How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

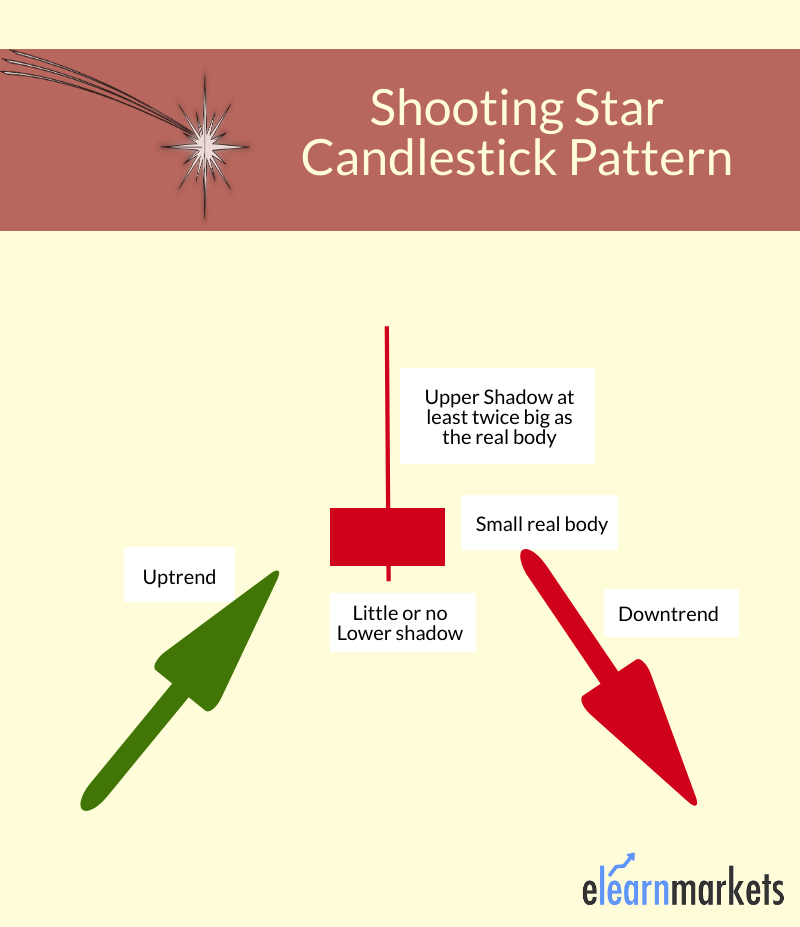

Shooting Star: A shooting star is a type of candlestick formation that results when a security's price, at some point during the day, advances well above the opening price but closes lower than.

