Tata motors Fundamental & Ratio Analysis

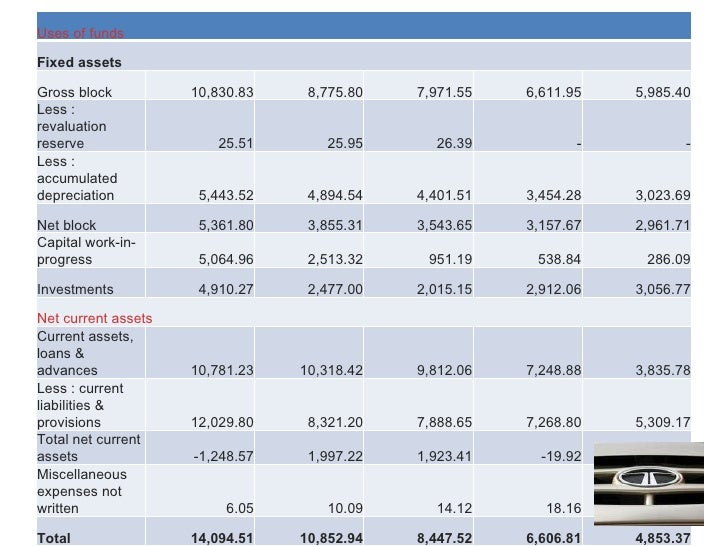

Financial ratio analysis is a study of ratios between various items or groups of items in financial statements. Following are the important ratios: LIQUIDITY RATIO Liquidity refers to the ability of a firm to meet its obligations in the short run, usually one year.

Tata Motors Ratio Analysis PDF Equity (Finance) Dividend

Download full-text PDF Read full-text. Download full-text PDF. Read full-text.. Hotwani R (2001). Profitability Analysis of Tata Motors. Ratio 2.8918.06: 763-35. Pavitra and Anita. Comparative.

ACCOUNTANCY PROJECT CLASS 12 (TERM 1) RATIO ANALYSIS (TATA MOTORS ) YouTube

The main focus has been laid on financial performance of Tata Motors and Toyota Motor Corporation Car Company for the five years from 2015-2019 and to analyze whether the improper working.

Ratio Analysis Tata Motors PDF Vehicles Land Vehicles

The purpose of this project is to financially study company Tata Motors Limited by doing ratio analyses and research. Both quantitative and qualitative methods were used for this report..

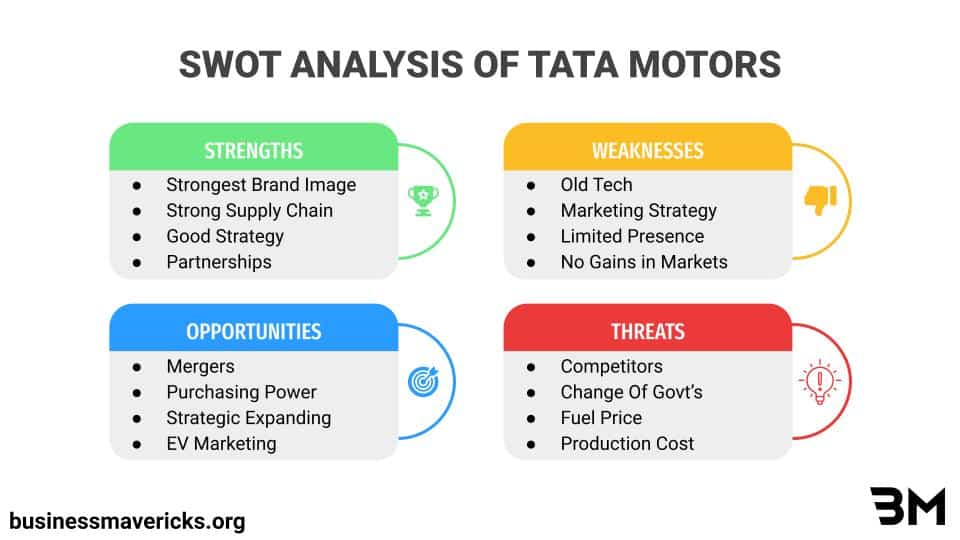

Tata Motors Stock Study Strengths, SWOT & Fundamental Analysis!

