Ordinary Annuity vs Annuity DueDifference between ordinary annuity and

Income payments from an annuity are taxed as ordinary income. Annuity Due vs. Ordinary Annuity An annuity due payment is a recurring issuance of money upon the beginning of a period..

Ordinary Annuity vs. Annuity Due Which Is Better? [EXPLAINED]

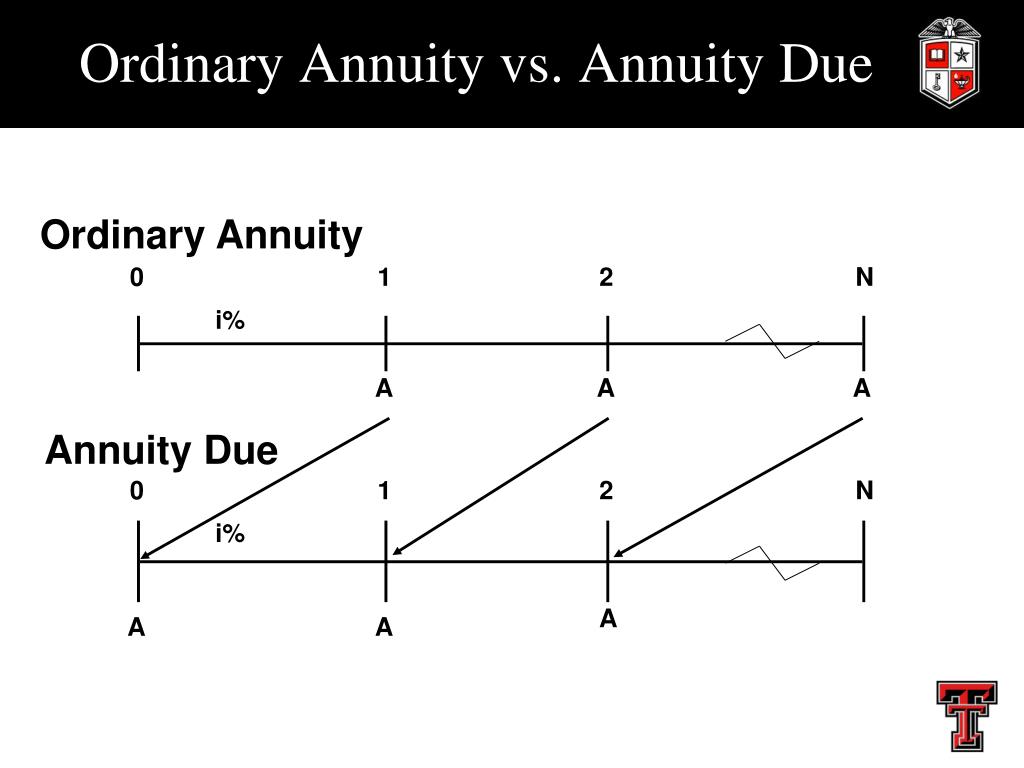

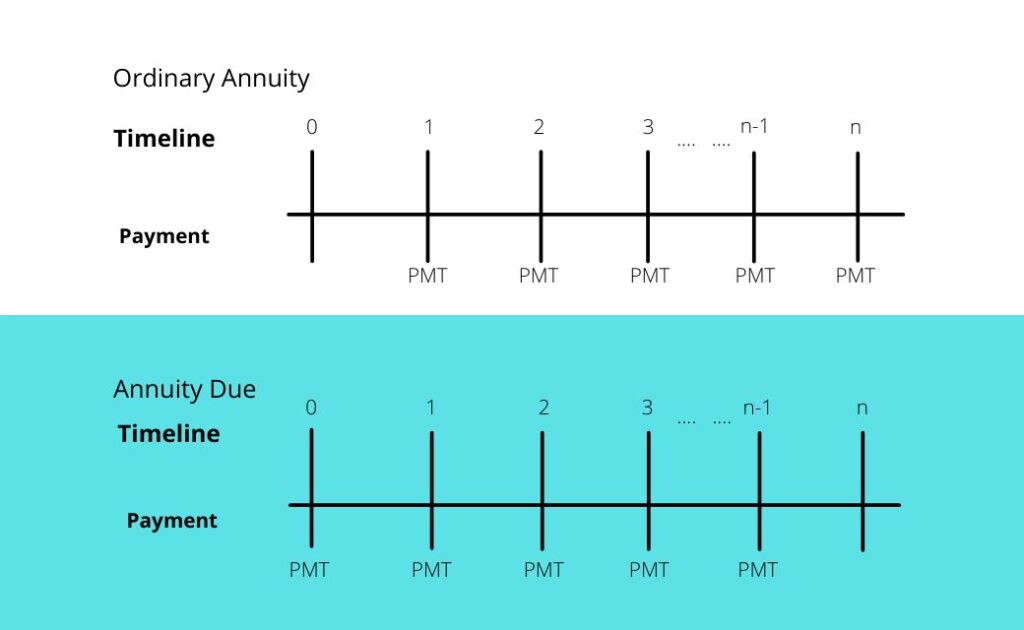

Ordinary annuities: An ordinary annuity makes (or requires) payments at the end of each period. For example, bonds generally pay interest at the end of every six months. Annuities due: With.

The Key Differences Between Ordinary & Annuity Due

Get Instant Quotes Schedule a meeting with an Agent Best Life Insurance in Canada Biggest Life Insurance Companies Are you considering getting an annuity? This blog can help you earning about the difference between ordinary annuity and annuity due.

What is an Annuity? Ordinary Annuity vs. Annuity Due Differences

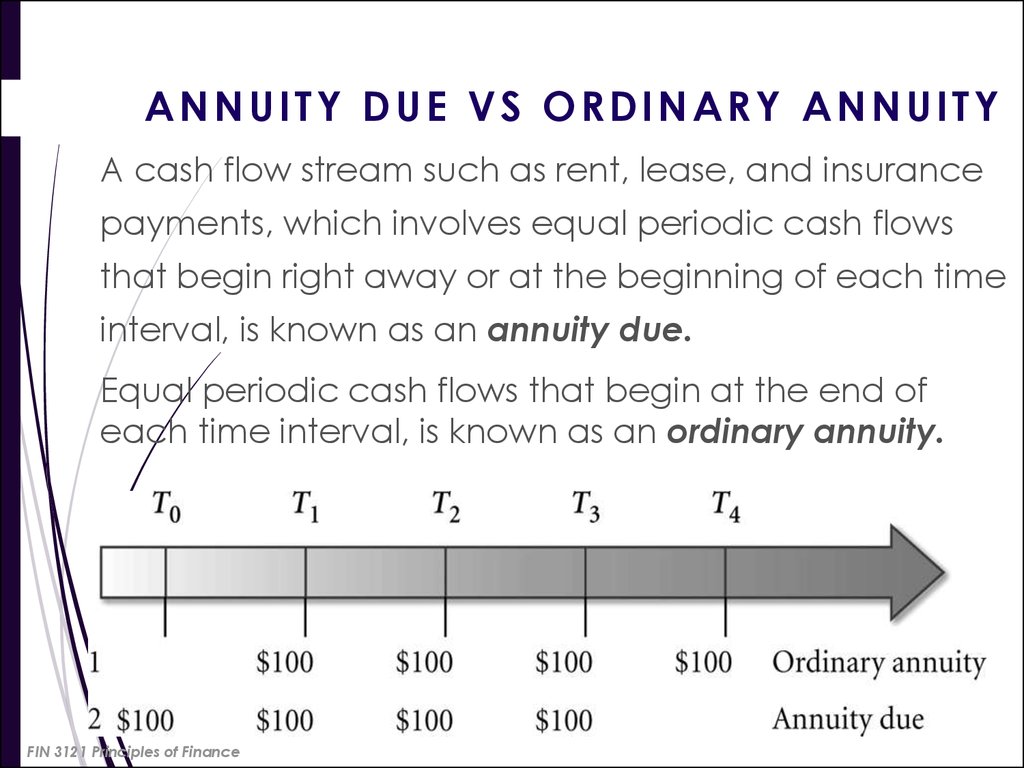

Ordinary annuity means an annuity which is related to the period preceding its date, whereas annuity due is the annuity related to the period following its date. Most of the people use an annuity as a retirement tool (pension) that guarantees steady income in the coming years.

Understanding the Difference between Ordinary Annuity and Annuity Due

Key Differences Between Ordinary Annuity and Annuity Due Present Value Calculation The Bottom Line Difference Between Ordinary Annuity and Annuity Due FAQs What Is an Annuity? An annuity is a series of cash flows occurring over time.

(8 of 26) Ch.6 Annuity "ordinary" vs "due" Future Value YouTube

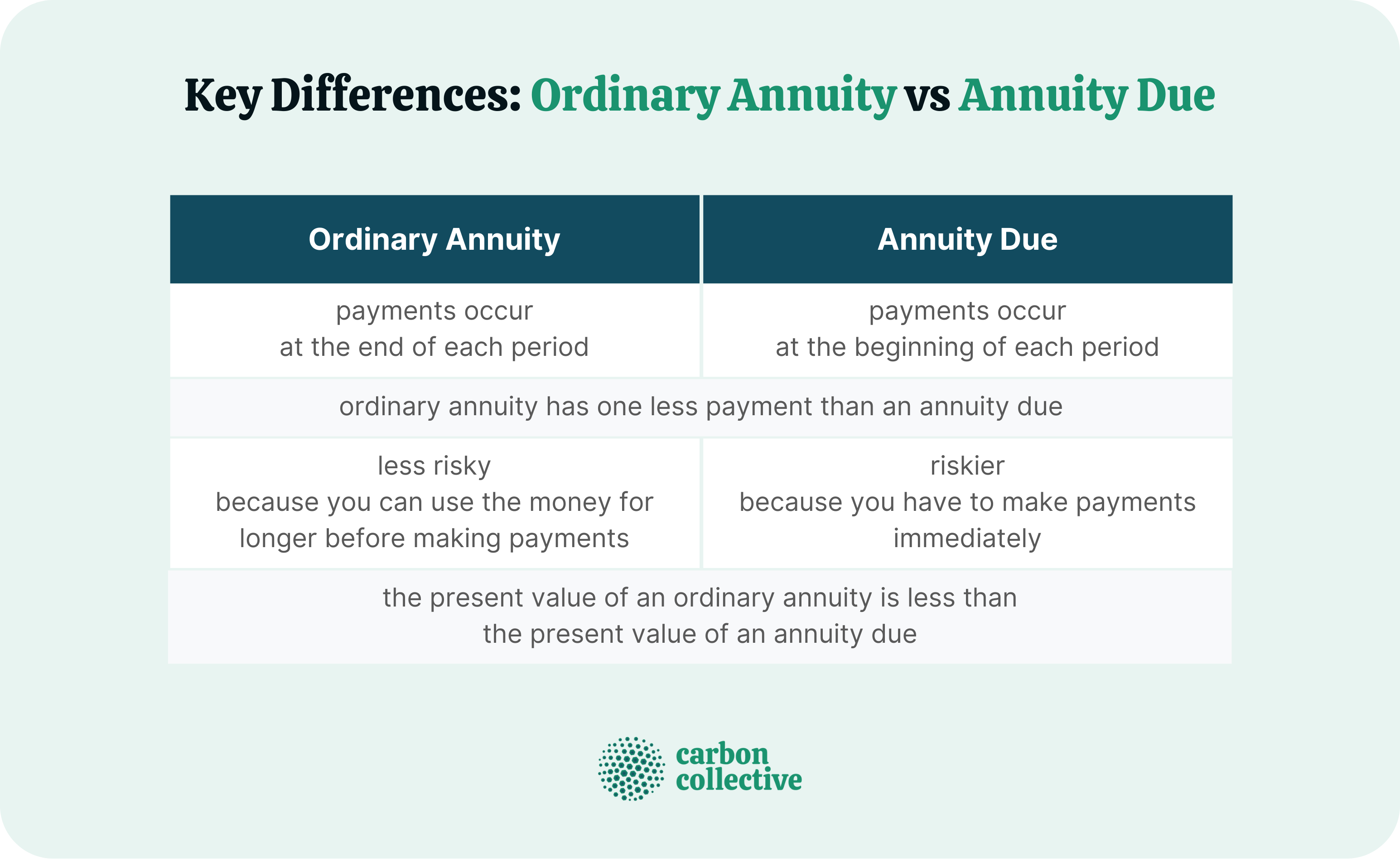

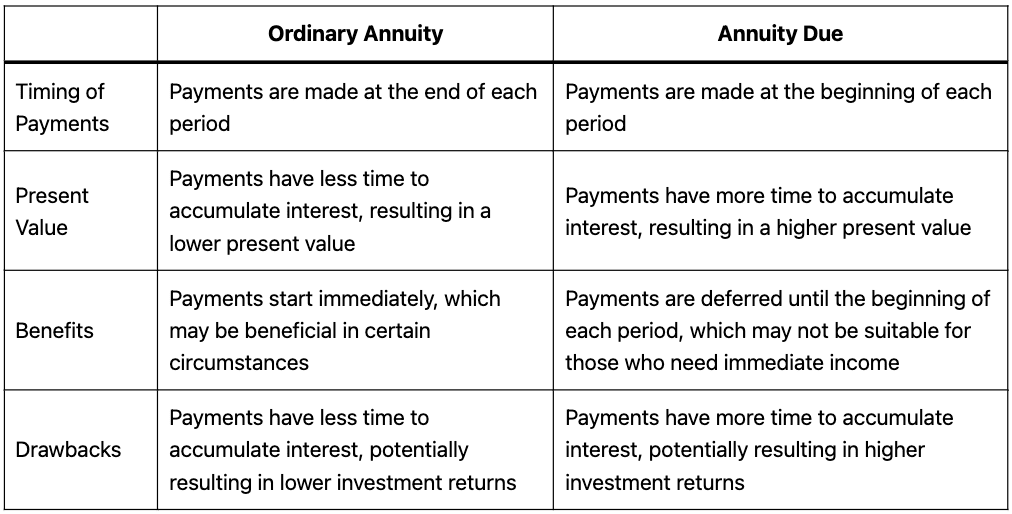

As noted, the primary difference between an ordinary annuity and an annuity due is whether the payment is made in arrears or in advance. This difference, in turn, affects the annuity's.

PPT Time Value of Money PowerPoint Presentation, free download ID

This video explains the difference between an ordinary annuity and an annuity due. Both an ordinary annuity and an annuity due are a stream of cash flows; t.

Annuity Ordinary and Annuity Due Present & Future Value Financial

The differences between ordinary annuity vs annuity due are as follows: Payment In an ordinary annuity, the payment you make is for the period preceding its date, whereas, in the payment in an annuity, due is for the period following its date. Also Read: Present Value of Annuity Present Value

PPT Time Value of Money PowerPoint Presentation, free download ID

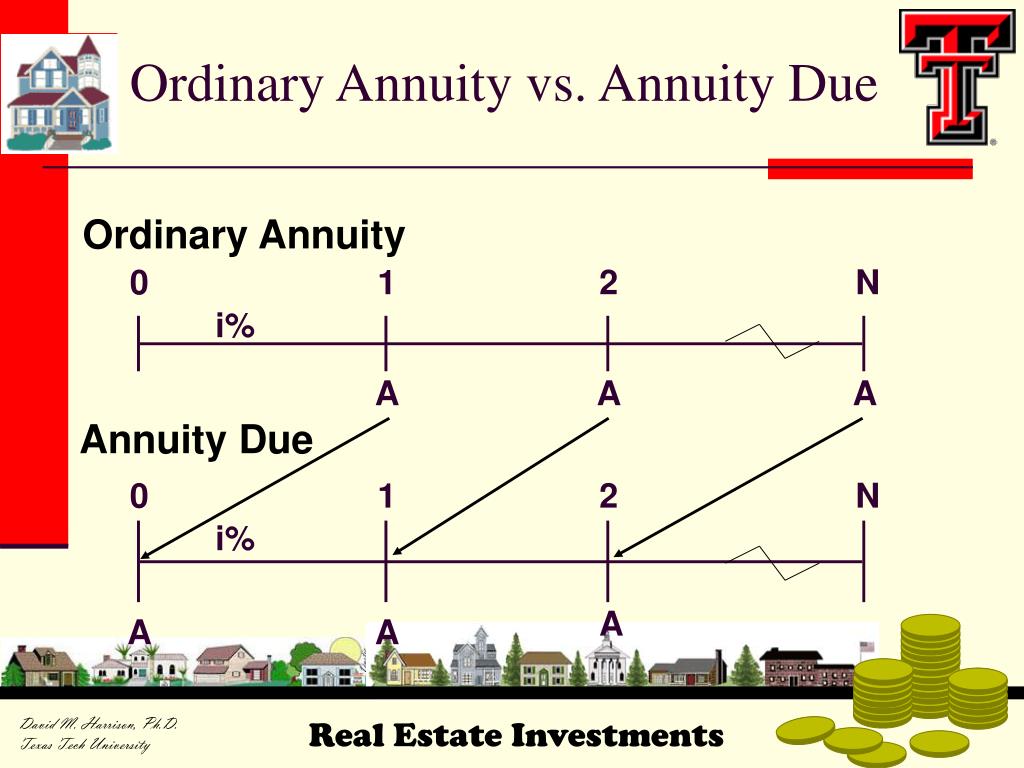

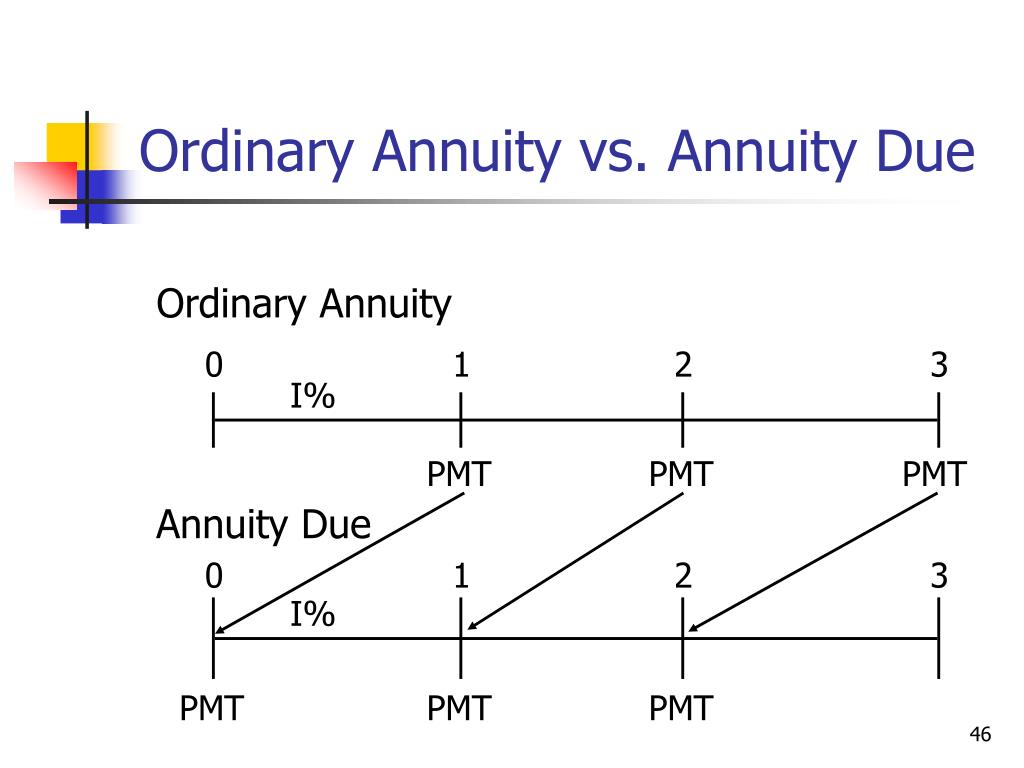

Ordinary Annuity vs. Annuity Due: The Key Differences. When it comes to ordinary annuities and annuities due, the main difference lies in the timing of cash flows. In an ordinary annuity, the payments or cash flows occur at the end of each period, while in an annuity due, the payments occur at the beginning of each period. This seemingly small.

PPT Chapter 4 PowerPoint Presentation, free download ID1641293

The variables mean the same as above. The main differences between ordinary annuity and annuity due are: - Ordinary annuities pay at the end of each period, while annuities due pay at the beginning. - Annuities due have a higher present value because payments are made earlier. - Annuities due allow more time for interest to accumulate on.

