Money Saving Strategies, Money Saving Plan, Entrepreneur Magazine

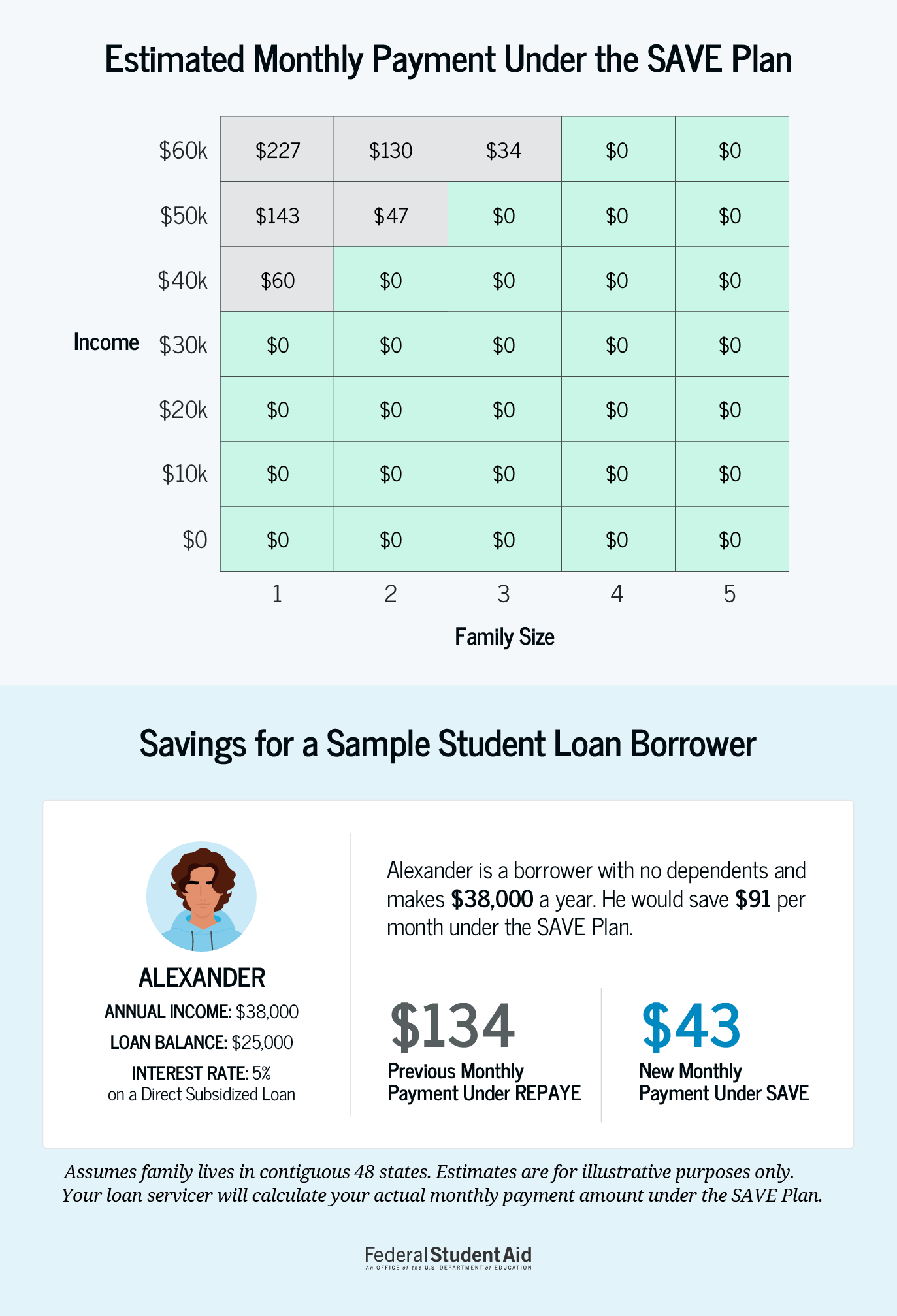

The SAVE plan, which is available to student borrowers with a Direct Loan in good standing, will replace the existing Revised Pay-As-You-Earn (REPAYE) plan which is the most generous existing IDR plan for most borrowers.