What is a Shooting Star Candlestick Pattern May 2023

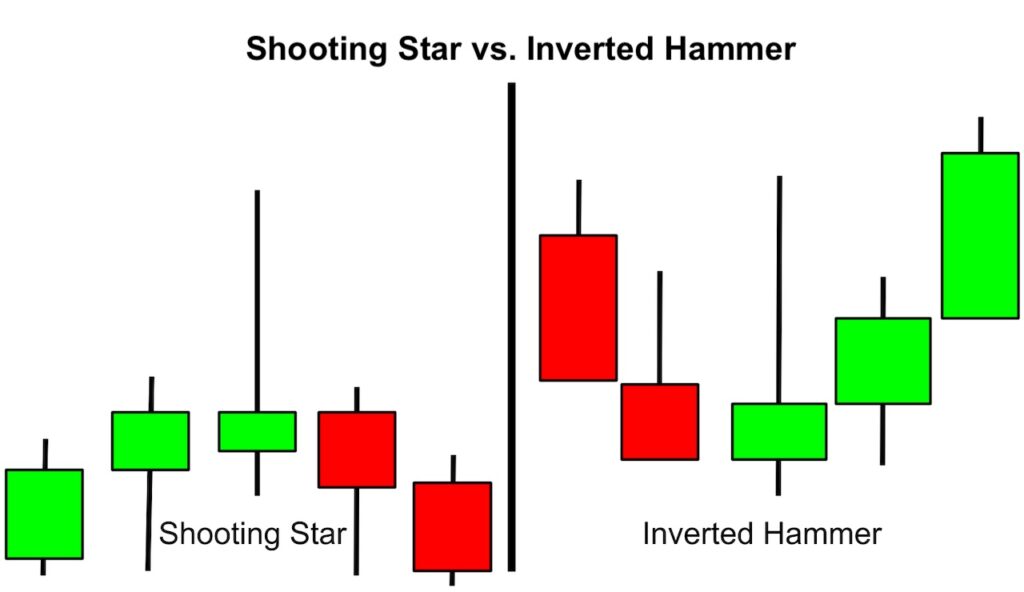

Shooting star. A shooting star, meanwhile, is a doppelgänger of an inverted hammer. But like the hanging man, a shooting star will appear at the crest of an uptrend instead of the trough of a downtrend.. It looks the same as a morning star, but with a green candle at the beginning - after an extended uptrend - and a red one at the end.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

