CIMB World Elite Mastercard Shopee Malaysia

Explore the world with Mastercard's offers curated specially for you. World Elite Mastercard is more than a travel rewards credit card, it's a personalized service offering premium travel benefits.

Best Credit Cards With Golf Privileges In Malaysia Deemples Golf

Golfers. CIMB World Mastercard. Affin Islamic World Mastercard. RHB World Mastercard. Green fees. 50% off green fees. 3x complimentary green fees. - Zero green fees at golf clubs in Malaysia by RHB Golf Privileges. - 50% off walk-in green fees across SEA by Mastercard Golf Privileges.

CIMB Revises World Mastercard To Offer Enhanced Travel Benefits

Priceless™ Specials. Explore the world with Mastercard's offers curated specially for you. World Mastercard is a travel credit card providing a host of travel benefits and offers best suited for your travel needs.

Best CIMB Credit Cards in Malaysia 2023 BizTech Community

Requirements for Travel World credit card. 1. Meet RM 5,000 minimum spend requirement in the calendar month of stay on principal CIMB Travel World credit card (For example, if the principal cardholder stays in the property from 20 April 2024, the principal cardholder is required to meet the spend requirement latest on 30 April 2024.

Travel World Credit Card Bonus Points and Rewards CIMB

Kad Kredit CIMB World Mastercard dicipta untuk pemain golf tegar yang kerap berkunjung ke padang golf di Asia Tenggara. Mohon untuk dapatkan keistimewaan bermain golf dan banyak lagi!. Ahli kad yang melancong di luar Malaysia boleh menghubungi World Mastercard Concierge di talian 852-30163977. CIMB Deals. Terokai keistimewaan dan tawaran.

CIMB Travel World And CIMB Travel Platinum MasterCard Credit Card Second Look GenX GenY GenZ

The CIMB Affinity Credit Card Programme is a new prestige member base that offers renowned association members a rebate and rewards programme. It has taken on new life since the 1990s, when it was formerly known as "Direct Access". You are eligible for this exclusive member-only programme if you are a member of any of the associations below:

Best CIMB Credit Cards (2024) What's the Best Card for You

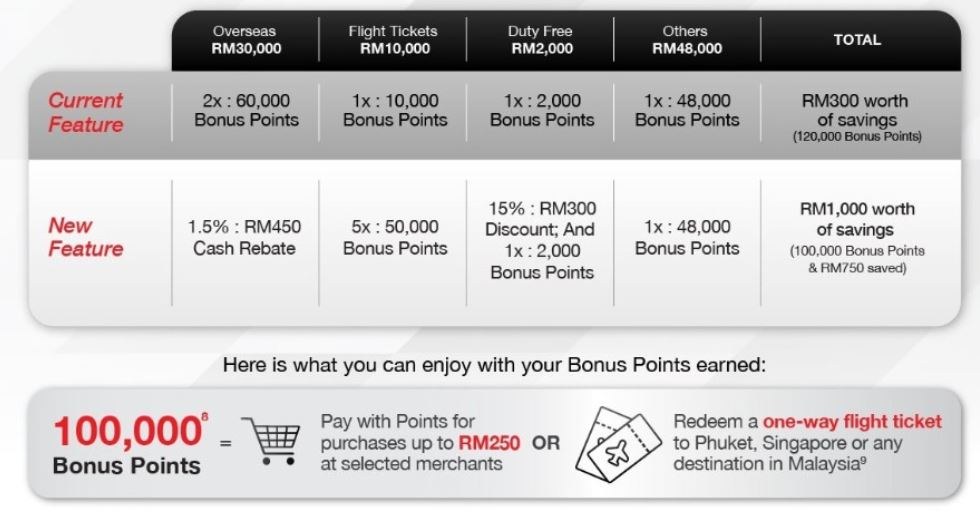

With the CIMB World MasterCard, get Unlimited Cash Rebates of 1.5% on overseas spend, and also earn great rewards i.e 5x Bonus Points with every RM1 spent on airline transaction with predefined merchant category codes [MCC 3000 to 3350 and 4511]. You are also eligible with every 1x Bonus Points on RM1 spent locally on retail ,entertainment.

