Accounting Notes 2007 ACCG2000 Management Accounting MQ Thinkswap

Chapter 1: Application of Accounting Standards; Chapter 2: Partnership Accounts. Unit 1: Dissolution of Partnership Firms; Unit 2: Amalgamation, Conversion and Sale of Partnership Firms; Module-2. Initial Pages; Chapter 3: Accounting for Employee Stock Option Plans; Chapter 4: Buyback of Securities and Equity Shares with Differential Rights

Advanced financial accounting notes pdf generatorhohpa

Banking Final Accounts. 1.1 Introduction : Bank business in India is governed by the banking Regulation Act 1949, which. came into force from16th March 1949. As per section 2 of this Act, provisions of. companies Act 1956, are also applicable to Banking companies. Bank is a commercial. institution, licensed to accept deposits and acts as a safe.

Management accounting notes FIN4284 Management Accounting SEGi Thinkswap

In the newly revised eighth edition of Advanced Accounting, a decorated team of accounting professionals delivers authoritative and comprehensive coverage of all three methods of consolidated financial reporting: cost, partial equity, and complete equity. This invaluable work compares and contrasts United States and international principles, drawing reader attention to enduring differences.

Advanced Corporate Accounting Notes ACC3704 Advanced Corporate Accounting and Reporting

Advanced Accounting delivers an in-depth, comprehensive introduction to advanced accounting theory and application, using actual business examples and relevant news stories to demonstrate how core principles translate into real-world business scenarios.

Business Accounting Notes BKAL1013 Business Accounting UUM Thinkswap

Handouts of Advanced Accounting: summaries and notes for free Online | Docsity. Notes for Advanced Accounting: summaries, handouts, exercises. Add this subject to your profile. Then we will suggest the best study materials related to your subject (s). Download and look at thousands of study documents in Advanced Accounting on Docsity.