What is an Annuity? Ordinary Annuity vs. Annuity Due Differences

The payments made on an annuity due have a higher present value than an ordinary annuity due to inflation and the time value of money. An ordinary annuity is when a payment is made at the end of a period. An annuity due is when a payment is due at the beginning of a period. While the difference may seem meager, it can make a significant impact.

The time value of money. (Lecture 2) презентация онлайн

An ordinary annuity describes an annuity where the policyholder receives earnings paid out over a specific period. An ordinary annuity pays out to policyholders in intervals, and each payment occurs at the same interval, such as monthly payments made on a specific day. A common type of ordinary annuities might include the following contracts:

Annuity due Table Annuity Types Annuity Due And Ordinary Annuity

An Ordinary annuity is a fixed payment made at the end of equal intervals (Semi-annually, Quarterly or monthly), which is mostly used to calculate the present value of fixed payment paying securities like Bonds, Preferred shares, pension schemes, etc. Table of contents What is Ordinary Annuity? Examples of Ordinary Annuity Example #1 Example #2

PPT CHAPTER 3 Time Value of Money PowerPoint Presentation, free

An ordinary annuity means you are paid at the end of your covered term; an annuity due pays you at the beginning of a covered term. If you have an annuity or are considering buying annuities, here's what you need to know about an ordinary annuity vs. an annuity due.

The time value of money. (Lecture 2) презентация онлайн

An ordinary annuity means you are paid at the end of your covered term; an annuity due pays you at the beginning of a covered term. If you have an annuity or are considering buying.

The Key Differences Between Ordinary & Annuity Due

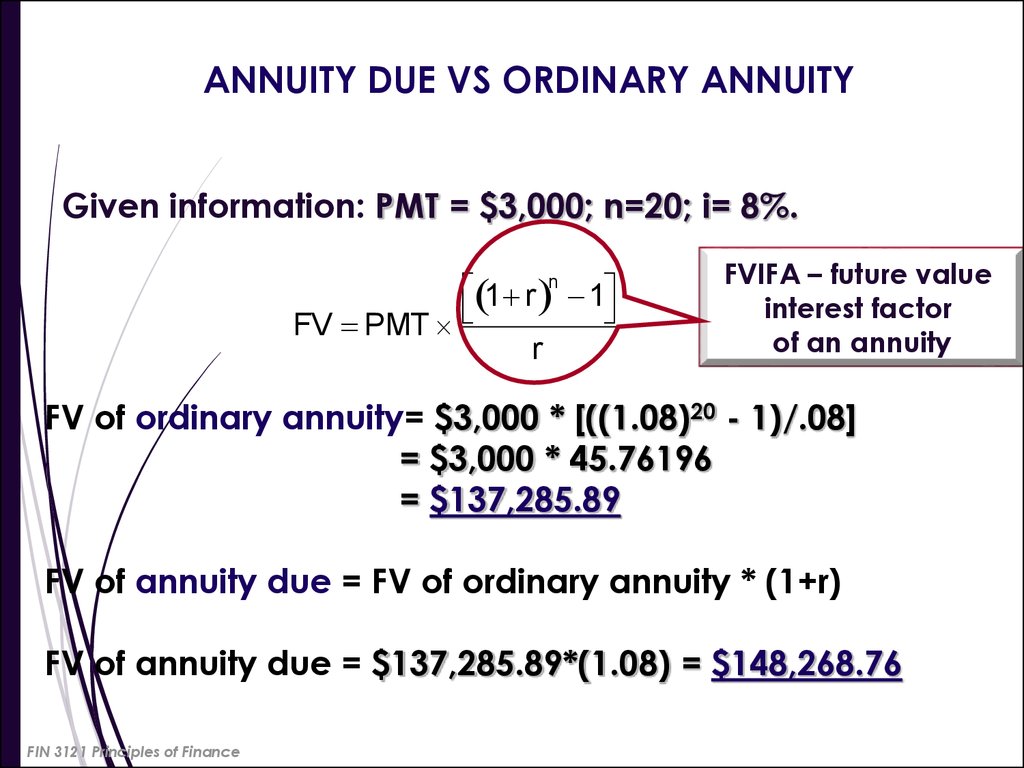

To calculate the future value of an ordinary annuity: Where: PMT - Periodic cashflows r - Periodic interest rate, which is equal to the annual rate divided by the total number of payments per year n - The total number of payments for the annuity due Example