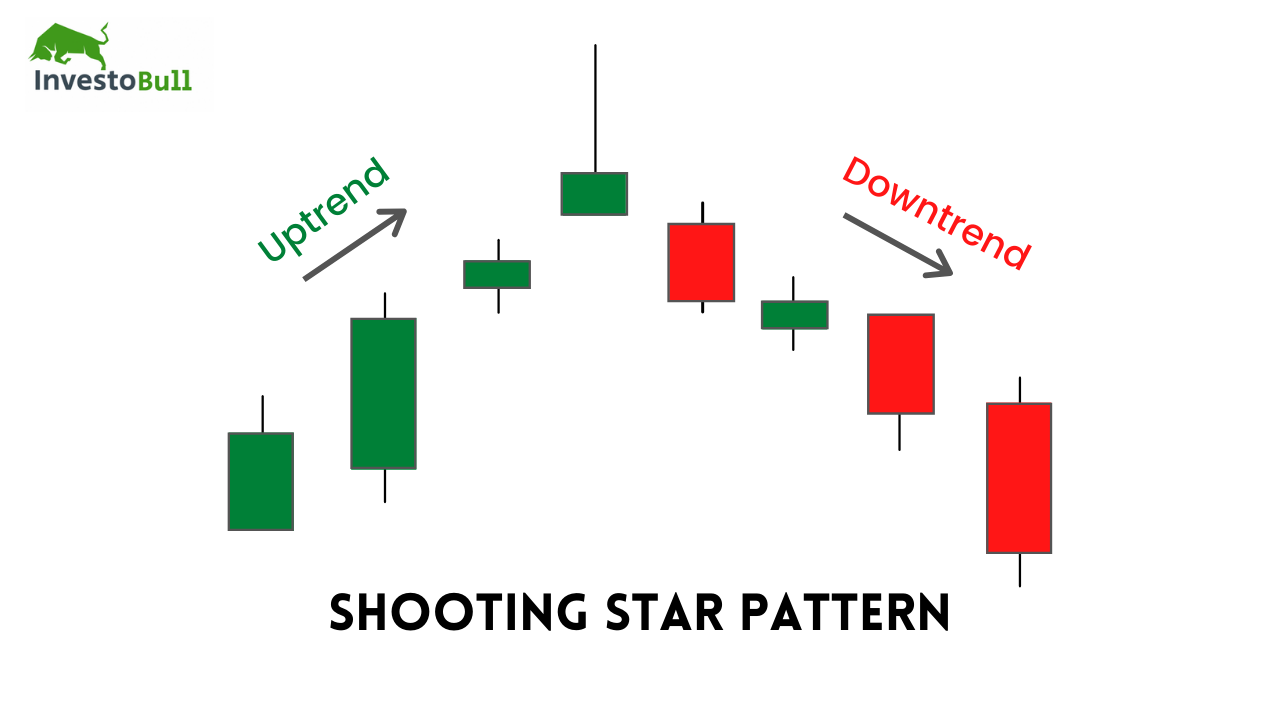

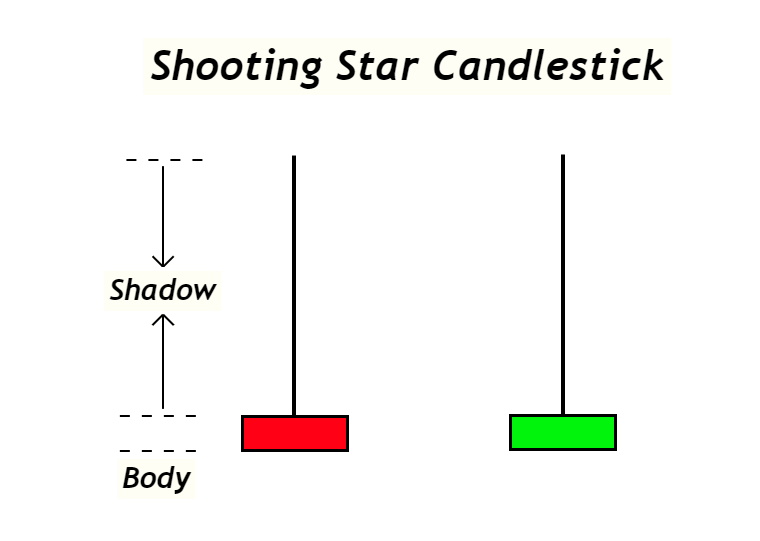

A shooting star candlestick pattern is a chart formation that occurs when an asset's market price is pushed up quite significantly, but then rejected and closed near the open price. This creates a long upper wick, a small lower wick and a small body. The upper wick must take up at least half of the length of the candlestick for it to be.

GLASS JAR CANDLE Shooting Star Candle Wooden Wick Candle Etsy

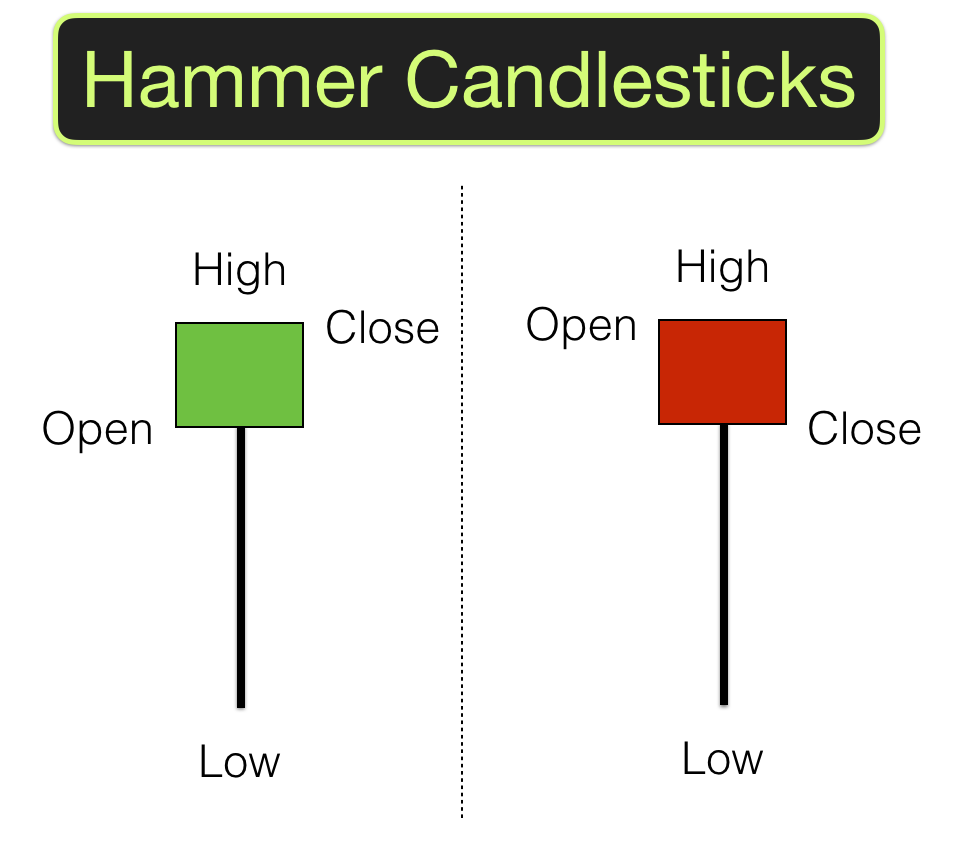

Famous One-Candlestick Patterns - Hammer & Shooting Star Doji . In this segment, one candle stick pattern will be the focus. Note the common characteristic of both the shooting star and the hammer is that the candles have a prominent wick and relatively small candle body.