The card that keeps on giving Earn more points and redeem points faster with Malaysia’s CIMB

To qualify for the CIMB Travel World Elite Mastercard, you'll need an annual salary of 250,000 MYR or more. There's also an annual fee of 1,215.09 MYR, although you may qualify to have some or all of this fee waived, depending on your spending patterns. The Travel World Elite card has a heavy focus on travel and lifestyle benefits, offering.

CIMB World Mastercard review 2021 Unlimited cashback of up to 2 but there's a catch, Money

Collecting CIMB Bonus Points with CIMB World MasterCard is easy: for every RM1 spent locally, you will earn 1x Bonus Point. 5x Bonus Points. It is more rewarding to swipe your World MasterCard credit card to purchase flight tickets, as every Ringgit spent is equivalent to 5x Bonus Points. Keep your cash away and always go for cashless payment.

CIMB Credit Cards Compare and Choose the Best CIMB Credit Card

What are the types of credit cards available in Malaysia? From cash and petrol rebates to travel credit cards, there are many types of credit cards that are available in Malaysia. For example, CIMB offers a variety of credit cards with features and benefits that you can choose from. Some of these are: Cash rebate

Get CIMB World MasterCard Travel Insurance & Privileges

Plus, unlike most major World credit cards that have an annual income requirement of RM100,000, the CIMB World Mastercard has a slightly lower requirement of RM90,000. The card comes with a few travel perks for frequent globe-trotters: automatic travel insurance coverage of up to RM1 million, 15% off at The ZON Duty Free outlets in Malaysia and.

CIMB World Mastercard Review Unlimited 2 Cashback With Luxury Perks

CIMB Cash Rebate Platinum MasterCard Min. Income RM2,000 /month Annual Fee Free Cashback up to 5%; CIMB PETRONAS Visa Infinite-i Credit Card Min. Income RM10,000 /month Annual Fee Free Cashback up to 12%; CIMB Travel World Credit Card Min. Income RM8,333.33 /month Annual Fee Free* Cashback No; CIMB Travel World Elite Credit Card Min. Income.

CIMB World Mastercard Credit Card New Features And Benefits

The CIMB World Mastercard is a cashback card that offers unlimited cashback of up to 2% when you spend money on dining, online food delivery, movies, digital entertainment, taxi rides, ride-hailing, automobile and luxury goods. That's not all. The card doesn't charge any annual fees.

Cimb Petronas Gold Mastercard / Credit Cards In Malaysia For Foreigner An Ultimate Guide

Travel Rewards. Complete Care. Exciting Privileges. CIMB Deals. Earn Up to 5X Bonus Points¹ for every RM1 spent. 5X Bonus Points on Overseas, Airlines and Duty free stores. 2X Bonus Points on other local spend. 1X Bonus Point on Local Education, Local Insurance and Local Utilities 2. 1 Bonus Points earned shall be subject to Members Rewards.

CIMB Niaga Mastercard World Punya Nilai Tukar Kompetitif

The CIMB World Mastercard offers travelling perks you won't be able to resist! Receive unlimited 1.5% cash rebate for all your retail spendings overseas, including online transactions. Shopping at The ZON Duty Free outlets all over Malaysia enables you to receive at 15% discount as well, even more savings! With all the travelling you're.

CIMB World Mastercard review 2021 Unlimited cashback of up to 2 but there's a catch, Money

The insurance coverage for the CIMB Travel World Elite Credit Cards is gratuitous for the benefit of the CIMB Travel World Elite Cardholders ("Cardholder (s)") and shall not in any way be treated as creating any legal relationship between CIMB Bank Berhad ("Issuer") and the Cardholders. No claimant shall have any right of recourse or.