Extension of timelines for filing of returns and various reports of audit for the

Deduction for state and local taxes paid:, it allows taxpayers to deduct up to $10,000 of any state and local property taxes plus either their state and local income taxes or sales taxes. Deduction for mortgage interest paid: Interest paid on the mortgages of up to two homes, with it being limited to your first $1 million of debt.

[PDF] Tax Assessment Form 202021 PDF Download InstaPDF

Question: The Income Tax Department has recently notified the new Income Tax Return forms applicable for Financial Year 2023-24 (Assessment Year 2024-25). Accordingly, kindly highlight the changes.

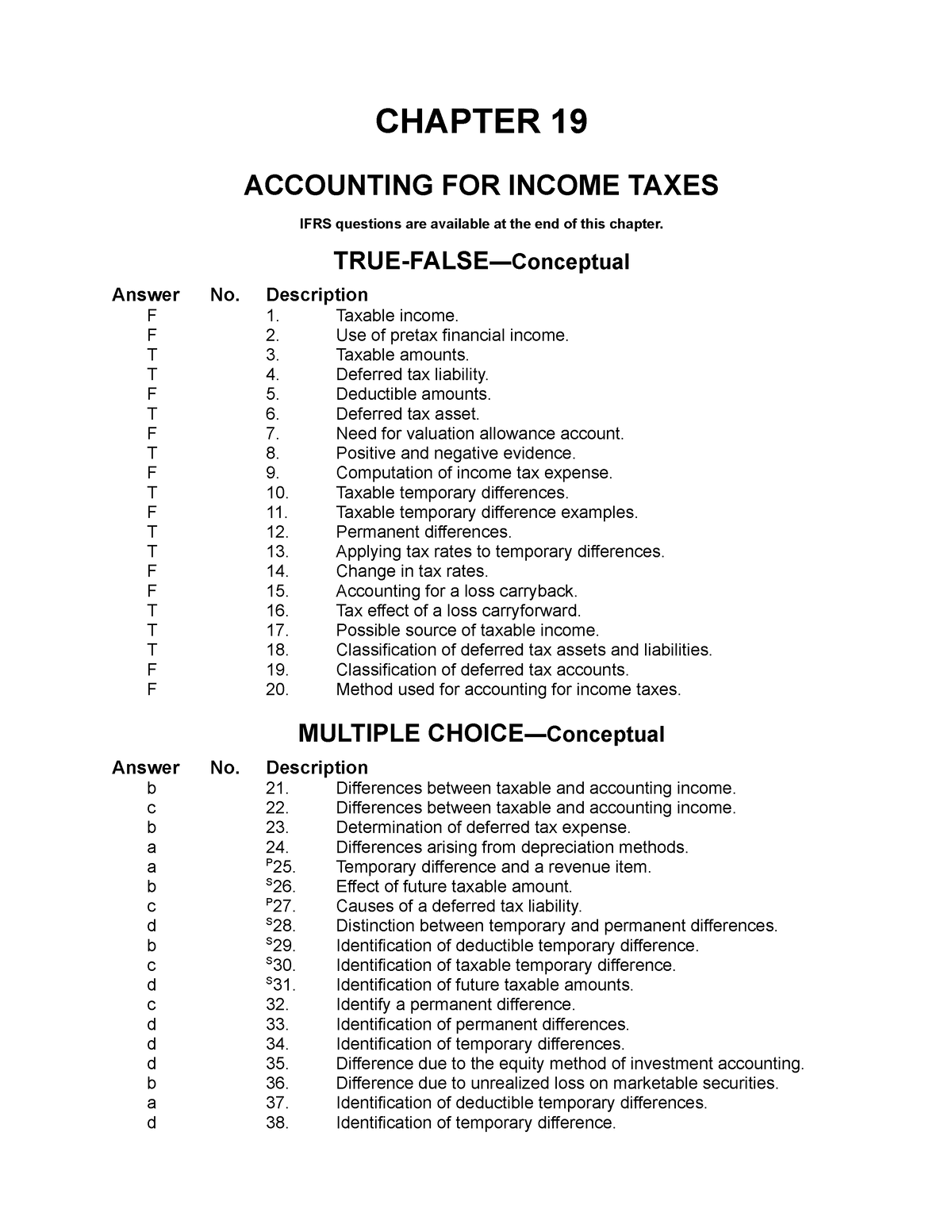

Ch19 Practice test CHAPTER 19 ACCOUNTING FOR TAXES IFRS questions are available at the