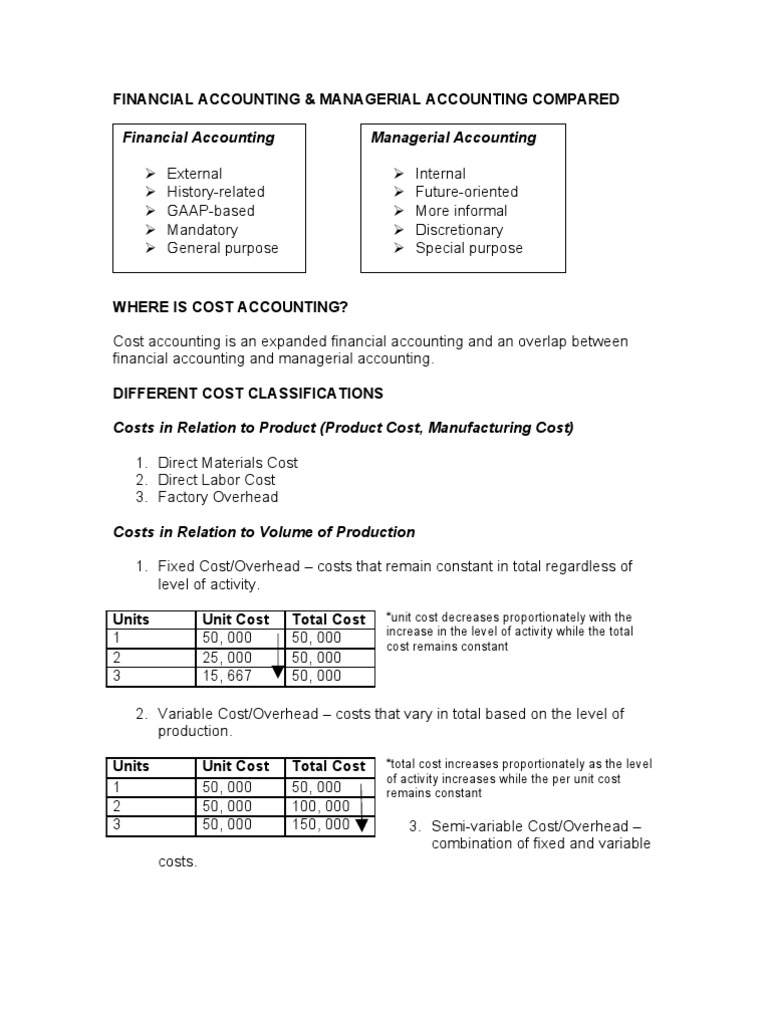

Cost Accounting Notes PDF Cost Accounting Management Accounting

Advanced Accounting Notes Uploaded by Tajammul M'd Taki Financial statements provide mostly historical data since its elements like assets and liabilities etc are measured mostly using historical cost. In India financial statements are prepared recognizing legal form of the transactions and ignoring the substance. Copyright:

Advanced accounting Summary "advanced accounting" Introduction Financial statements Studocu

ate introductory, intermediate, and advanced financial account - ing. He also teaches financial accounting theory and financial statement analysis at the master's level, as well as financial accounting courses in Ex ecutive MBA programs, and a doctor-al seminar in financial accounting and capital markets research.

Accounting Notes BUSS1030 Accounting, Business and Society Thinkswap

these accounting measurements are used by stakeholders (owners, investors, creditors/bankers, etc.) in course of business operation. Hence, accounting is identified as 'language of business'. (ii) Systematic Recording of Transactions To ensure reliability and precision for the accounting measurements, it is necessary to keep a systematic record

Advanced Corporate Accounting Notes ACC3704 Advanced Corporate Accounting and Reporting

Most of the world's work is done through organizations-g roups of people who work together to accomplish one or more objectives. In doing its work, an organization uses resources-l abor, materials, various services, buildings, and equipment.

Corporate Accounting (Question Bank) Academy of Accounts

Advanced Accounting. January 6, 2020. Get real-world support and resources every step of the way. Contact & Locations. Diversity, Equity & Inclusion. Get the 14e of Advanced Accounting by Joe Ben Hoyle, Thomas Schaefer and Timothy Doupnik Textbook, eBook, and other options. ISBN 9781260247824.

Accounting Standards Short Notes.pdf Consolidation (Business) Inventory

Lailane Amoroto. 2019, LAILANE AMOROTO. See Full PDF. Download PDF. See Full PDF. Download PDF. Loading Preview. Accounting Management Accounting Accounting Education Cost Accounting Accountancy Accounting and Finance. ADVANCED FINANCIAL ACCOUNTING AND REPORTING: Summary Notes.

Accounting Notes ACCT1501 Accounting and Financial Management 1A UNSW Thinkswap

accounting, bookkeeping, finance, business Collection. Full Title: Advanced Accounts--A Manual of Advanced Book-Keeping and Accountancy for Accountants, Book-Keepers and Business Men. Addeddate 2015-11-03 21:26:49 Identifier CarterR.N.AdvancedAccountsAManual1939 Identifier-ark. PDF download. download 1 file.

Advanced financial accounting notes for warspowen

Advanced Financial Accounting is written for second and third year financial accounting students on accounting or business studies degrees and is also suitable for MBA courses. The book provides extensive coverage of the syllabuses for the advanced papers in financial accounting and financial reporting of the ACCA, CIMA, ICAEW, ICAI and ICAS.

Handwritten notes of basic accounting terms and introduction of accounting. CLASS 11 YouTube

Advanced Accounting (CA-IPCC) (Group II) 1.4 Recognition of the elements of Financial Statements 8 1.4.1 Meaning of Recognition 8 1.4.2 Recognition criteria 8 1.4.3 Probability of Future Economic Benefit 8 1.4.4 Reliability of Measurement 8 1.4.5 When should asset be recognized in the Balance Sheet 8