The 76 th Integrated Annual Report 2020-21 of the Tata Motors Group outlines its financial and non-financial performance. The report narrates in detail how. Ratio of female employees to total employees (%) Tata Motors Limited (31bps) FY 21. 5.48 . FY 20. 5.79. FY 19.. From global projects benefiting millions, to local initiatives helping.

Tata Motors Ratio Analysis

MANAGEMENT DISCUSSION AND ANALYSIS Resilience ebound. 102 | 76th Integrated Annual Report 2020-21 WORLD % Global GDP 2020 GDP Projections 2021 GDP Projections 2022 US Euro Area UK China 6.0-3.3 -3.5-6.6-9.9 4.4 6.4 3.5 4.4 3.8 5.3 5.1 2.3 5.6 8.4 Economic Growth: Global activity is estimated to have contracted 3.3%

Tata Motors Ratio Analysis PDF Revenue Dividend

The main objective of this study is to analyze the solvency and activity ratios and financial break- point of Tata Motors Ltd from 2013-14 to 2017-18. The study highlights the financial performance of Tata Motors Ltd. KEYWORDS Ratios, Financial Break-point, Financial performance. Introduction

Tata motors Fundamental & Ratio Analysis

Abstract: The current study is an investigation on the financial performance of Tata Motors. Companies can assess their performance over the previous years through financial analysis, recognising their strengths and weaknesses and working to improve them.

SWOT Analysis of Tata Motors in a Simplified Way Business Mavericks

A PROJECT REPORT ON FINANCIAL RATIO ANNALYSIS OF TATA MOTORS PROJECT REPORT TATA MOTORS TATA MOTORS . CHAPTER-1 EXECUTIVE SUMMARY:- Financial statements provide summarized view of the financial position and Operation of the company. Therefore, now a day it is necessary to all companies to know as well as to show the. RATIO ANALYSIS.

Tata Motors Ratio Analysis

Financial ratio analysis is the process of reviewing the financial position of the company This study aims at analyzing the financial performance of Tata Motors by calculating financial ratios. The primary objective of this study is to evaluate the performance of Tata Motors during the last decade.

A Project On Ratio Analysis of Financial Statements & Working Capital Management at HVTL, Tata

Refer MD&A para Overview of Automotive Operations for detail analysis. TATA MOTORS Tata Motors recorded sales of 4,63,742 vehicles, a growth of 4.4% over FY 2019-20, whereas the Indian Auto Industry volumes declined by 6.1%. The Company's market share (calculated on wholesales) increased to 14.1% in FY 2020-21 from 12.7% in FY 2019-20.

Tata motors project A PROJECT REPORT ON ‘’A STUDY ON SALES AND PROMOTION OF TATA MOTORCARP’’ A

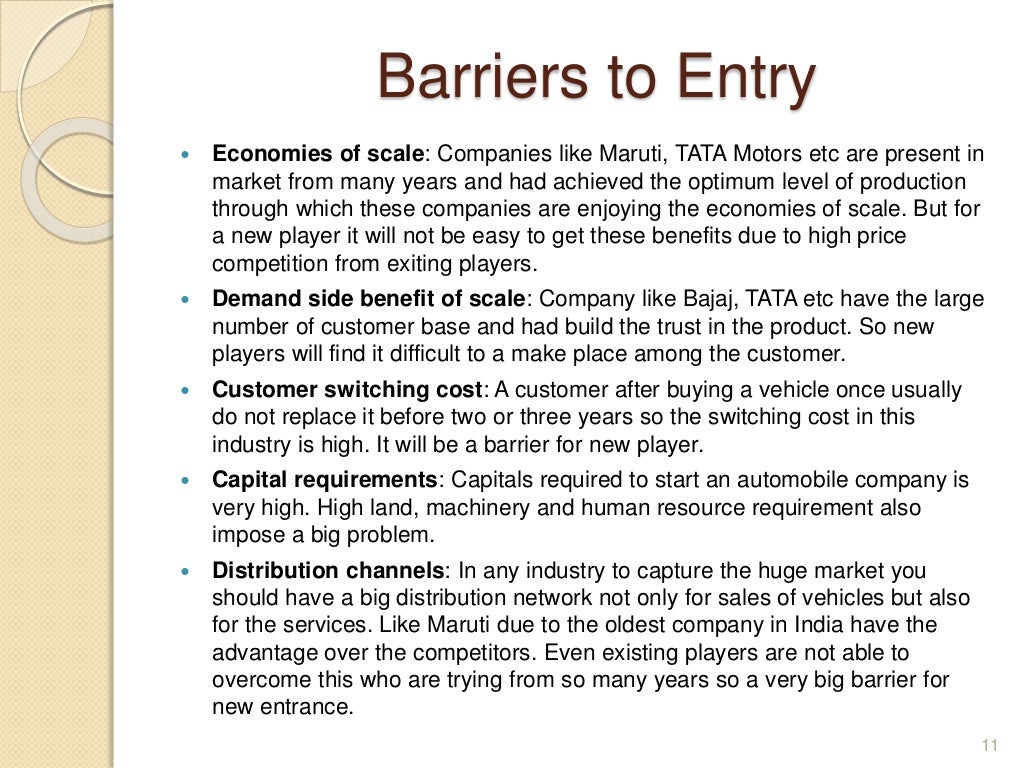

Request PDF | FINANCIAL RATIOS AND ANALYSIS OF TATA MOTORS | The paper investigates the financial health of Tata Motors in comparison with the Maruti Suzuki, Ashok Leyland, and SML.

Project Report On Tata Motors Promotion (Marketing) Strategic Management

A COMPREHENSIVE PROJECT REPORT ON ANALYSIS OF PROFITABILITY OF TATA MOTORS LIMITED Submitted to Atmiya institute of technology & science IN PARTIAL FULFILLMENT OF THE REQUIREMENT OF THE AWARD FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION IN Gujarat Technological University UNDER THE GUIDANCE OF Project Guide Prof. (Dr.) Vijay H. Vyas

Ratio Analysis Tata Motors PDF Interest Dividend

47,450.25 -708.75 ( -1.47 %) NIFTY Midcap 100 46,894.35 -501.95 ( -1.06 %) PARTNERED BY BHARAT Bond ETF - April 2031 - Regular Plan (G) Equity Funds

Ratio Analysis Tata Motors PDF Business Economics Financial Economics

Various Ratios of Mahindra & Mahindra and Tata Motors Mahindra & Mahindra Tata Motors Years 2013 2014 2013 2014 Current Ratio 1.10 1.29 0.48 0.36 Quick Ratio 0.80 0.97 0.27 0.25 Asset Turnover 147.30 129.46 1.40 1.02 Ratio Total Asset 2.29 1.99 1.48 1.12 Turnover Ratio Investment 17.94 15.38 11.07 9.78 Turnover Ratio Dividend Payout 23.80 22.94.

Tata Motors Ratio Analysis [PPT Powerpoint]

© All Rights Reserved Flag for inappropriate content of 32 Project Report on TATA MOTORS Financial Accounting AndAnalysis Submitted To: Submitted By: Dr. Jayasree GAJAVELLI MANOJ (146) In Partial Fulfilment of the Requirements ofMBA Program Batch (2022-2024) f ACKNOWLEDGEMET The satisfaction and euphoria that accompany the successful