Printable 1 Year Money Saving Goal Sheet 2500 Money saving challenge

Here are three drawbacks of the SAVE plan: 1. Borrowers with mid-level balances don't stand to benefit as much. Your monthly payment on the SAVE plan is income-driven, whereas your monthly.

Save Plan. Save. Retire. MyFloridaCFO

With the Saving on a Valuable Education (SAVE) Plan, families and individual borrowers with low or middle incomes will typically have lower monthly payments compared to other IDR plans. You can apply for the SAVE Plan now. This new IDR plan replaced the Revised Pay As You Earn (REPAYE) Plan.

How To Buy A Boat And Not Sink Your Budget Money Talks News Making

The SAVE plan offers the lowest monthly payments of any income-driven repayment plan out there — even triggering a $0-a-month payment for those living on limited budgets. Payments are based.

Saving Chart Bi Weekly

Available to borrowers now, SAVE is the most generous undergraduate student loan repayment plan yet: Borrowers earning less than about $32,800 individually, or less than $67,500 for a family of.

Use this Money Savings Chart to save an extra 1,000 this year! It's

The newest federal income-driven repayment plan will be called SAVE, Saving on a Valuable Education. It includes several exciting changes for borrowers. The calculator below was created using the exact terms as proposed in the federal registrar.

""

With the SAVE plan, even borrowers who don't qualify for a $0 monthly payment can still save at least $1,000 a year compared with other IDR plans, ED says. Plus, you won't owe excess interest.

Best Student Loan Calculator + Free Excel Repayment Plan Template

Our Income-Based Repayment calculator compares existing income-driven plans to the new SAVE plan finalized by President Biden in June 2023. This calculator also uses the latest 2023 federal poverty line numbers. What is your family size? (including unborn children) List the smaller of your prior year AGI or your current income.

Valentines Day Savings Save 280 Savings Challenge Etsy Saving Money

Chief among them is President Biden's new income-driven repayment plan — Saving on a Valuable Education plan, commonly known as SAVE — which ties monthly payments to earnings and family size.

