Discount Factor Table PDF Financial Economics Business

The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain discount rate. When you multiply this factor by one of the payments, you arrive at the present value of the stream of payments. Thus, if you expect to receive 5 payments of $10,000 each and use a.

:max_bytes(150000):strip_icc()/discountrate-Final-2389abe245f049f98e386201d314404e.jpg)

Discount Rate Defined How It's Used by the Fed and in CashFlow Analysis

To determine the discount rate for monthly periods with semi-annual compounding, set k=2 and p=12. Daily Compounding (p=365 or p=360) The above formula can be used to calculate an effective annual interest rate for daily compounding by setting p =1 and k to the number of banking days in the year (typically 365 or 360).

Average Discount Rate For A Convertible Note

Annuity Table: A method for determining the present value of a structured series of payments. The annuity table provides a factor, based on time and a discount rate , by which an annuity payment.

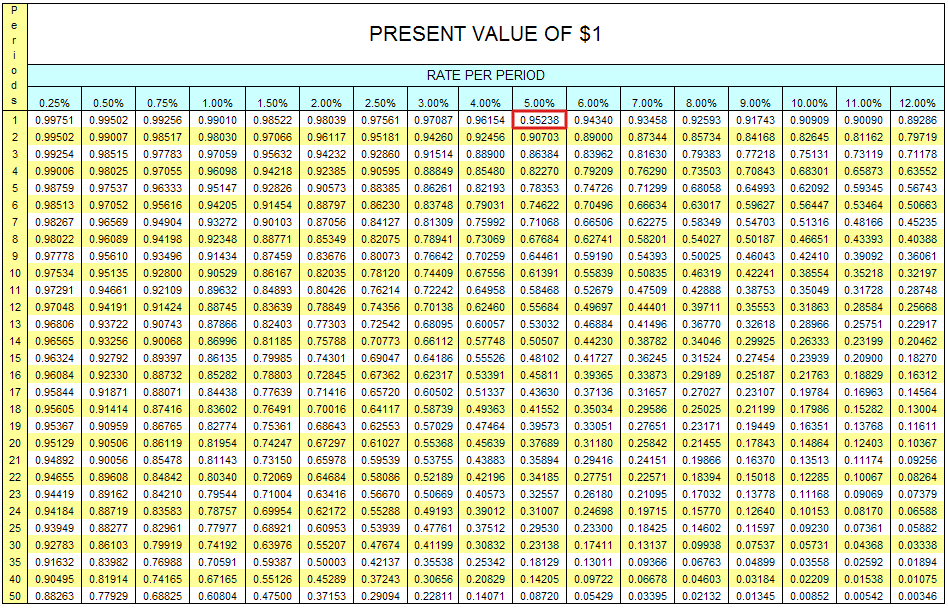

Present value factors, given selected discount rates. Download Table

Thus, if you expect to receive 5 payments of $10,000 each and use a discount rate of 8%, then the factor would be 3.9927 (as noted in the table below in the intersection of the "8%" column and the "n" row of "5". You would then multiply the 3.9927 factor by $10,000 to arrive at a present value of the annuity of $39,927.

What is the Discount Rate? Formula + Calculator

The present value of an annuity formula is: PV = Pmt x (1 - 1 / (1 + i)n) / i. As can be seen present value annuity tables can be used to provide a solution for the part of the present value of an annuity formula shown in red. Additionally this is sometimes referred to as the present value annuity factor. PV = Pmt x Present value annuity factor.

Tabel Discount Rate PDF

Here is an example of how to calculate the factor from our Excel spreadsheet template. In period 6, which is year number 6 that we are discounting, the number in the formula would be as follows: Factor = 1 / (1 x (1 + 10%) ^ 6) = 0.564. If the undiscounted cash flow in that period is $120,000, then to get the present value of that cash flow, we.

Appendix Present Value Tables Accounting for Managers Course Hero

Discount Factor = 1 / ( 1 + r )n Where r = Discount rate. Reproduced from. The Farmers Forest: Multipurpose Forestry for Australian Farmers p121.

