Gold and Silver Correlation

This interactive chart tracks the current and historical ratio of gold prices to silver prices. Historical data goes back to 1915.. Gold Prices and U.S Dollar Correlation. Gold Price - Last 10 Years. Dow to Gold Ratio. Gold to Oil Ratio. S&P 500 to Gold Ratio.

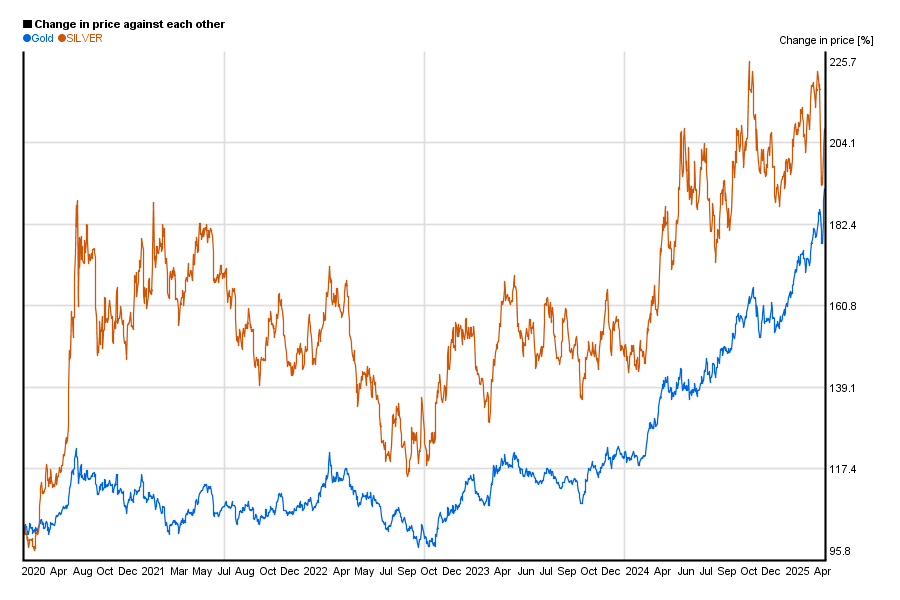

Gold vs silver price chart of performance 5yearcharts

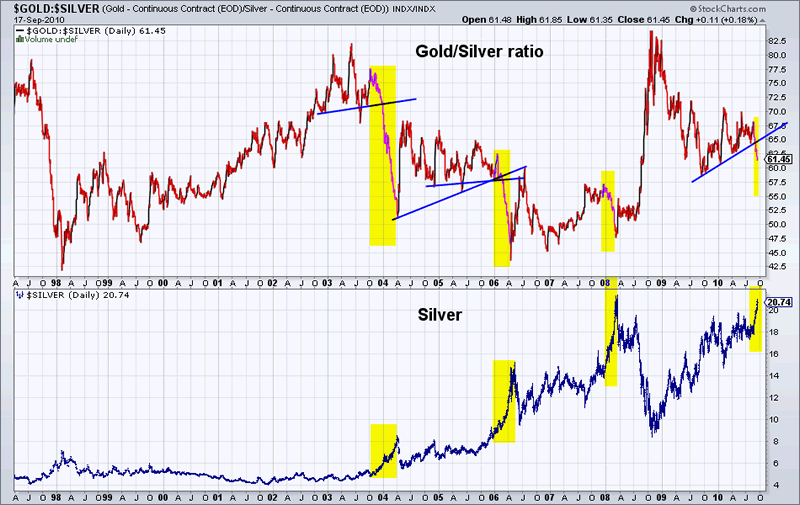

If gold trades at $500 per ounce and silver at $5, traders refer to a gold-silver ratio of 100:1. Similarly, if the price of gold is $1,000 per ounce and silver is trading at $20, the ratio is 50:.

Gold and Silver Correlation

This chart compares the historical percentage return for the Dow Jones Industrial Average against the return for gold prices over the last 100 years.. Gold Prices and U.S Dollar Correlation. Gold Price - Last 10 Years. Dow to Gold Ratio. Gold to Monetary Base Ratio. Fed Balance Sheet vs Gold Price. Gold Prices vs Silver Prices. Silver.

Gold To Silver Ratio Hits 100! SPONSOR Affinity Metals AAF.ca SII.ca TUD.ca GTT.ca AMK.ca

Natural Gas. $2.499. +3.61%. From Investopedia: " Correlation is a statistic that measures the degree to which two variables move in relation to each other. Correlation measures association, but.