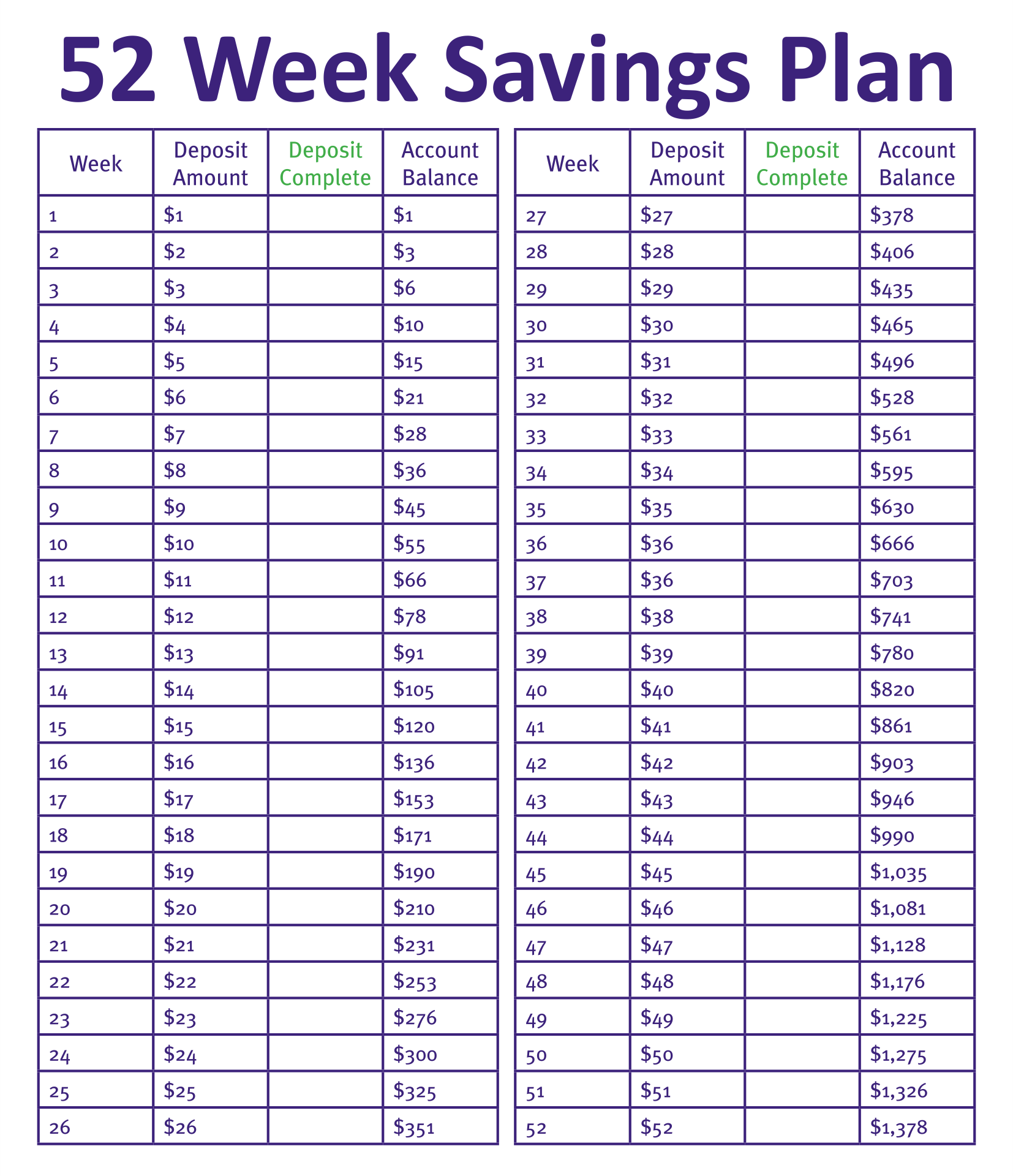

13 Best Printable 52 Week Saving Chart

Your session will time out in: 0 undefined 0 undefined. End My Session

The Best Vacation Savings Plans With Free Printables Vacation savings

Student loan borrowers have four income-driven repayment plans to choose from: the new SAVE plan (which is replacing the Revised Pay As You Earn, or REPAYE, plan), Pay As You Earn (PAYE),.

Pick one Monthly Savings Challenges to find success Money Bliss

The plan - known as SAVE (Saving on a Valuable Education) - calculates monthly payments based on a borrower's income and family size and does not take into consideration how much student loan.

52 Week Money Saving Chart template has a simple design and its

Student Loan Forgiveness Calculator (w/ New SAVE Plan) This student loan forgiveness calculator, updated with the new SAVE program (formerly known as REPAYE), compares new and old income-driven repayment (IDR) plans and alternative repayment options.

Saving Money Chart, Money Saving Strategies, Money Saving Plan, Best

While other income-driven repayment plans use 100% to 150% of the poverty guideline, the SAVE plan uses 225%. That means more of your income is exempt, so you should have lower monthly payments as a result. On SAVE, a single borrower who earns $32,800 or less or a family of four earning $67,500 or less will have payments of $0 in most states.

Are you up for a financial makeover to save 10,000 in the next year

The SAVE plan is an income-driven repayment (IDR) plan that calculates payments based on a borrower's income and family size - not their loan balance - and forgives remaining balances after a.