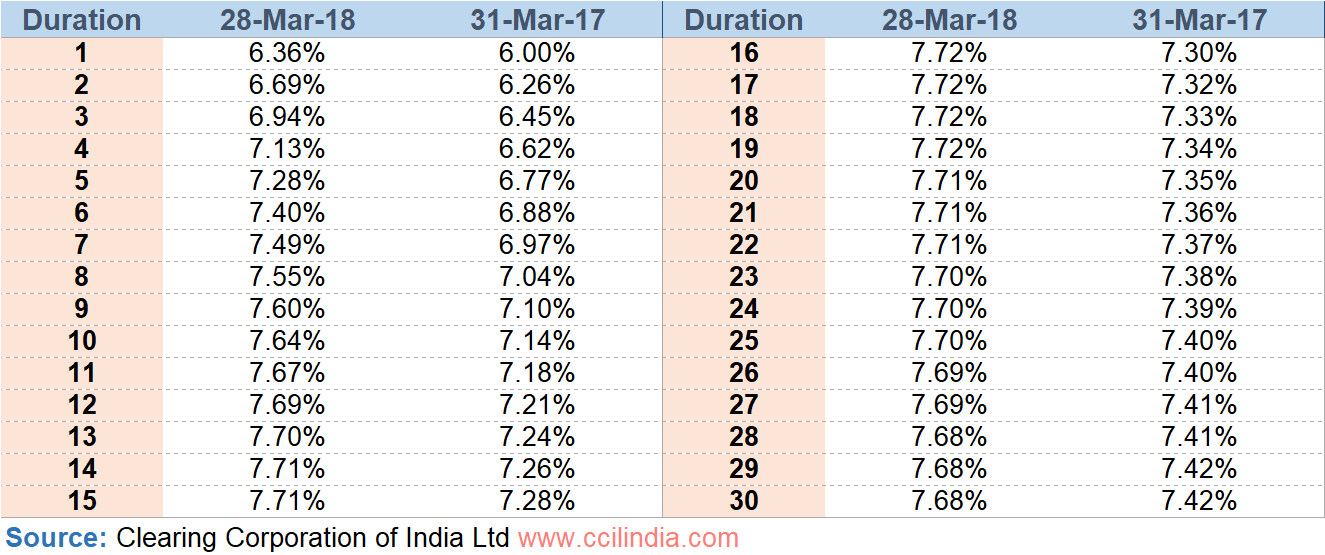

Discount rate for actuarial valuation as at 31 March 2018 • Numerica

They provide the value now of 1 received at the end of period n at a discount rate of i%. The present value formula is: PV = FV / (1 + i) n. This can be re written as: PV = FV x 1 / (1 + i) n. PV tables are used to provide a solution for the part of the present value formula shown in red, this is sometimes referred to as the present value factor.

63 [FREE] PV DISCOUNT RATE TABLE PDF PRINTABLE DOCX DOWNLOAD ZIP PVTable

Discount Factor Formula. Mathematically, it is represented as below, DF = (1 + (i/n) )-n*t. where, i = Discount rate. t = Number of years. n = number of compounding periods of a discount rate per year. Discount Factor Formula. You are free to use this image on your website, templates, etc, Please provide us with an attribution link.

Cara Membuat Tabel Cash Flow Rumus Menghitung Penyusutan, DF Discount Factor dan PV Kas Bersih

Thus, if you expect to receive a payment of $10,000 at the end of four years and use a discount rate of 8%, then the factor would be 0.7350 (as noted in the table below in the intersection of the "8%" column and the "n" row of "4". You would then multiply the 0.7350 factor by $10,000 to arrive at a present value of $7,350.

What is the Discount Rate? Formula + Calculator

The discount factor increases over time (meaning the decimal value gets smaller) as the effect of compounding the discount rate builds over time. The discount factor is an alternative to using the XNPV or XIRR functions in Excel. As opposed to using the XNPV function, manually calculating the discount factor allows you to identify the present.

Discount Rate Formula How to calculate Discount Rate with Examples

Created Date: 1/30/2002 1:13:17 PM

Distribution of Discount Rate and Compensation Growth Rate Assumptions Download Table

The purpose of the future value tables or FV tables is to carry out future value calculations without the use of a financial calculator. They provide the value at the end of period n of 1 received now at a discount rate of i%. The future value formula is: FV = PV x (1 + i)n. Future value tables provide a solution for the part of the future.

Discount Factors Table Economics Corporate Law

Tabel Discount Factor Present Value merupakan tabel baku yang memuat koefisien angka desimal berdasarkan tingkat bunga diskonto yang berlaku. Discount Factor digunakan untuk menghitung kembali nilai sekarang ( present value ) dari proyeksi arus kas yang akan diterima di masa mendatang.

Distribution of Discount Rate and Compensation Growth Rate Assumptions Download Table

Tabel Discount Factor - View presentation slides online. This document contains discount factor tables showing the present value of $1 at future dates for interest rates ranging from 1% to 25% per year over periods of 1 to 35 years. The tables allow users to calculate the future or present value of an amount using compound interest formulas for different interest rates and time periods.

2. Discount factor for constant yearly costs Download Table

Annuity Table Present value of an annuity of 1 i.e. Where r = discount rate n = number of periods Discount rate (r) Periods (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%