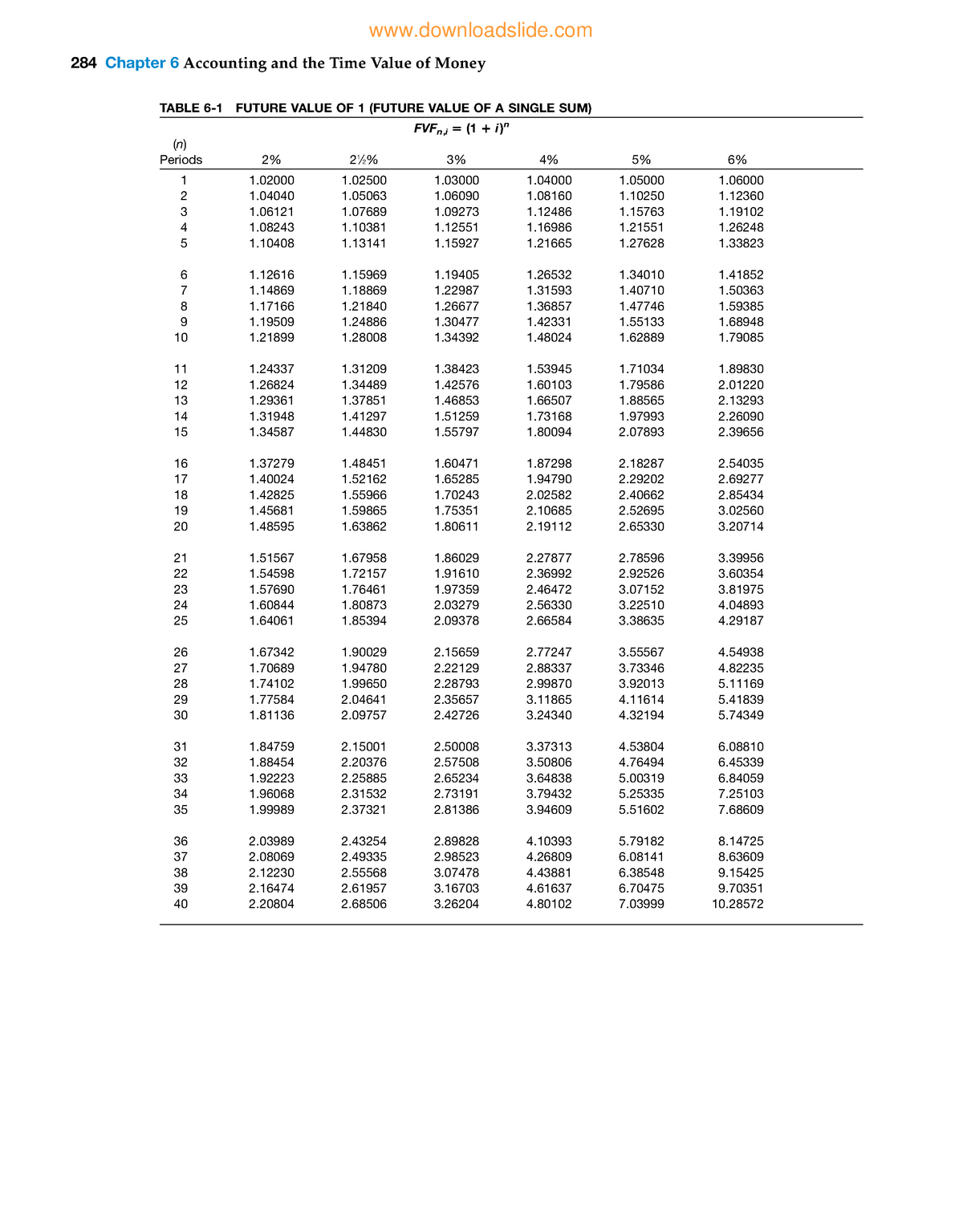

Appendix A: Time Value of Money Tables Get Finance and Accounting for NonFinancial Managers, 3rd Edition now with the O'Reilly learning platform. O'Reilly members experience books, live events, courses curated by job role, and more from O'Reilly and nearly 200 top publishers.

Appendix A Time Value of Money Tables Finance and Accounting for NonFinancial Managers, 3rd

Table 3--Future Value of an Ordinary Annuity of $1 (157.0K) Table 4--Present Value of an Ordinary Annuity of $1 (153.0K) Table 5--Future Value of an Annuity Due of $1 (157.0K) Table 6--Present Value of an Annuity Due of $1 (153.0K) To learn more about the book this website supports, please visit its Information Center. 2007 McGraw-Hill Higher.