This amount is reduced by the prior (2021) tax inclusion amount of $8, which results in the recognition of $92 of revenue for tax purposes in 2022. Taxpayer is entitled to a $60 COGS deduction for tax purposes in 2022, as ownership of the goods passed to the customer in 2022. The result to Taxpayer in 2022 is gross income for tax purposes of $32.

tax self assessment Money Donut

On January 12, 2024, IRS will host a webinar, Sailing Through the Rules of Refundable Credits. Tax professionals will receive the most current information about the latest changes to the rules for the Earned Income Tax Credit, Child Tax Credit, Additional Child Tax Credit, and the American Opportunity Tax Credit for tax year 2023 returns.

How to Compute Tax on Salary Kanakkupillai

IR-2024-03, Jan. 5, 2024 — With the 2024 tax filing season just around the corner,. A significant number of taxpayers eligible for refundable credits such as the Earned Income Tax Credit or Child Tax Credit choose to enlist the assistance of tax preparers and rely on paid tax professionals to accurately file their returns. The IRS reminds.

Tax Escaping Assessment Objectives Notices under Section 148

IR-2024-04, Jan. 8, 2024 WASHINGTON — The Internal Revenue Service today announced Monday, Jan. 29, 2024, as the official start date of the nation's 2024 tax season when the agency will begin accepting and processing 2023 tax returns. The IRS expects more than 128.7 million individual tax returns to be filed by the April 15, 2024, tax deadline.

Making the Tax Fair Zenconomics

The broad benefits are clear: enhanced market resilience, reduced liquidity risks, lower margin requirements, and reduced costs for investors, among many others. In our latest brief, you'll learn: Lessons from T+2 adoptions. Specific impacts of an accelerated settlement cycle by market group. How to prepare for the T+1 conversion process.

How to Pay HMRC Self Assessment Tax Bill in the UK

Tax Espresso - July 2021 2 1. Income Tax (Accelerated Capital Allowance) (Machinery and Equipment including Information and Communication Technology Equipment) Rules 2021 [P.U.(A) 268/2021] P.U.(A) 268/2021 (the Rules) was gazetted on 15 June 2021 and shall have effect from the year of assessment (YA) 2020. Application

Residential Aged Care Fee Assessment Form Printable Printable Forms Free Online

There are four types of accelerated assessments: Jeopardy assessments, initiated when collection of tax is in danger and the tax is due, but there is no return on file (neither a voluntarily filed return or IRS return prepared under IRC 6020 (b) authority) Termination assessments, initiated by Examination and used to assess income tax.

Reassessment u/s 147 of Tax Act After Expiry of Four years from End of Relevant Year of

Editor: Christine M. Turgeon, CPA. Sec. 451 governs the timing of including an item in income.. The 2017 law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, made significant changes to Sec. 451.The TCJA added new Sec. 451(b), which accelerates the recognition of income for certain accrual-method taxpayers, and Sec. 451(c), which codified the existing one-year deferral for certain.

Challan 280 Self Assessment & Advanced Tax Payment Learn by Quicko

Also, it's shown separately in box 12 with code C. Box 12 will also show the amount of uncollected social security and Medicare taxes on the excess coverage, with codes M and N. You must pay these taxes with your income tax return. Include them on Schedule 2 (Form 1040), line 13. For more information, see the Instructions for Forms 1040 and.

