Need cash quickly? Consider a Personal Loan from OCBC

The effective interest rate (EIR) of loan products on our site range from 6.5% p.a. to up to 20.0% p.a. The EIR of your loan will be dependent on the loan you apply for as well as your personal financial needs. For an example of a loan with 8.5% EIR, you would need to pay S$316/month for an S$10,000 Personal Loan with a loan tenure of 3 years.

Ocbc Personal Loan Malaysia / Home Loan OCBC Singapore / If you want value, look no further

Until June 30, 2022, you can receive 1.2 per cent cashback and $100 cashback when you make an online application for an OCBC Cash-on-Instalments credit line for new customers taking $10,000 loan.

OCBC Personal Loan YouTube

36.00%. 29.80% (for customers with annual income S$20,000 - S$29,999) 36.00%. Get a line of credit for standby cash conveniently with OCBC EasiCredit. Choose the repayment amount and tenure of your outstanding balance. Instant approval via Myinfo.

OCBC offers lower mortgage rate — but for just 15 days TODAY

Your outstanding amount with OCBC $7,000. Your credit card interest rate 26% per annum. Your interest rate with Balance Transfer 0%. What you need to pay Bank X $1,820. One-time processing fee 4.5%. What you need to pay OCBC $315. (You saved 81% on interest charges!) Period (months) 3 months.

ocbc personal loan malaysia Ryan Newman

Consolidate your outstanding credit card and personal loans across multiple financial institutes into one fixed monthly repayment with OCBC. Secure a personal loan in Singapore with OCBC's low interest rates and flexible repayment options. Choose from a range of affordable loan solutions.