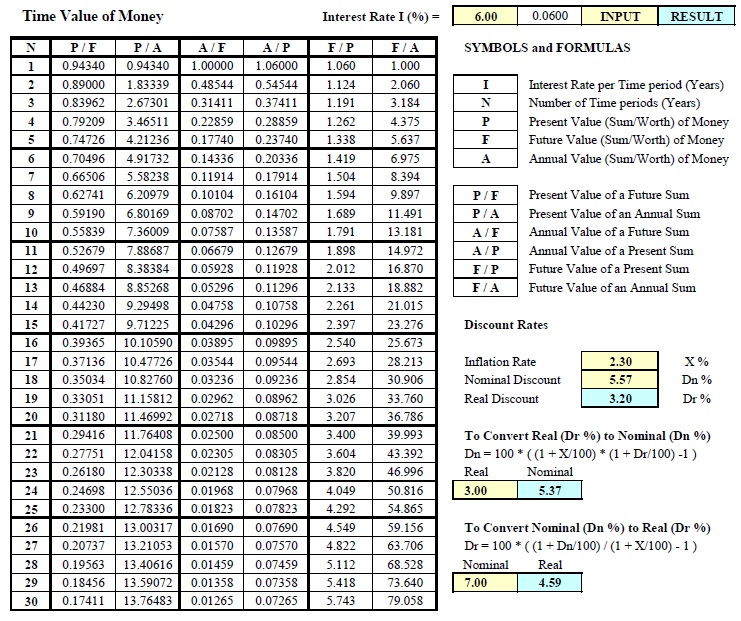

Time Value of Money — Tables of Factors v2 Principles of Accounting — Financial Accounting

The time value of money is a fundamental concept in finance - and it influences every financial decision you make, whether you know it or not. Learn the basi.

Time Value of Money

Excel Templates: https://calonheindel.etsy.com/Start a Print On Demand Etsy Store with Printful: https://www.printful.com/a/8269674:5b.Looking to make mone.

What Is The Time Value Of Money? WorldAtlas

The time value of money is the relationship between a dollar at one point in time and the value of that same dollar at another point in time. For example, $50 today likely won't have the same value as $50 a year from now, just as $1 million now is not the same as $1 million 20 years ago (when a million dollars bought more than it does now)..

Explain Time Value of Money Concept

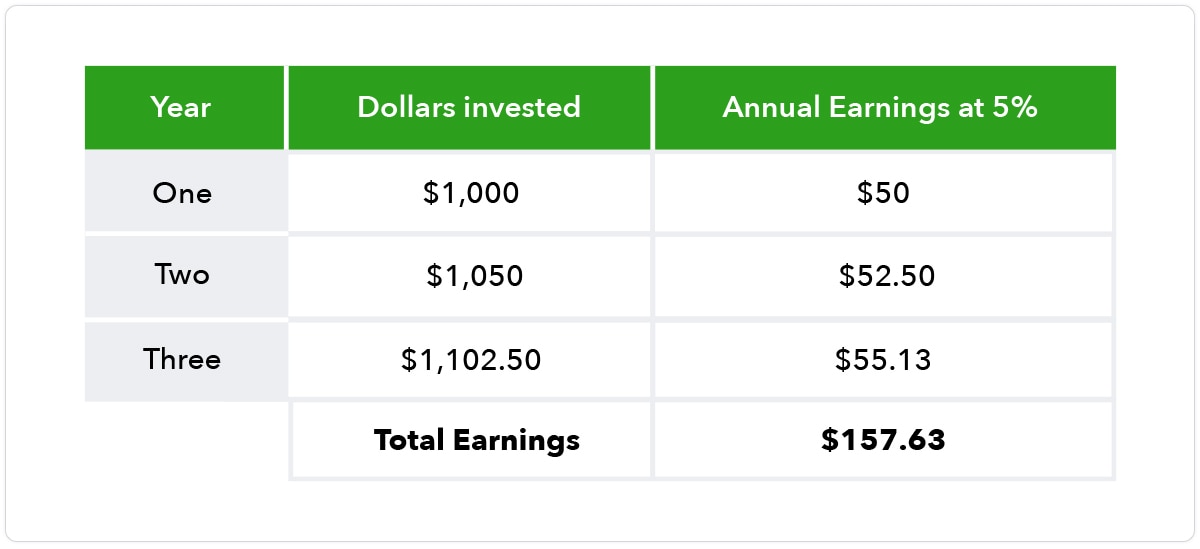

Using the future value formula. FV = PV × (1 + r)n FV = PV × ( 1 + r) n. 7.14. that we covered earlier, we would arrive at the following values: $105 at the end of year one, $110.25 at the end of year two, $115.76 at the end of year three, $121.55 at the end of year four, and $127.63 at the end of year five.