Accounting Notes/Assignment ACC101 Financial Planning for Business CSU Thinkswap

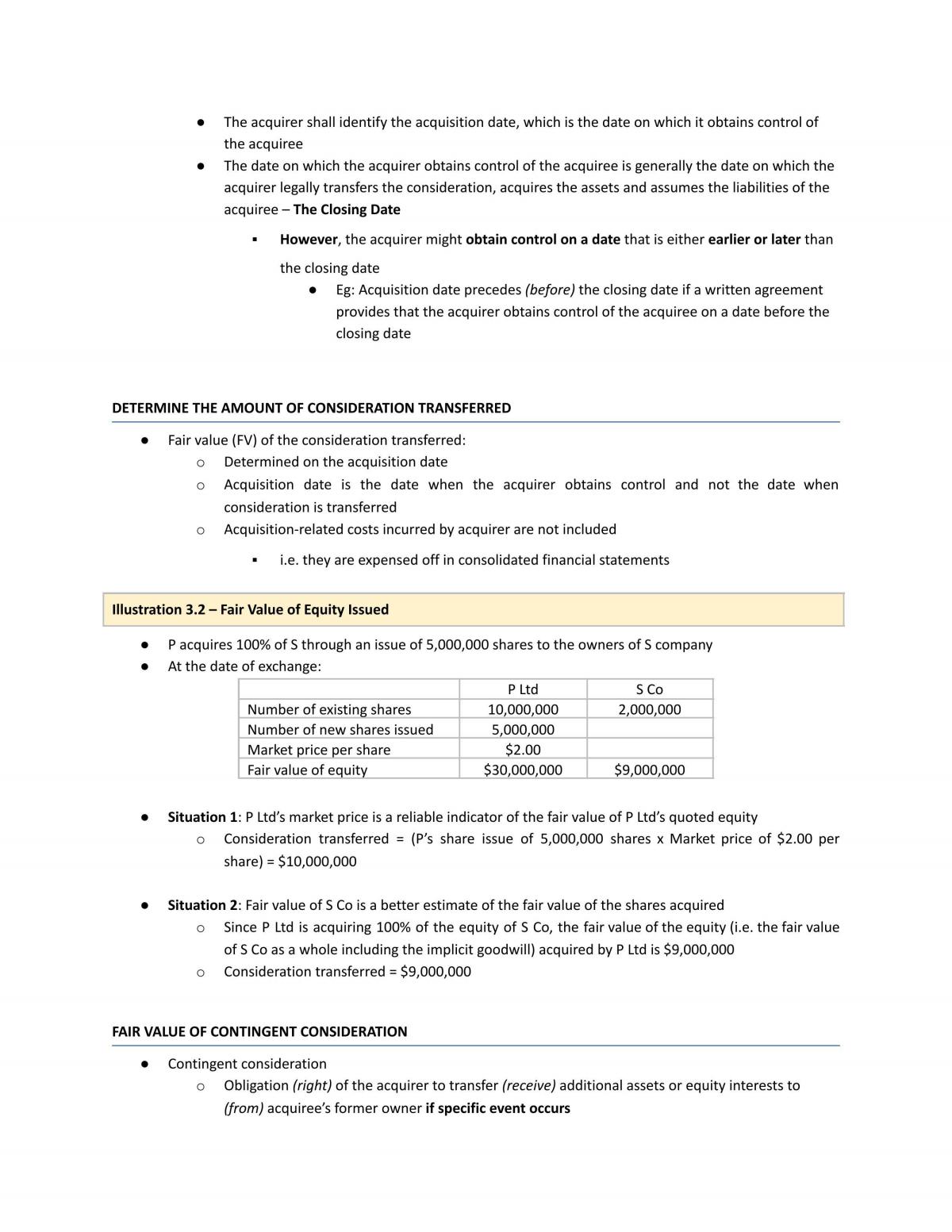

Methods of Accounting for Business J Combinations 27 Questions 28 Cases 29 Exercises 32 Problems 43 Chapter 2 Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries with No Differential 53 Berkshire Hathaway's Many Investments 53 Accounting for Investments in Common Stock 54 Reasons for Investing in Common Stock 56

advancedaccountingnotessummarynotesforadvancedaccountingcpaboardexam.pdf

Objectives: To ascertain the financial results To create accountability among branches To measure individual financial position and performance To exercise proper control To suggest measures for improving efficiency Types of branches: Dependent branches Independent branches Foreign branches Format of branch account