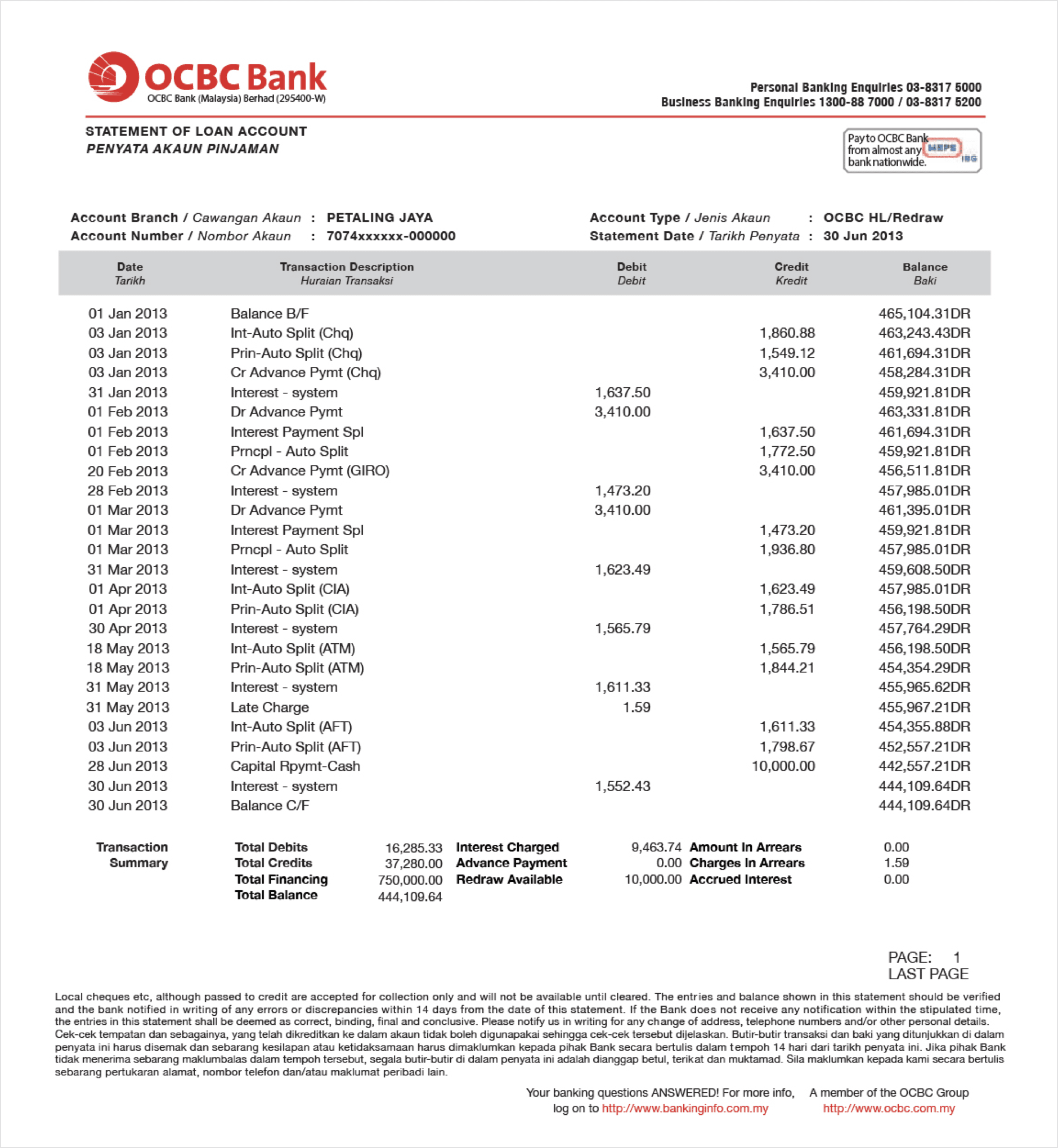

Help & Support Home Loan Statement Guide OCBC Malaysia

Interest Rate if minimum payment is not received by due date. 22.90%. 28.00%. 28.00%. 36.00%. 29.80% (for customers with annual income S$20,000 - S$29,999) 36.00%. Get an affordable fast cash loan with OCBC ExtraCash Loan. Get up to 6x monthly income with fixed repayments up to 60 months.

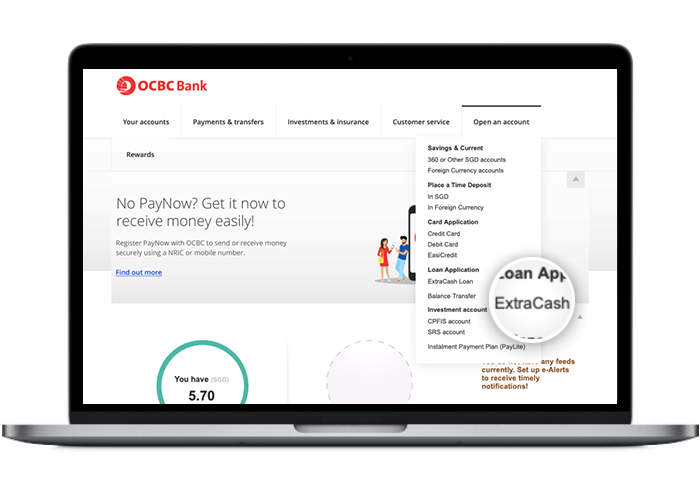

Apply for ExtraCash Loan Stepbystep guides for Digital Banking OCBC Singapore

OCBC charges some of the highest effective interest rates, ranging from 17.1 to 29.8%, for personal loans in Singapore. This makes the total cost of these loans more expensive than other banks. However, OCBC is 1 of 4 banks that offers personal loans to individuals with incomes of less than S$30,000, and could serve as a backup option for those.

OCBC Business Loan Singapore Guidelines Cash Mart Singapore

The OCBC Women Entrepreneurs Programme builds on a similar initiative managed by OCBC Indonesia. Since the launch in 2020, OCBC Indonesia has supported about 1,400 women entrepreneurs running micro, small and medium sized enterprises (MSMEs) under its Women Warriors Programme with over S$300 million (IDR3.5 trillion) in loans disbursed.

Cara Pinjam Uang di Bank OCBC Limit Besar Tenor Panjang KTA Cash Loan YouTube

OCBC Bank (Hong Kong) Limited (the "Bank") has the right to amend the above information and all applicable terms and conditions from time to time and at any time without any prior notice to or consent of any parties. The Bank reserves the right for the final judgment on credit review and approval of the loan.

OCBC Bank ShaunniSaarah

Best Private Student Loans; Best Student Loan Refinance;. Margin loan rates from 5.83% to 6.83%.. managing director of investment strategy at OCBC Bank in Singapore, said if the data come in.

Ultimate Guide To OCBC Personal Loan Singapore Cash Mart Singapore

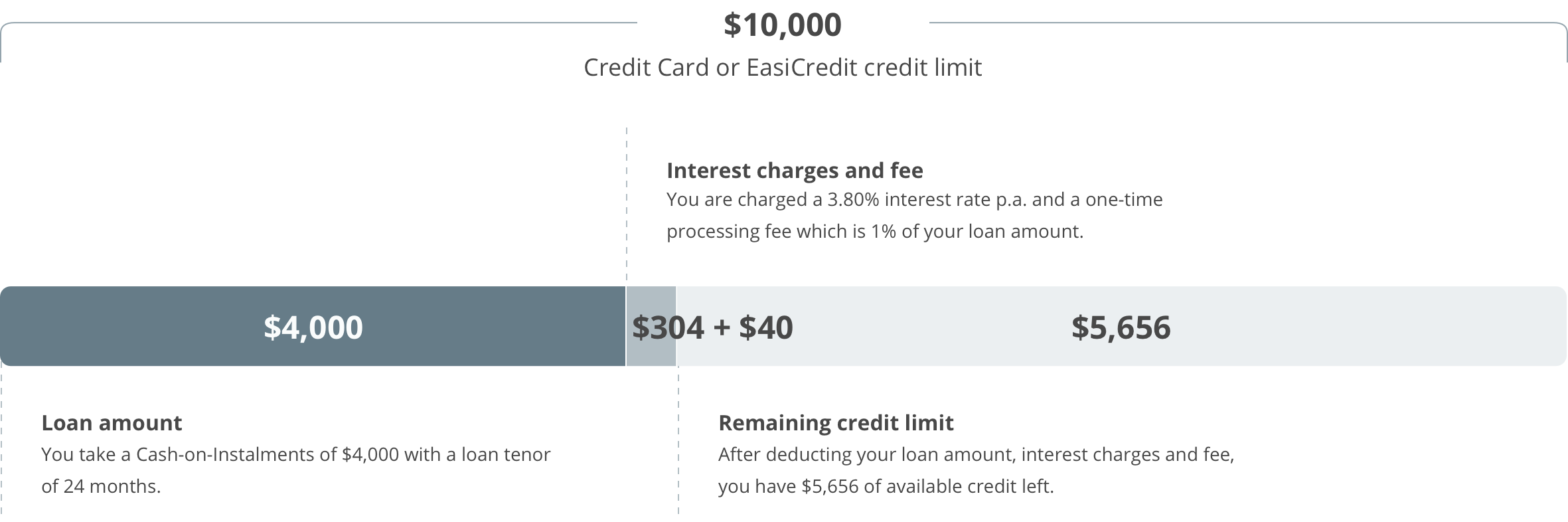

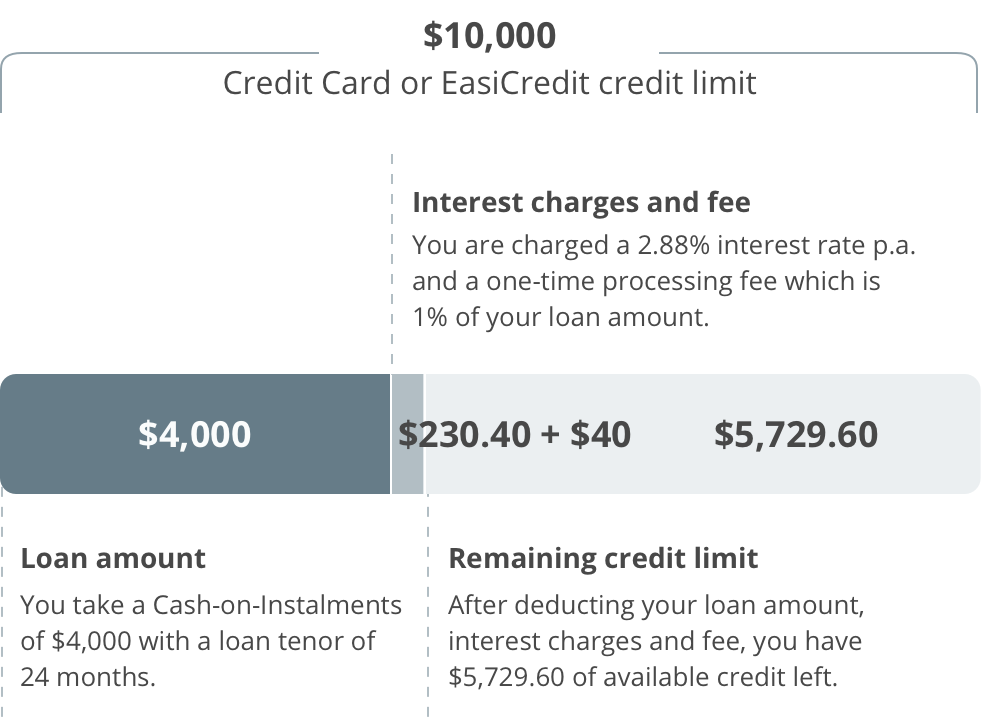

For Cash-On-Instalment on EasiCredit This offer is only open to EasiCredit Account holders with an annual income of S$30,000 and above. The minimum request amount is S$1,000 and interest on the loan amount is calculated based on front-end add-on method.

Quick Guide OCBC iBanking in Singapore Cash Mart Singapore

loan services. Estimated interest payable from Feb to May. S$637.30. Estimated interest payable post extension. S$6231.33. Estimated Interest payable. S$6,868.63. Make adjustments to your OCBC home, renovation or car loan easily with OCBC Bank's online loan services. Explore here.

OCBC CashonInstalments Monthly Instalment Loans Singapore