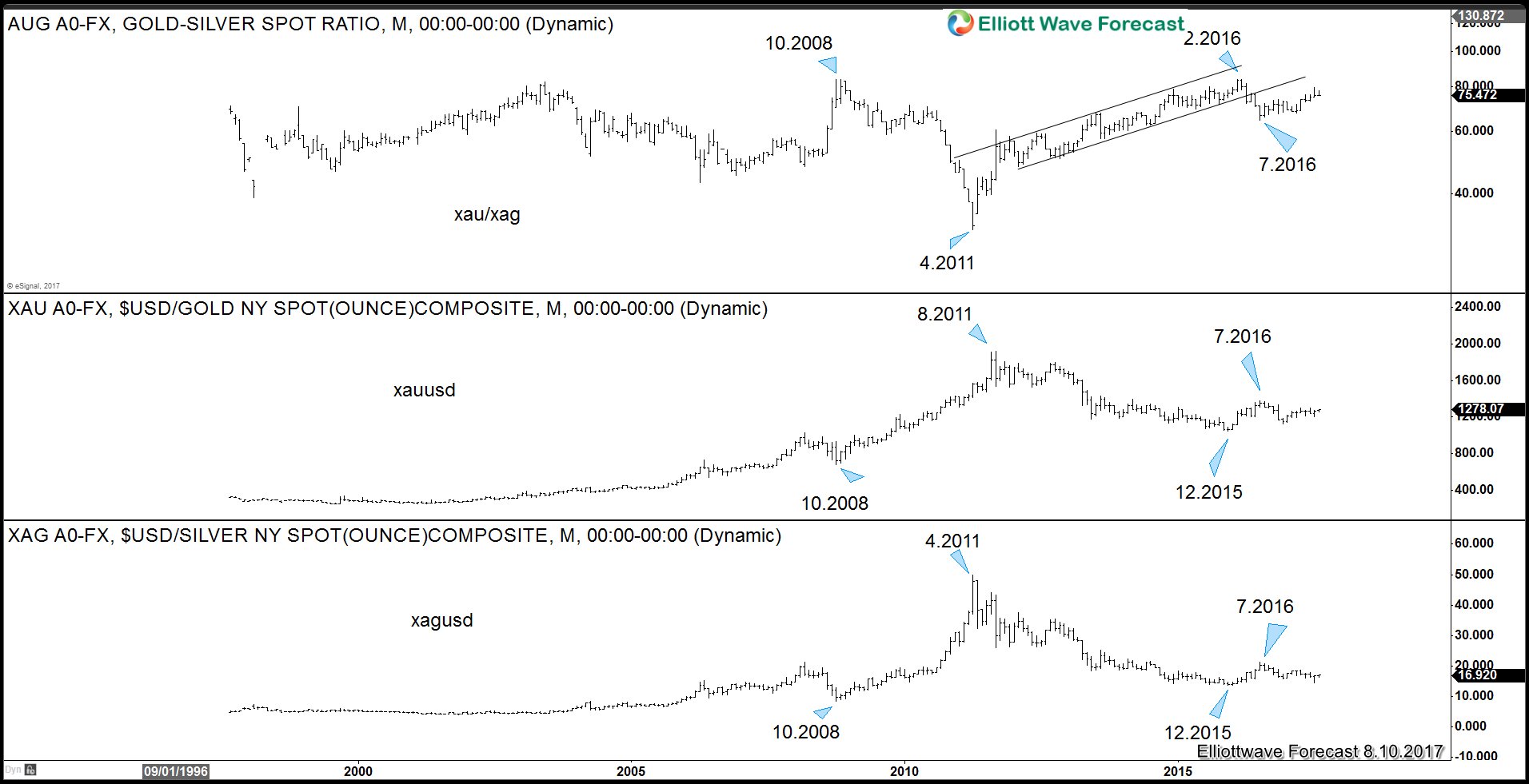

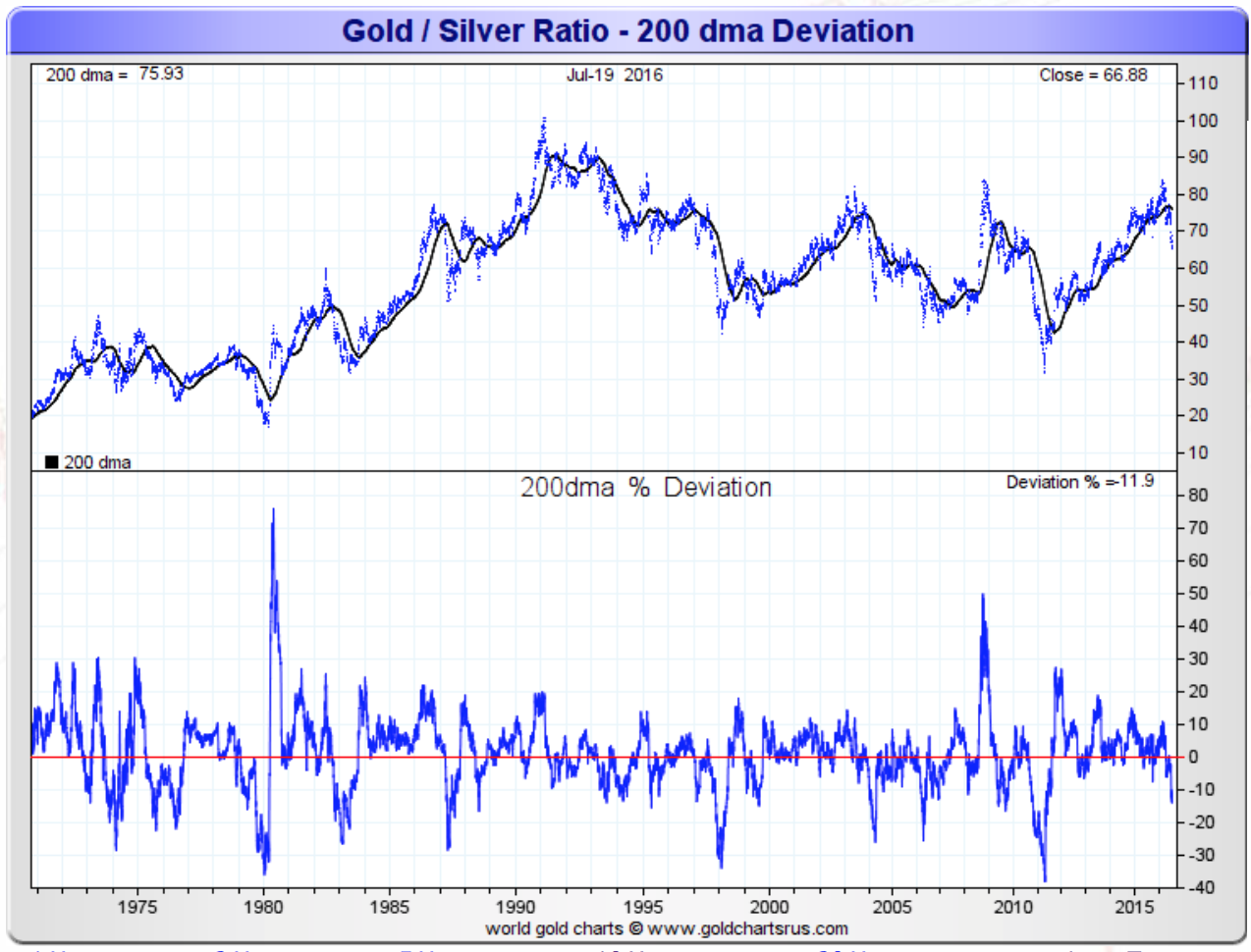

Gold to Silver Ratio Turning Lower

2 Year Gold Silver Ratio History. 5 Year Gold Silver Ratio History. 10 Year Gold Silver Ratio History. 15 Year Gold Silver Ratio History. 20 Year Gold Silver Ratio History. 30 Year Gold Silver Ratio History. All Data Gold Silver Ratio History. Receive Gold and Silver Price Updates via Email. gold silver ratio - Historical gold silver ratio charts.

Gold To Silver Ratio A Look At Correlation, History

Gold/Silver Ratio Climbs to Start 2024. Advancing the Timeline of Economic Collapse. From Investopedia: "Correlation is a statistic that measures the degree to which two variables move in relation to each other. Correlation measures association, but doesn't show if x causes y or vice versa, or if the association is caused by a third.