Bonds Payable Time Value of Money and issuing a bond at par (market = stated rate) YouTube

The time value of money is the idea that receiving a given amount of money today is more valuable than receiving the same amount in the future due to its potential earning capacity. If you invest.

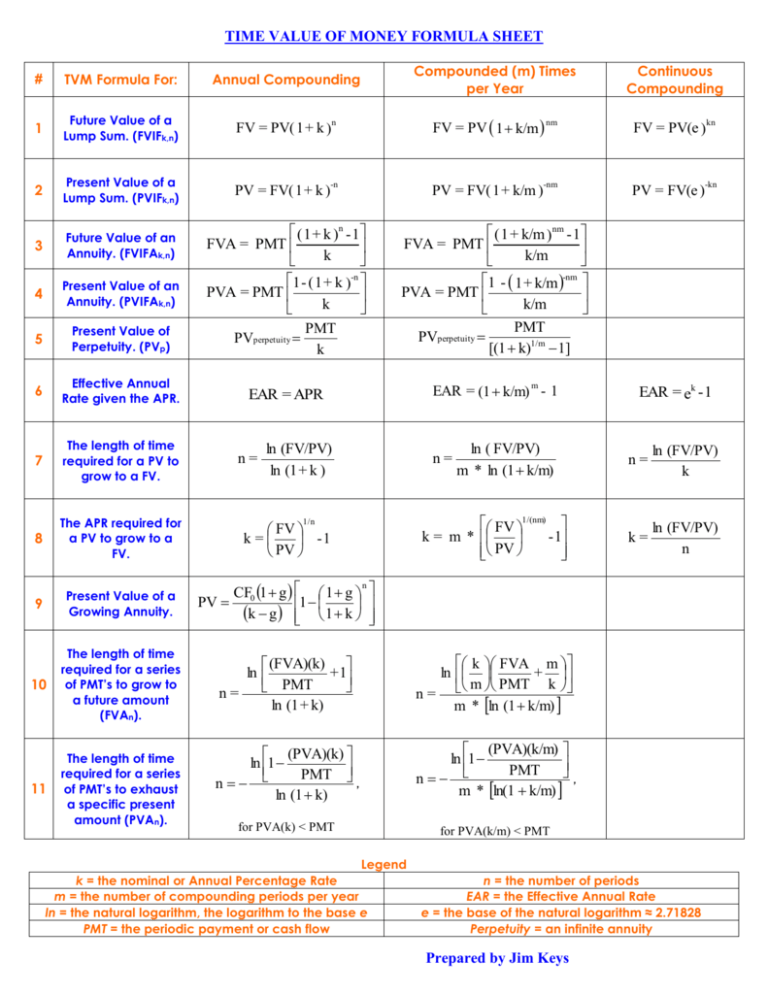

Time Value of Money Formula Sheet

The calculation of time value of money (TVM) depends on the following inputs: present value (PV), future value (FV), the value of the individual payments in each compounding period (A), the number of periods (n), the interest rate (r). You can use the following two formulas to calculate present value and future value without periodical payments.

Time value of money Meaning, Examples, Formula and Uses Finance Basics

12. Stockholders' Equity 1h 58m. 13. Statement of Cash Flows 1h 57m. 14. Financial Statement Analysis 3h 39m. 15. GAAP vs IFRS 56m. Learn Using Time Value of Money Tables with free step-by-step video explanations and practice problems by experienced tutors.

:max_bytes(150000):strip_icc()/Term-Definitions_Time-value-of-money-1bd784d74c3848d7b2d431569715d0d1.jpg)

Time Value of Money Explained with Formula and Examples

The formula for compound interest is: P n = value at end of n time periods. P 0 = beginning value. i = interest. n = number of periods. For example, if one were to receive 5% compounded interest on $100 for five years, to use the formula, simply plug in the appropriate values and calculate.

Time Value of Money

Present value and Future value tables Visit KnowledgEquity.com.au for practice questions, videos, case studies and support for your CPA studies

Table Time Value of Money 284 Chapter 6 Accounting and the Time Value of Money TABLE FUTURE

Time Value of Money - TVM: The time value of money (TVM) is the idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity.