Doji Candlestick Pattern Guideline Download Free PDF

Candlestick Patterns PDF Free Guide Download Candlestick patterns are one of the oldest forms of technical and price action trading analysis. Candlesticks are used to predict and give descriptions of price movements of a security, derivative, or currency pair.

Doji candlestick pattern. Candlestick chart Pattern For Traders. Powerful doji Candlestick chart

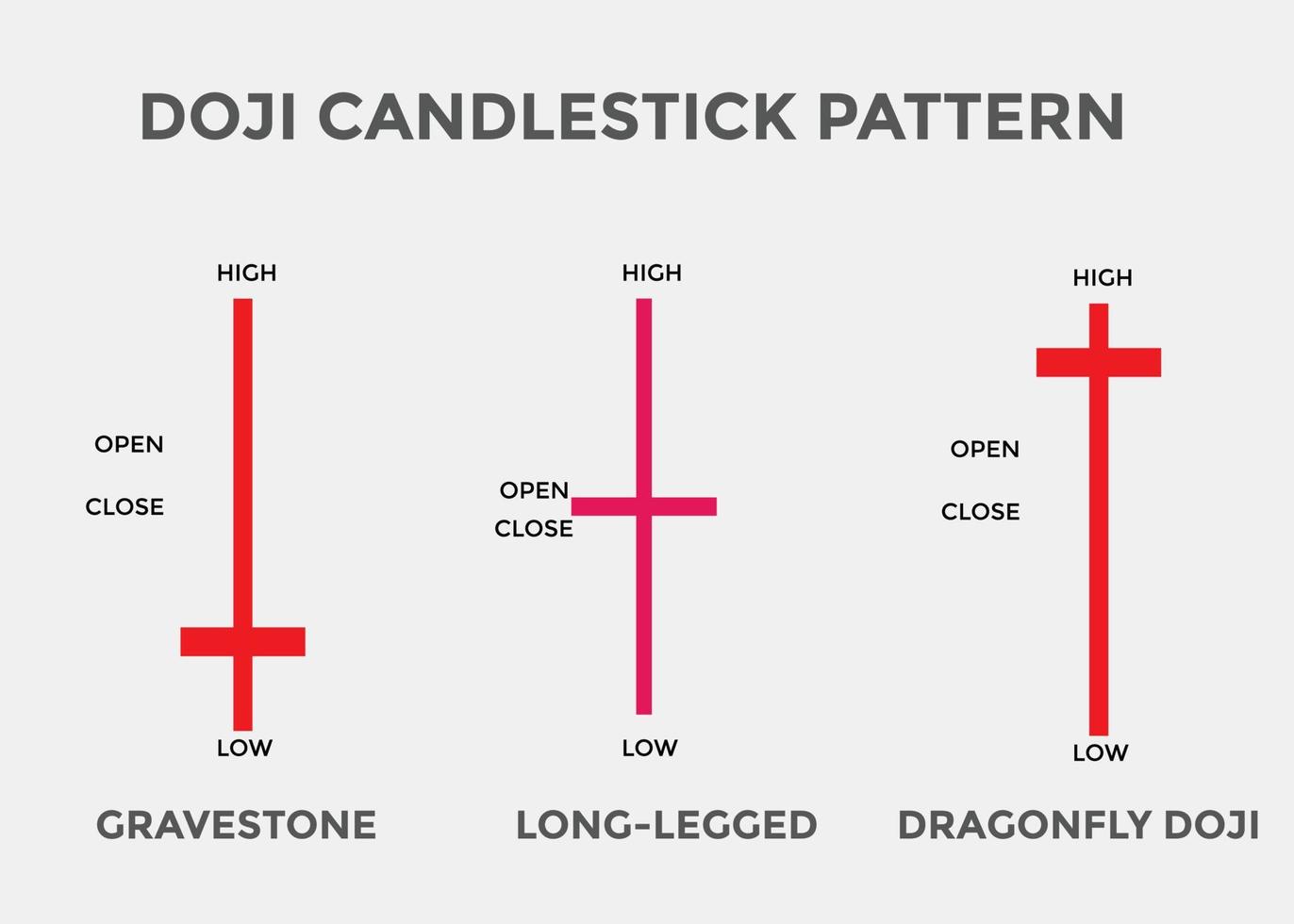

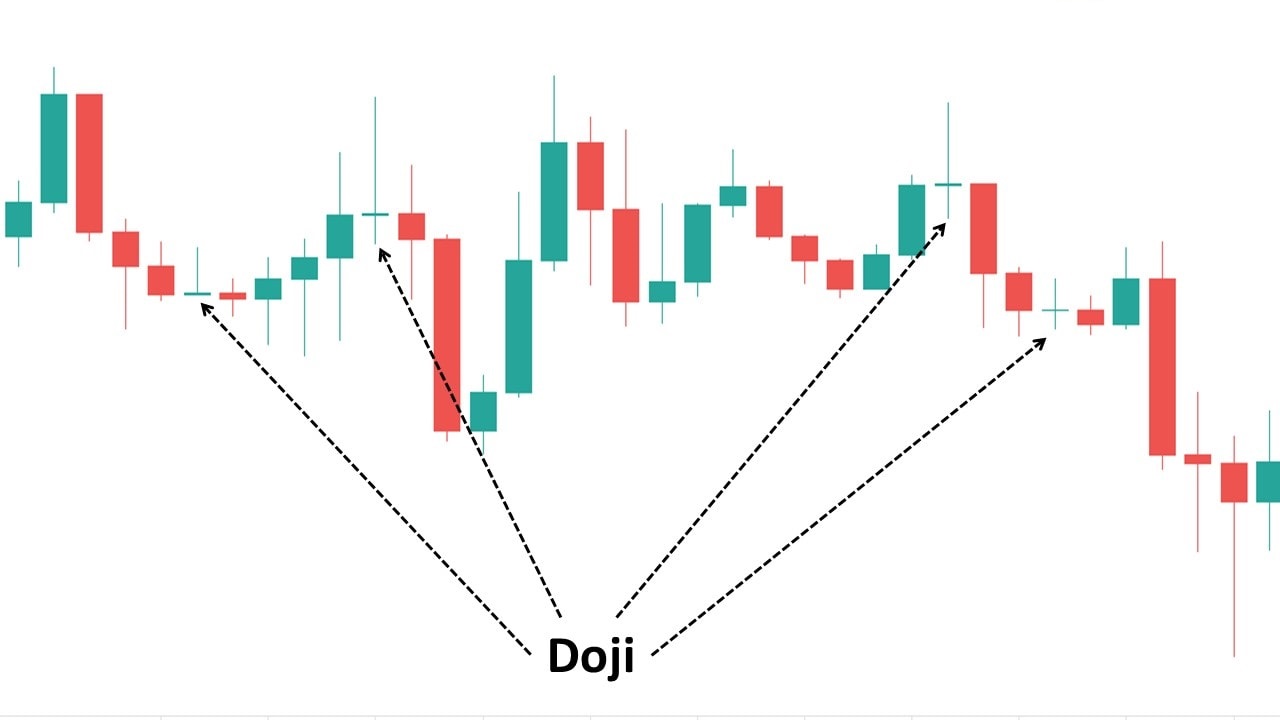

A doji candlestick is a neutral indicator that provides little information. They are rare, so they are not reliable for spotting things like price reversals. Doji formations come in three.

Candlestick Chart Study Doji Candlestick Analysis Maja Curcic

1. Standard Doji pattern A Standard Doji is a single candlestick that does not signify much on its own. To understand what this candlestick means, traders observe the prior price action building up to the Doji. Trades based on Doji candlestick patterns need to be taken into context.

Doji Candlestick Pattern How to use it to identify Reversals DTTW™

2. Trade the breakout. Now…. If the price has tested the highs/lows (of the Long-Legged Doji) multiple times, then it's likely to break out. So, look for a buildup to form (as an entry trigger) and trade the breakout. Here's an example: AUDJPY Weekly: The market went into a range after it formed a Long-Legged Doji.

Doji Candlestick Kebaikan, Jenis, Tips, Cara Menggunakan

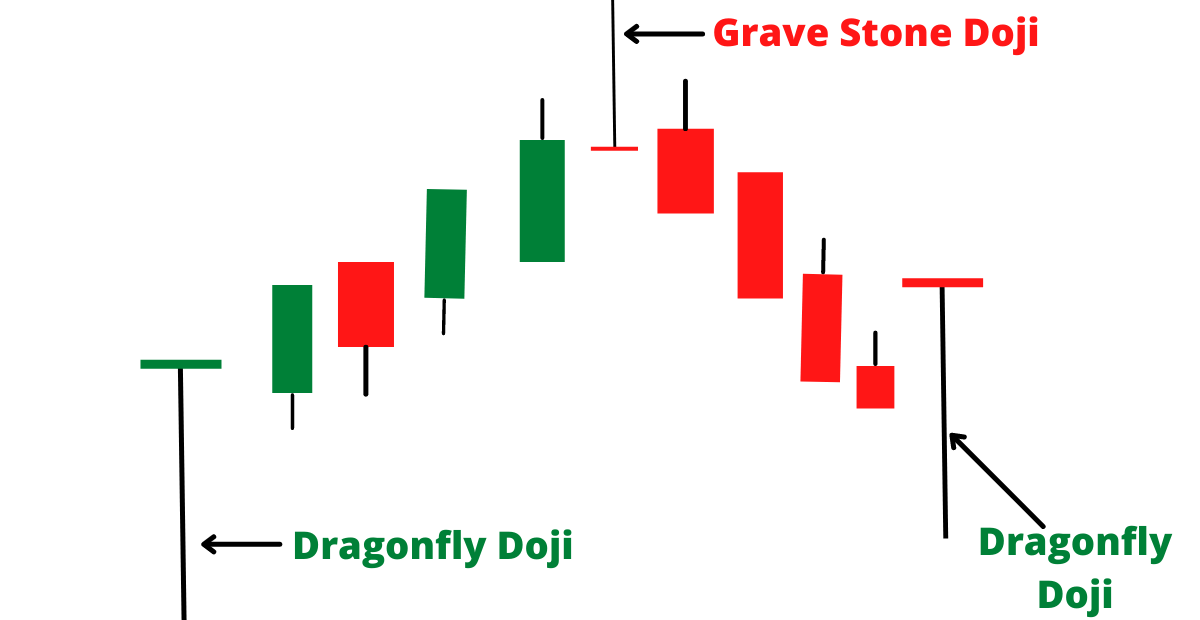

A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the former three.

Dragonfly doji candlestick pattern in Hindi MAYA SHARES

Download FREE PDF Candlestick patterns are a key part of trading. They are like a special code on a chart that shows how prices are moving. Imagine each pattern as a hint about what might happen next in the stock market. History of Candlestick Charting Candlestick charting started over 200 years ago in Japan with rice traders.

Doji Candlestick Pattern In Hindi PDF Download 2023 Techno Prasant

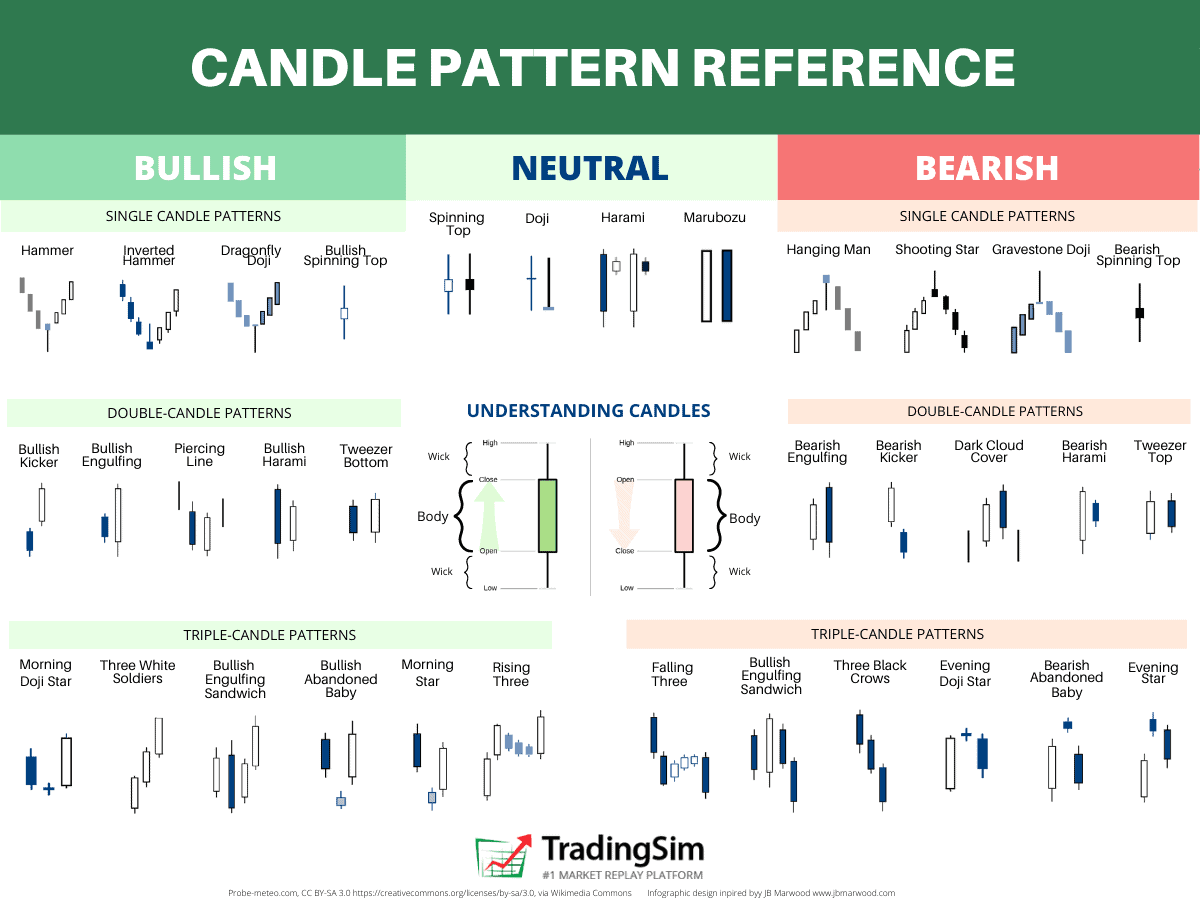

QUICK REFERENCE GUIDE CANDLESTICK PATTERNS BULLISH BEARISH BEARISH Hanging Man Bearish single candle reversal pattern that forms in an up trend. Shooting Star Bearish single candle reversal pattern that forms in an up trend. BEARISH Bearish Engulfing Bearish two candle reversal pattern that forms in an up trend. Bearish Harami

Most Powerful Candlestick Patterns You Must Know Trading Tuitions

The Doji candlestick pattern is a single-candle pattern used to trade market reversals, breakouts, or consolidation. Read on to learn how to identify, classify, and trade Doji patterns in the live market. Table of Contents What is the Doji Candlestick Pattern? How to Identify and Use the Doji Pattern? How to Trade the Doji Candlestick Pattern?

How to trade binary Doji candlestick pattern forex

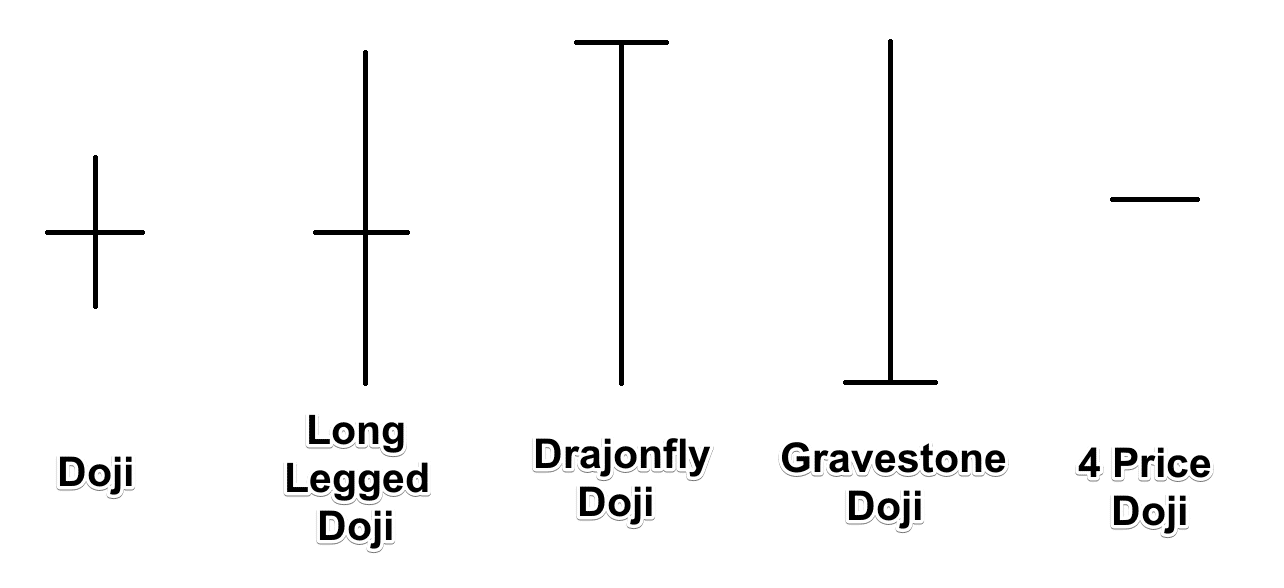

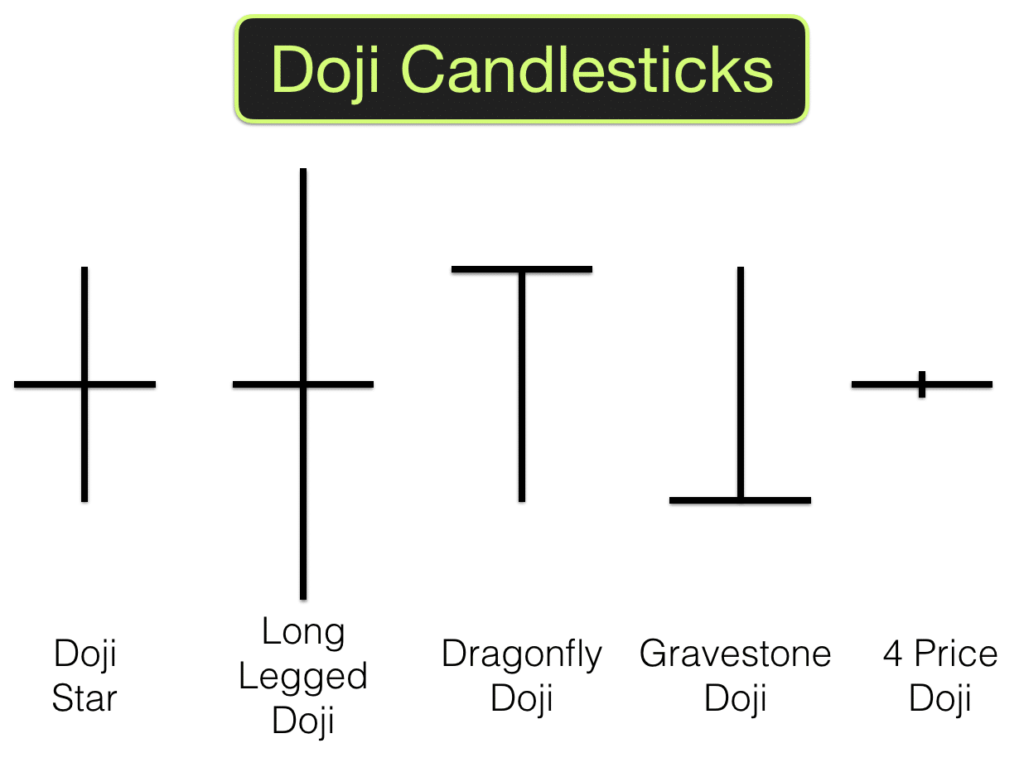

In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji: Standard Doji. Long legged Doji. Dragonfly Doji. Gravestone.

How to Trade the Doji Candlestick Pattern FxTradingMonitor

The bottom line. A cheat sheet for candlestick patterns is a convenient tool, allowing you to quickly identify the patterns you see on a candlestick chart and whether they're usually interpreted as bullish or bearish patterns. Our candlestick pattern cheat sheet will help you with your technical analysis. For example, the candlestick patterns.

Long Legged Doji Candlestick Pattern [PDF Guide] Trading PDF

July 3, 2023 by AliFx Show your love: A Doji candlestick is a pattern where the opening and closing prices are virtually the same, resulting in a very thin or non-existent body, and typically having long shadows on both ends, symbolizing market indecision.

Doji Candlestick Pattern Types PDF [1.5 MB]

A "hammer" is a candlestick with a small body (a small range from open to close), a long wick protruding below the body, and little to no wick above. In this respect it is very similar to a dragonfly doji; the primary difference is that a dragonfly doji will have essentially no body, meaning the open and close prices are equal.

Doji Candlestick Pattern Investing and Online Trading for Beginners Beyond2015

July 3, 2023 by AliFx Show your love: A Doji Star is a candlestick pattern characterized by a very small body, signaling market indecision as the opening and closing prices are virtually equal, with shadows (or wicks) that can be varying lengths.

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

DOWNLOAD FREE PDF STRATEGY VIA FINANSYA APP What is a Doji candle pattern ? The Doji is meaning an important Japanese candle on the candlestick chart. Once a Doji shapes, it divulges to you that the financial asset opened and closed at the same trading price. Consequently, this implies parity between bulls and bears.

Doji Candlestick A Z Guide with FREE PDF Trading PDF

Pattern 1 DOJI Doji is a pattern formed by a single candlestick in which the opening and closing price of the candlestick intersect resulting in a very short body. The upper shadow and lower shadow are present along with a very thin candle body.

Japanese Candlesticks Patterns, Candlestick Patterns, Stock Chart Patterns, Stock Charts, Candle

Doji Candlestick Patterns - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. The Doji candlestick pattern represents indecision between bulls and bears in the market.