Gold and Silver Correlation

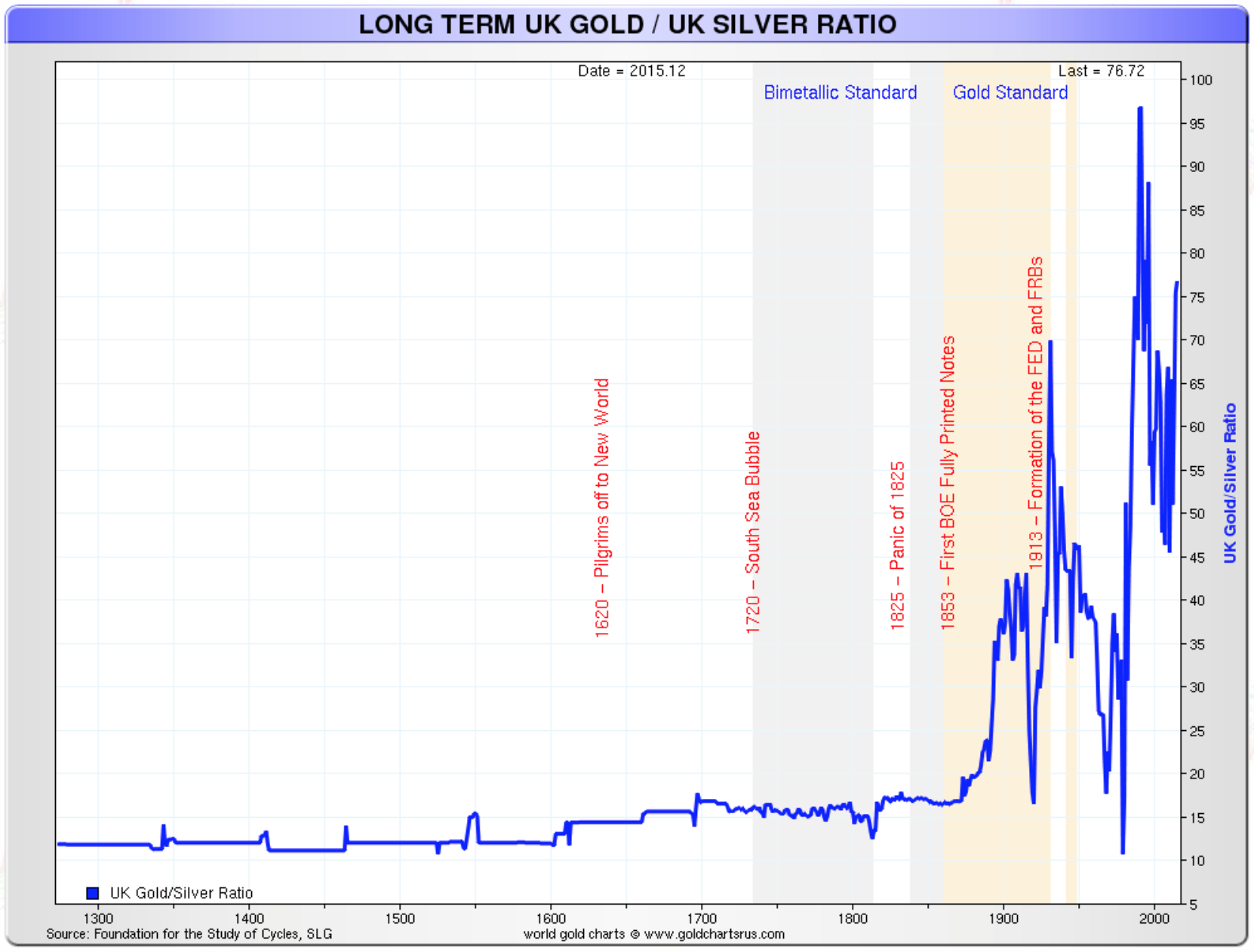

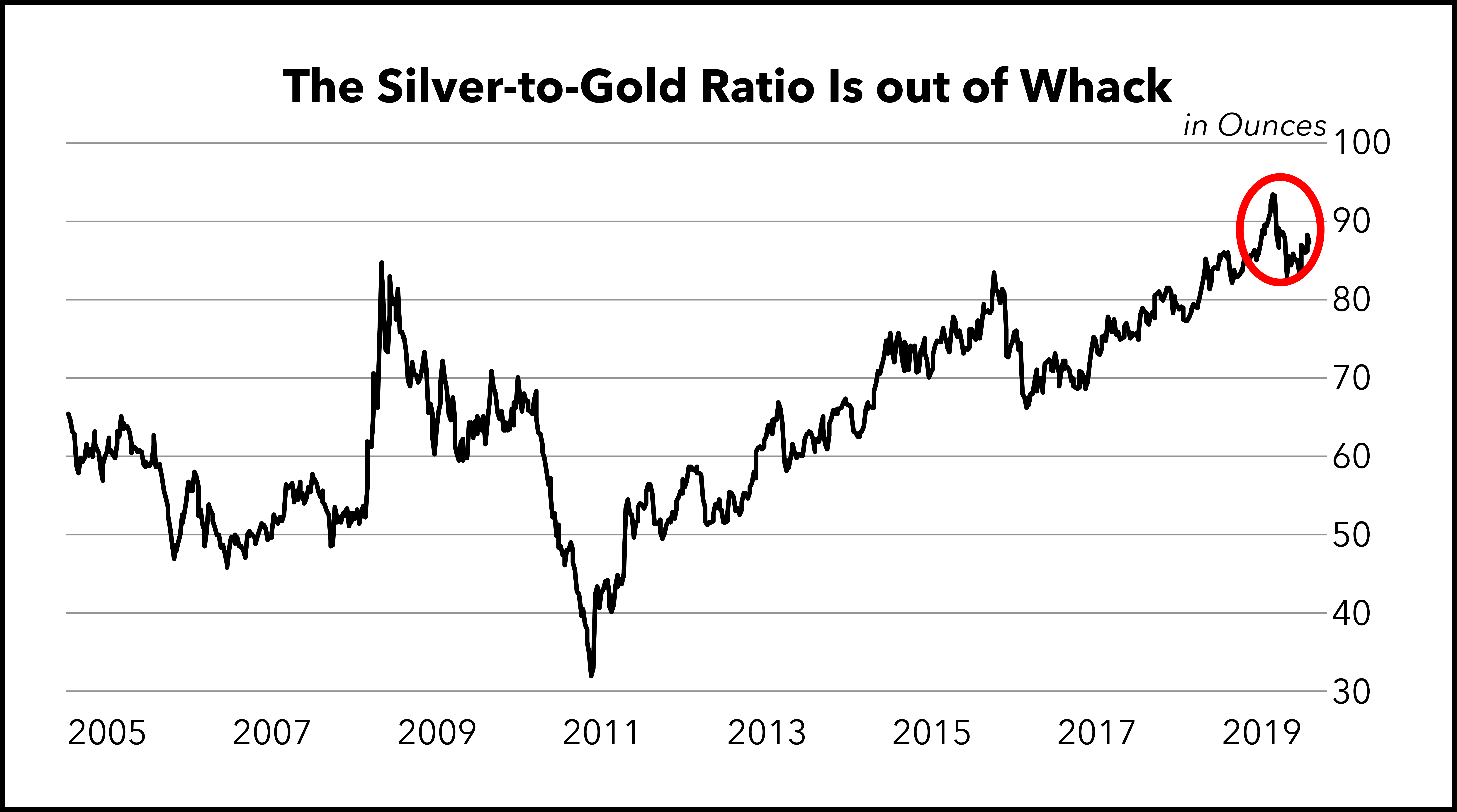

For the whole of the 20th century, the average gold-silver ratio was 47:1. In the 21st century, the ratio has ranged mainly between the levels of 50:1 and 70:1, breaking above that point in 2018.

How to Trade Silver for Gold

By the "Crime of 1873", the value of silver versus gold began to generally fall in value by law and fiat decree. This Gold Silver Ratio Chart's data is updated until May 18, 2020. This image also has an added green-color date set that helps illustrate the recent ongoing eBay American Gold Eagle vs Silver Eagle Coin sales ratio.

Gold and Silver Correlation

0. GOLDSILVER ratio- BUY strategy The GOLDSILVER ratio is low, and MACD being positive right now, and a low RSI suggest this being a reasonable trade to look at. The strategy is to BUY GOLD vs. SILVER in of course measured equal USD values and take profit for the ratio @ 82.75 for now. Place stop-loss below 78.25 for now.

Gold/Silver Ratio Analysis The Market Oracle

Stay informed with today's real-time gold and silver spot prices. Explore gold and silver's price history and discover previous per prices. Other Gold and Silver Price Resources. We offer a number of free resources for precious metals investors, including: London fix price history for silver and gold. Gold spot price details in: ounces, grams.