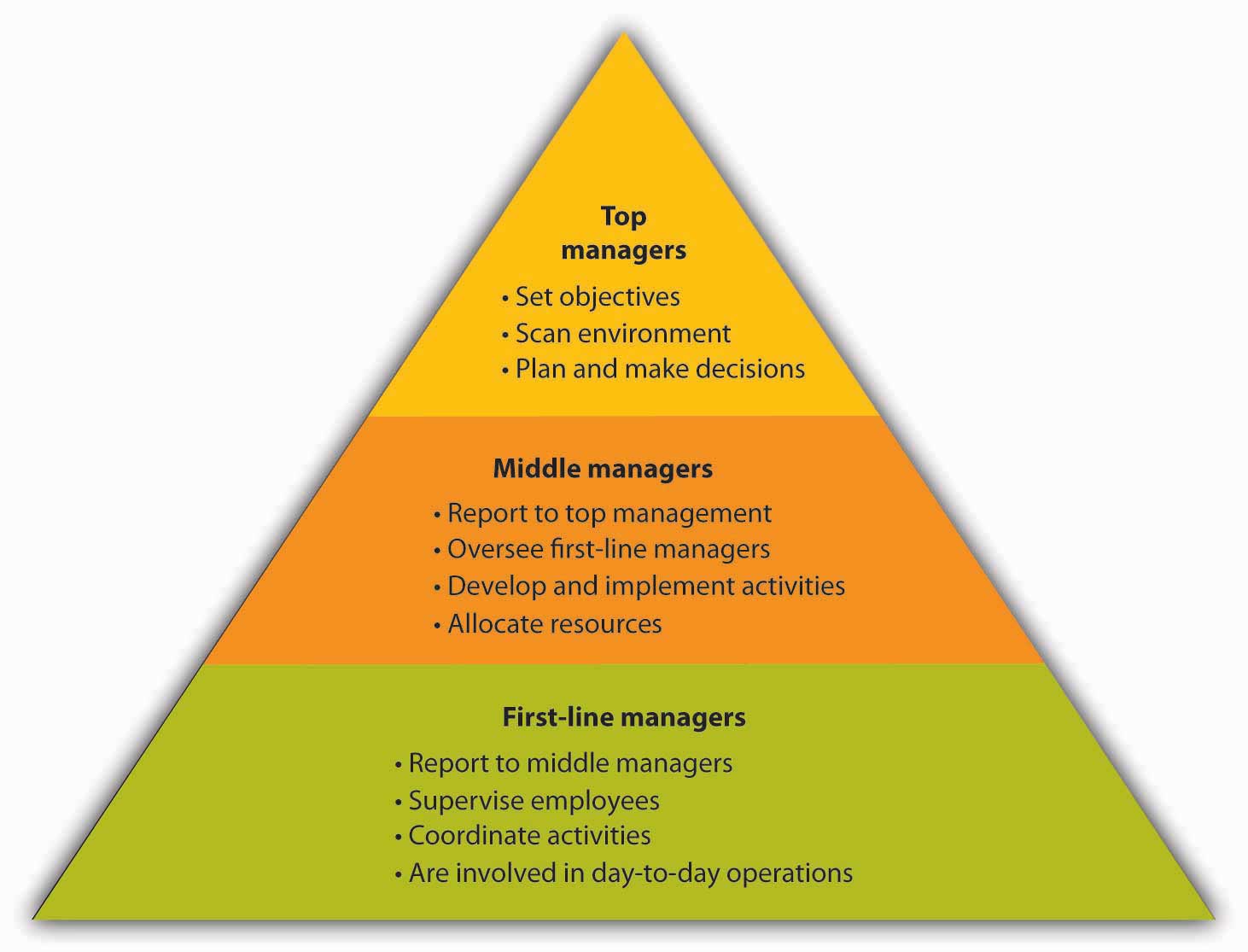

Reading Organizing Introduction to Business

The SAVE Plan, like other income-driven repayment (IDR) plans, calculates your monthly payment amount based on your income and family size instead of on the balance of your student loan. The SAVE Plan provides the lowest monthly payments of any IDR plan available to most borrowers. By enrolling in the SAVE Plan now, you will