OCBC Compare OCBC Personal Loan interest rates to other bank rates. Top 3 reasons to apply for OCBC ExtraCash Loan: Loan tenure from 12 to 60 months Borrow up to 6x monthly salary for annual income S$120,000 and above, 4x monthly salary for annual income S$30,000-S$119,999 and 2x monthly salary for annual income S$20,000-S$29,000 Make repayments easily via online or Mobile Banking funds.

How To Repay Your OCBC Student Loan Financially Independent Pharmacist

Jalankan semua rencana & wujudkan mimpimu bersama Cash Loan, pinjaman tunai dari OCBC NISP tanpa agunan dan tersedia dana tunai hingga Rp200 juta. Singapore Malaysia Hongkong.. This could negatively affect the Customer's application for future loan facilites or their existing loan facilites, either in OCBC or in other financial institution;

OCBC Personal Loan Facts You Need to Know Cash Mart Singapore

Today's OCBC Extra Cash interest rate trends in Singapore - As of Wednesday, December 27th, 2023, OCBC Extra Cash's annual interest rate stands at 5.42% with an effective interest of 12.11%.

OCBC CashonInstalments Monthly Instalment Loans Singapore

All three local banks reported weak loan growth in the fourth quarter of 2023. DBS and OCBC's gross loans fell by 1% compared to the previous quarter, while UOB's gross loans rose by 1% compared to the previous quarter. OCBC and UOB expect low single-digit loan growth in 2024, reflecting low appetite for new loans in a higher interest rate.