GoldSilver Ratio And Correlation KELSEY'S GOLD FACTS

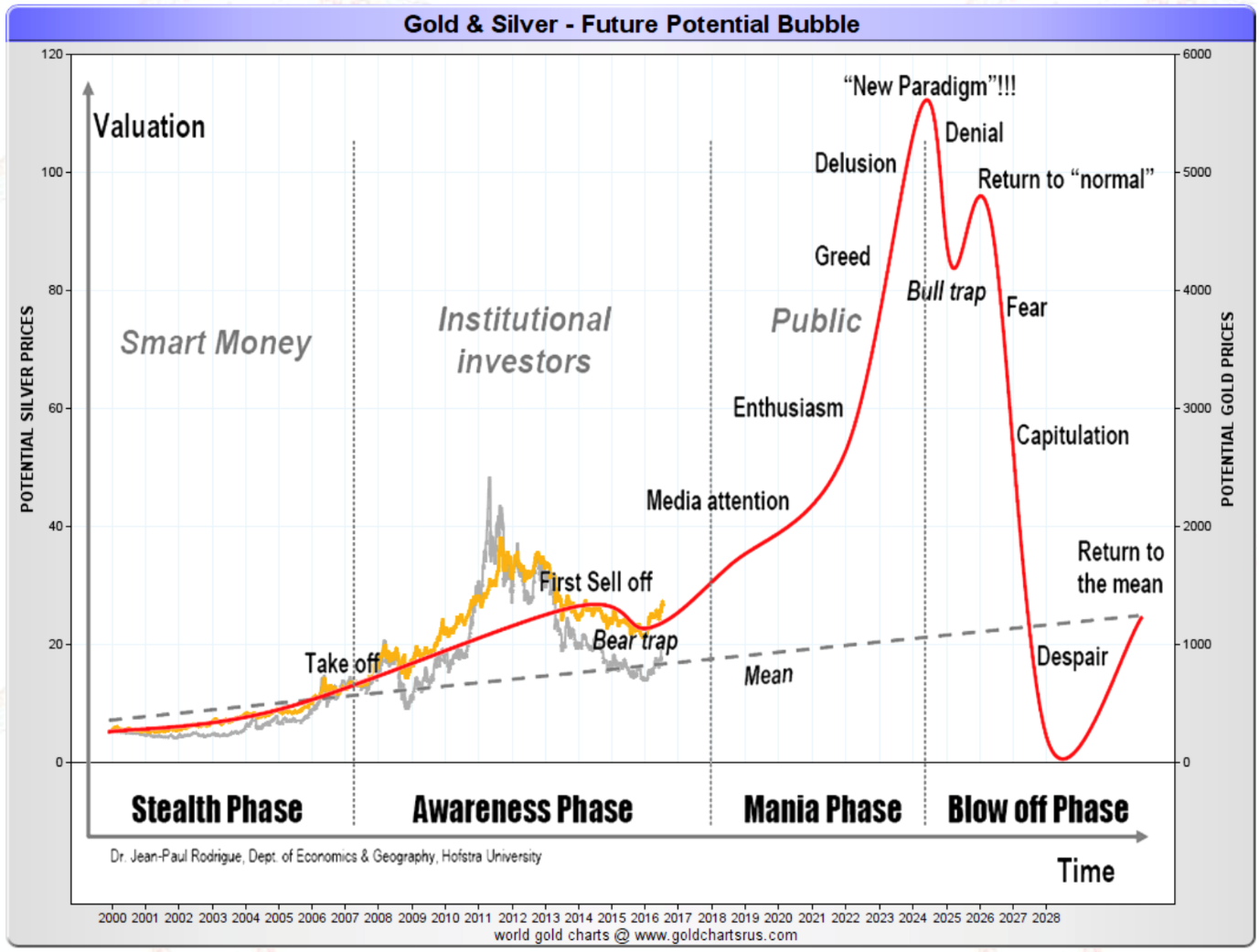

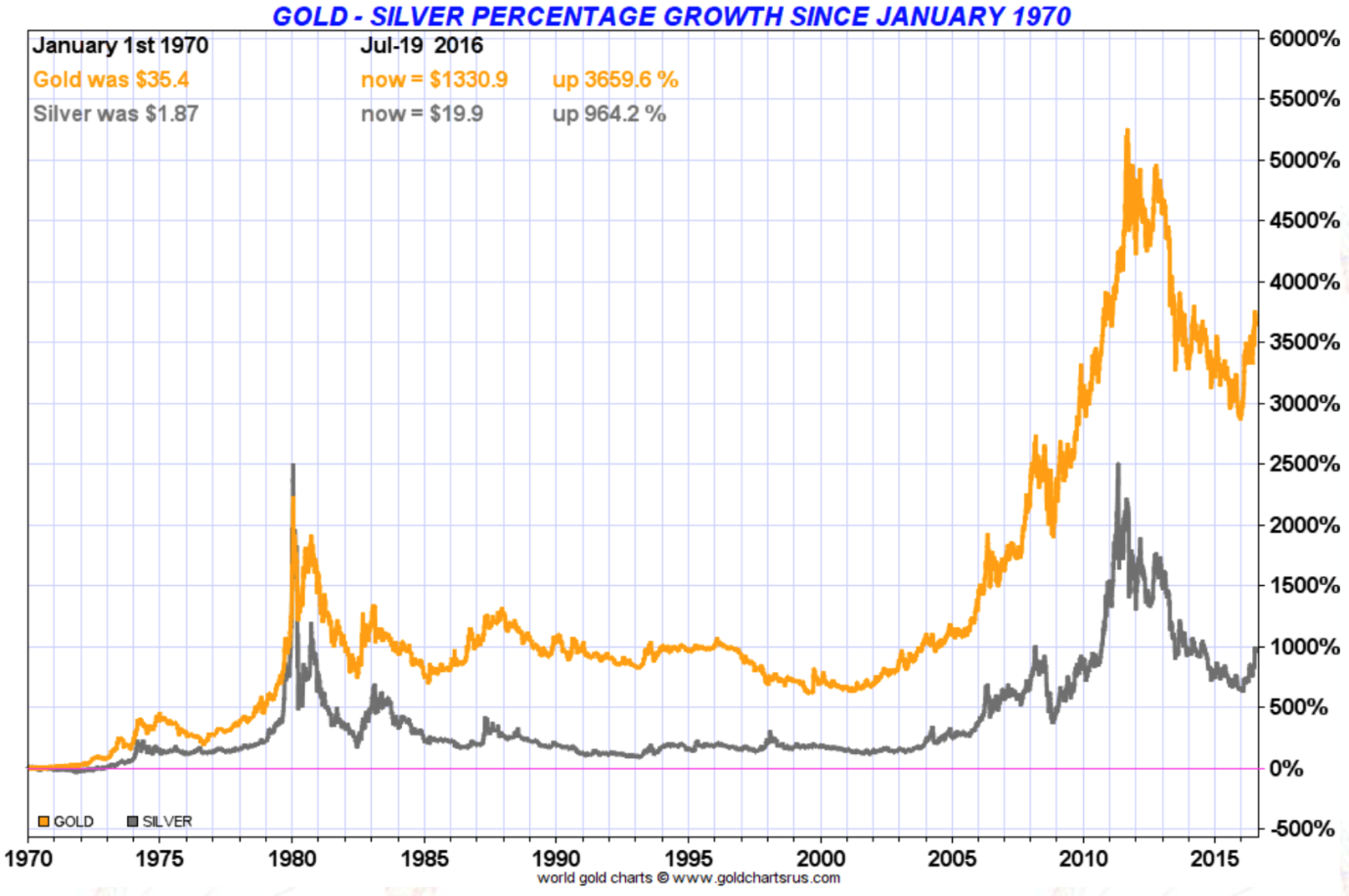

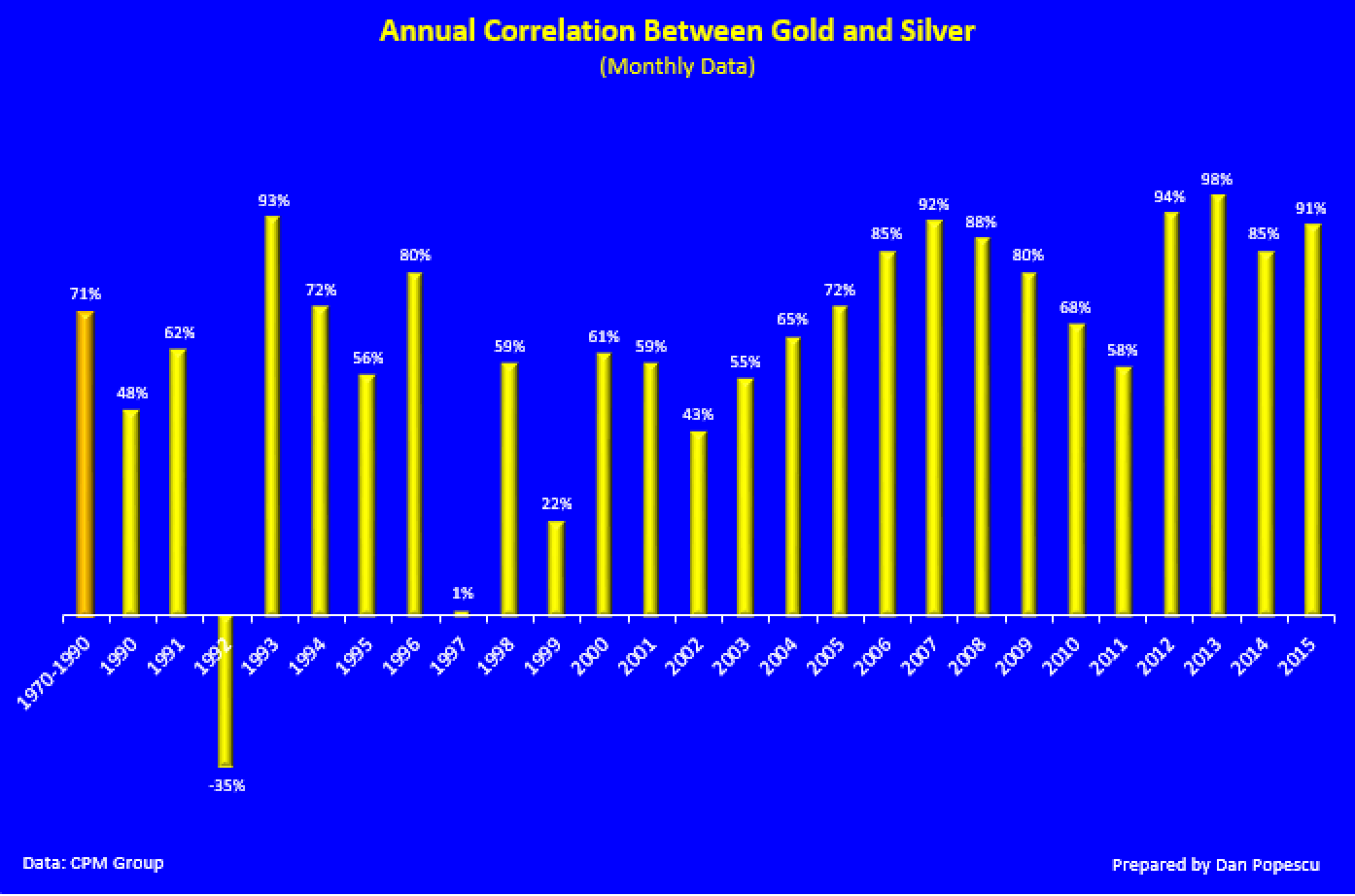

As you can see in the charts below, gold and silver have maintained a very high correlation moving, close to 100% during monetary crises like the ones in 1973 and 2008. Since 2012 it has been around 90%. It remains that silver is much more volatile than gold. Roy Jastram called silver the "restless metal".