Shooting Star Candlestick Pattern How to Identify and Trade

The inverted shooting star is a bullish analysis tool, looking to notice market divergence from a previously bearish trend to a bullish rally. An inverted shooting star pattern is more commonly known as an inverted hammer candlestick. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting.

Herb and Crystal Shooting Star Candle Etsy

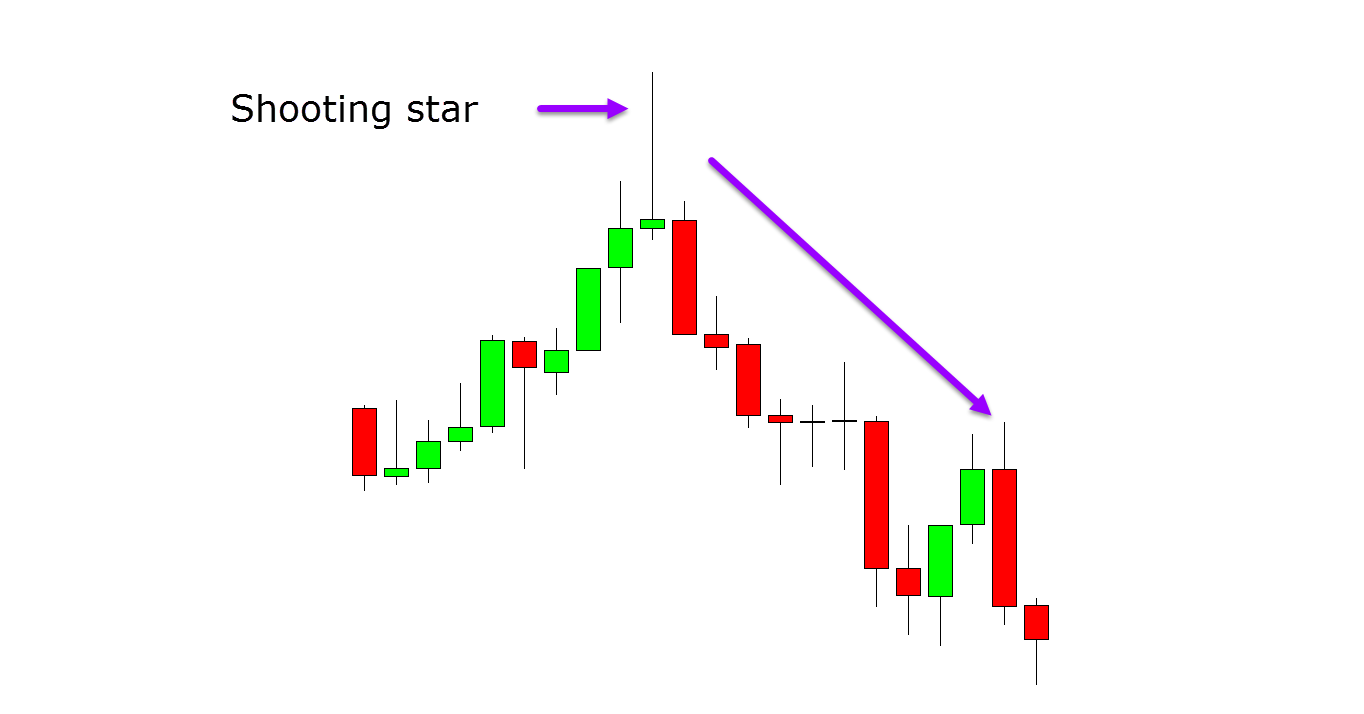

Raining Profits. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. After we short Apple, the price enters a downtrend. After the first bearish impulse on the chart, the price creates a range between $107.30 and $107.40 per share.