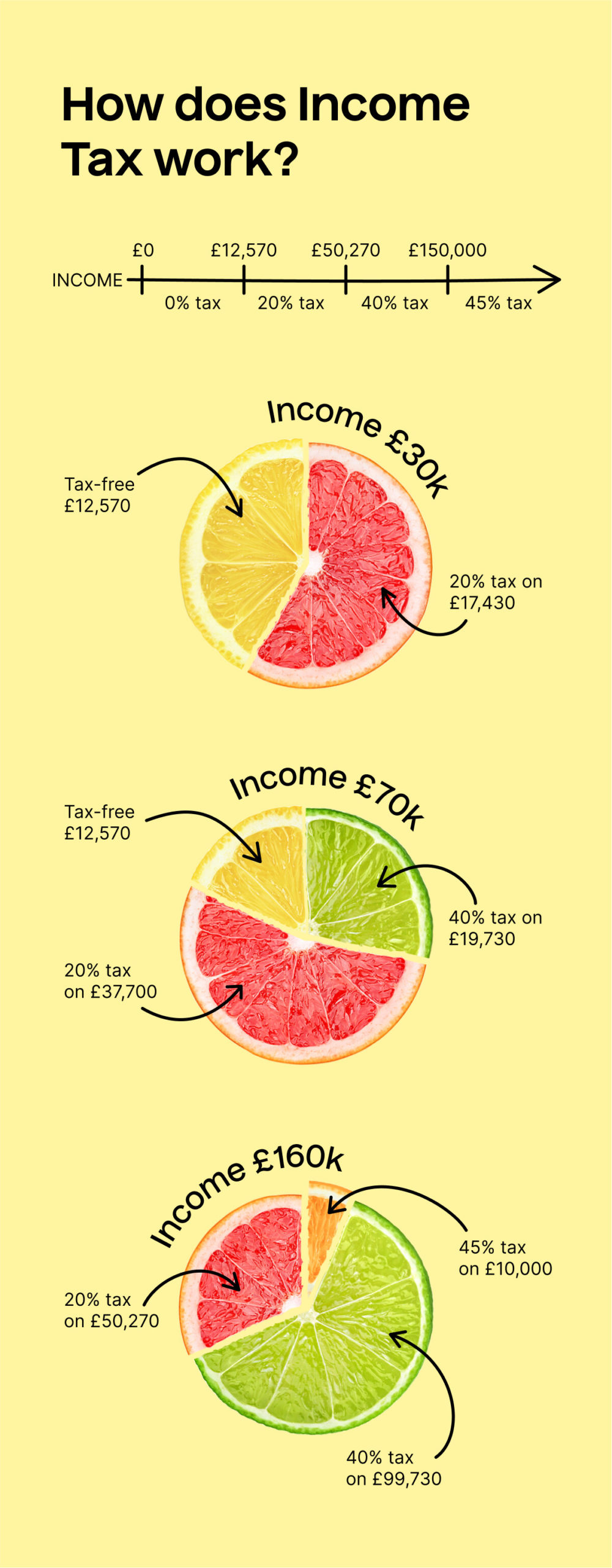

tax rates in the UK TaxScouts

Accelerated Assessment (Assessment during previous year itself) Every assessee is liable to be assessed during the assessment year, for the income earned during the previous year. However in certain circumstances an assessee will be assessed during the previous year itself. This is called 8 accelerated assessment 9.

Better understanding of Assessment or Reassessment U/s 147 and 148 of Tax Tax

The guidance in ASC 740 applies to taxes (and thus uncertain tax positions) that are "based on income." It should not be applied by analogy to non-income-based taxes, such as sales taxes, value-added taxes, or property taxes. Entities have historically applied ASC 450, Contingencies, to the recognition of non-income-based tax exposures.

Company UTR Number A Guide Mint Formations

Accelerated Assessments means any regular Assessments that have been accelerated and made due and payable immediately, that would not otherwise be due until a future date, pursuant to the Association 's governing documents or state or local statutes. Sample 1 Based on 1 documents Examples of Accelerated Assessments in a sentence

notice of assessment singapore Paul Wan & Co

In income tax, the accelerated assessment is a special provision that allows taxpayers to expedite the assessment and payment of their tax liability. The accelerated assessment process is designed to reduce the time and resources required for the tax authorities to process tax returns and collect taxes owed.

HighPitched Assessment by Tax Dept with unusual determination of Rate of Gross Profit

Even if tax changes are adopted, an acceleration strategy does not make sense in all circumstances. Some taxpayers will not face higher marginal tax rates in 2022. For example, C corporations generating up to $400,000 of taxable income would see their marginal U.S. federal income tax rates drop from 21% to 18% under the House proposal.