How to use the correlation between gold and the stock markets to trade

The Correlation Matrix shows the markets that influence gold, silver, gold stocks and juniors. It gives you an advantage over most investors that focus on the precious metals market alone. Technically, "correlation does not mean causation", but we know that the biggest markets influence the smaller ones - the tail doesn't wag the dog.

2020 Will Be the Year for Silver Stocks

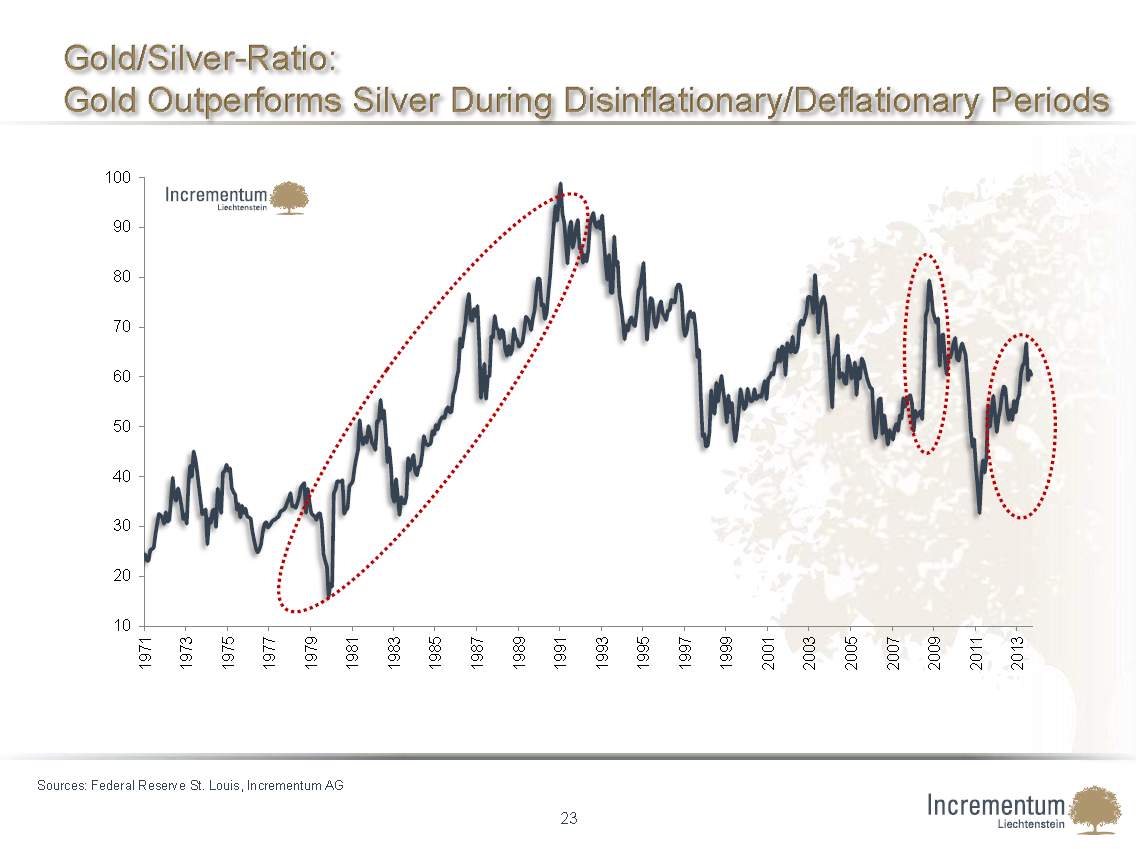

Gold price history is indicative of its association and inverse correlation with the US dollar. Silver prices reflect the white metal's primary use as an industrial commodity. GOLD-SILVER RATIO FAVORS GOLD. Let's look at one more chart. This one is the ratio of gold prices to silver prices, the gold-to-silver ratio…

Gold and Silver Correlation

The chart above displays the 1-year rolling correlation coefficient between the price of gold and the price of silver. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that the two precious metals moved in the same direction during the specified time window.

Gold Silver Correlation Matrix Sunshine Profits

This chart shows the monthly CPI reading for the entire 1970s decade. This was the last time inflation was "officially" as high as it is now, as well as the period of gold and silver's biggest gains in history (for you chart nerds, we used a monthly metal price).. (the closer to 1.0 the stronger the correlation). Gold and silver prices.

How to use the correlation between gold and the stock markets to trade

Ancient Rome was one of the earliest ancient civilizations to set a gold-to-silver ratio, starting as low as 8:1 in 210 BCE. Over the decades, varying gold and silver inflows from Rome's conquests caused the ratio to fluctuate between 8-12 ounces of silver for every ounce of gold. By 46 BCE, Julius Caesar had established a standard gold-to.