Shooting Star Candle in 2021 Shooting star candle, Candlestick

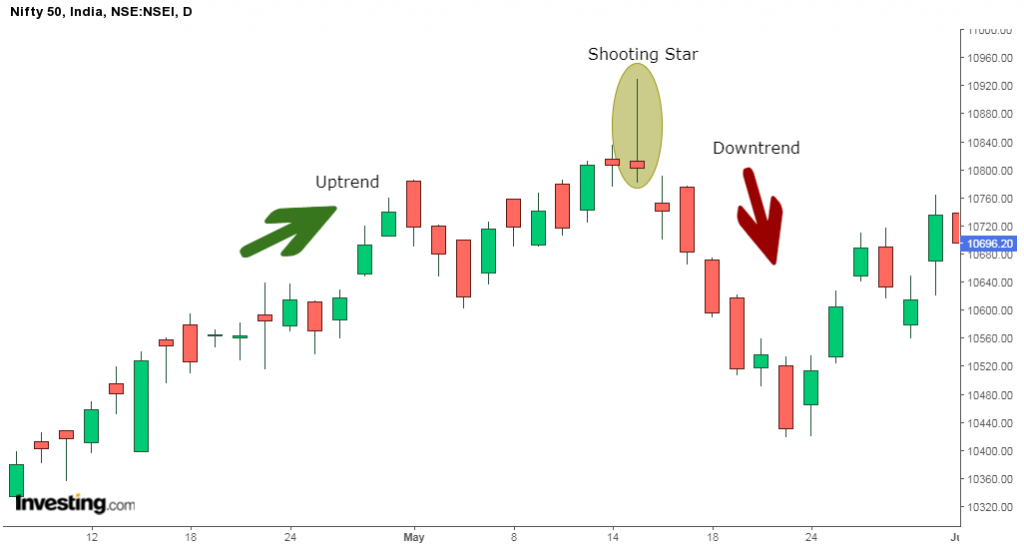

The shooting star is a bearish reversal candlestick that appears after a significant price advance. Therefore, it appears at the top of an uptrend suggesting that the price has peaked and the upward momentum is waning. In contrast, the inverted hammer is a bullish reversal candlestick pattern that occurs at the bottom of a downtrend.

What Is Shooting Star Candlestick? How To Use It Effectively In Trading

The percentage of Shooting Star winning trades was an impressive 57.1%, the 2 nd best candle I have tested, and significantly higher than the 55.8% average performance across all candlestick types. The Max Drawdown was -25%, versus the stock's drawdown of -59.3%, which shows less volatility than a buy-and-hold strategy.

Shooting Star Candlestick Pattern Trading the Shooting Star

A shooting star is a candlestick pattern with two candles, typically forming at the top of a trend. It resembles a shooting star with a long tail and small body, signaling potential resistance levels and entry points in the market. fci, rsi, stochastic. How to identify:

Shooting Star Candlestick Pattern How to Identify and Trade

Shooting star patterns are found in uptrends. In technical analysis, a shooting star is interpreted as a type of reversal pattern presaging a falling price. The Shooting Star looks exactly the same as the Inverted hammer, but instead of being found in a downtrend it is found in an uptrend and thus has different implications.Like the Inverted hammer it is made up of a candle with a small lower.

Herb and Crystal Shooting Star Candle Etsy

A shooting star formation is a bearish reversal pattern that consists of just one candle. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind a.

What Is Shooting Star Candlestick With Examples ELM

A shooting star candlestick is a technical analysis indicator. It is a Japanese candlestick pattern indicating a potential price trend reversal. It appears at the end of a bullish price trend. This candlestick pattern is characterized by its long upper shadow and a short lower shadow, with the candle body closer to the lower point.

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

The shooting star is a bearish candlestick with a long upper shadow. The shooting star is actually a hammer candle turned upside down. The wick extends higher instead of lower while the open, low and close are all near the same level. A candlestick is considered as a shooting star when the formation appears during the price advance.

Hammer Candlesticks Shooting Star Candlesticks

Step #2: The Shooting Star Candle should come after a strong bullish trend. The location, or where the shooting star candlestick develops, matters a lot. This whole ingredient is what makes the bearish shooting star candle performs with such a high degree of accuracy. We need a strong uptrend that has two important features:

Powerful Shooting Star Candlestick Formation, Example & Limitations2022

A shooting star is a single-candle bearish pattern that generates a signal of an impending reversal. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. It is considered to be one of the most useful candlestick patterns due to its effectiveness.

How to Trade the Shooting Star Candlestick Pattern IG Australia

What Does a Shooting Star Candlestick Mean? It is a bearish reversal pattern that consists of one candle. The candlestick pattern is formed when the price of an asset is pushed higher and then rejected back lower in the same session. This leaves a large upper wick rejecting higher prices.