96. Trading Breakouts using Pivot Points Forex Academy

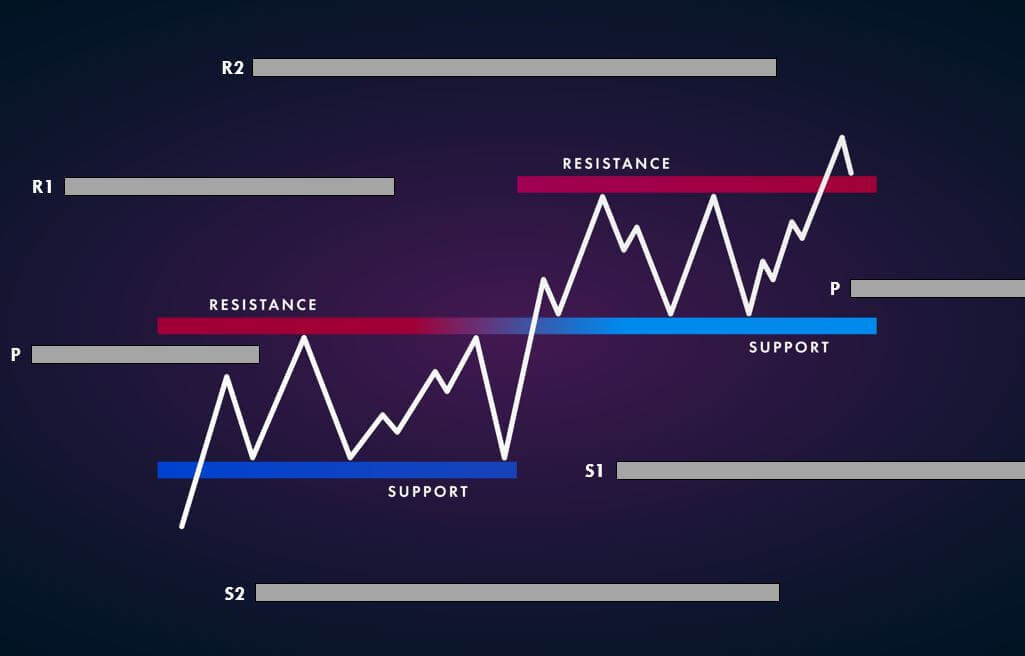

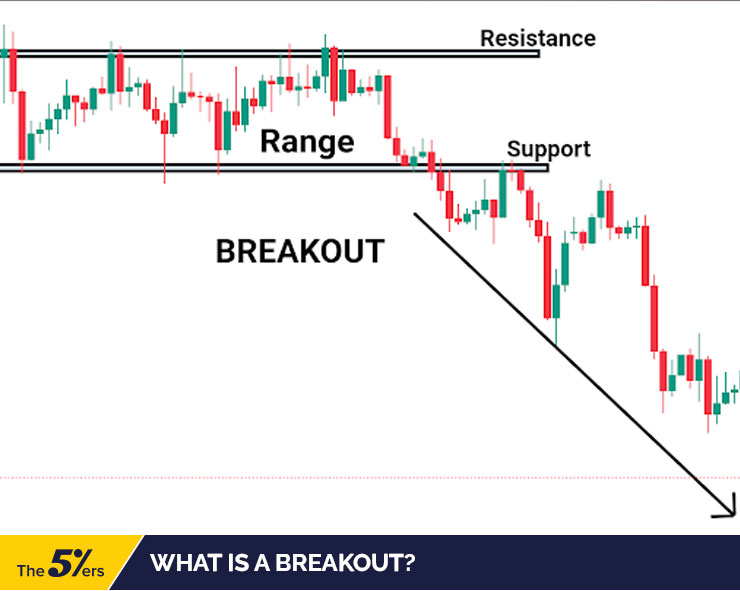

A breakout is when the market moves above a resistance or below a support level, and indicates that prices may continue in the direction of the breakout. However, while trading breakouts may seem very compelling, most of them end up as false breakouts, commonly called "fake-outs". This means that the market turns around and that the.

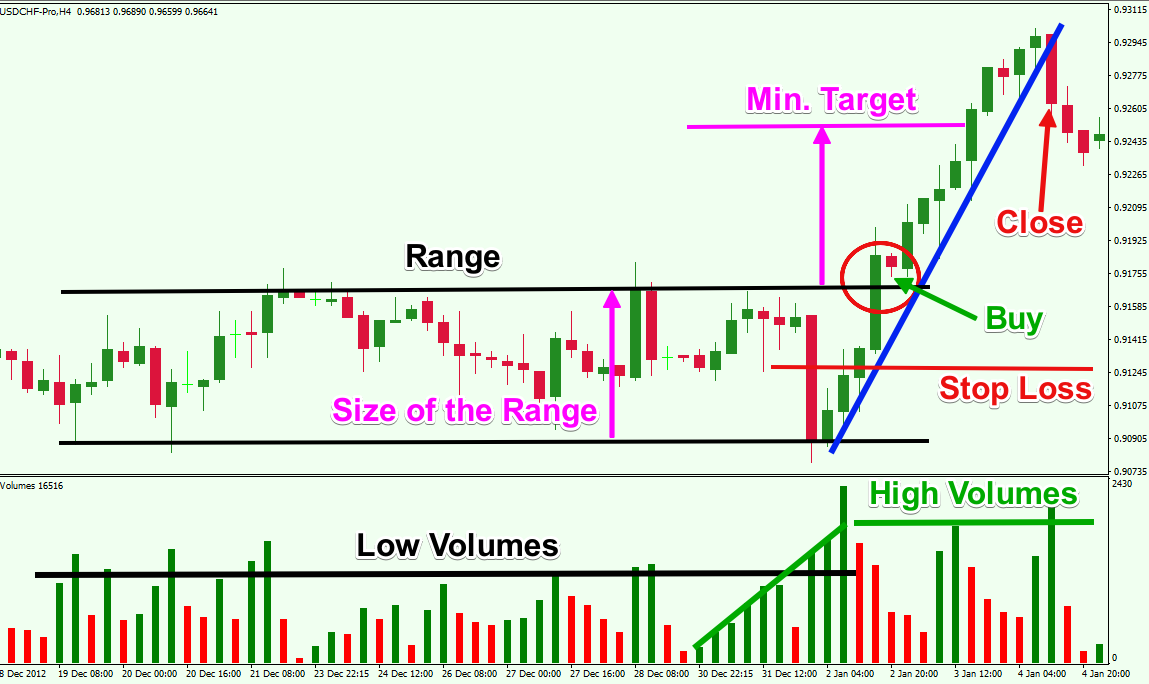

rangebreakouttradingexample Forex Training Group

Okay, the stage two breakout trader waits patiently until the price clearly breaks out of the zone. There is believed to be a support zone around the area from $92 to $96. The candle shown clearly went all the way down to $88, which was when the breakout trader sold. The price when down and then came back into the range.

The Complete Guide to Breakout Trading

A breakout trader tries to spot a breakout, which is when the price of a security rises above or drops below a range in which it has been oscillating. This range is usually bound by support and resistance levels, though some traders use other levels based on the Fibonacci sequence or other indicators. A support level is a low that a security.

The Best Breakout Trading Strategy Trade Room Plus

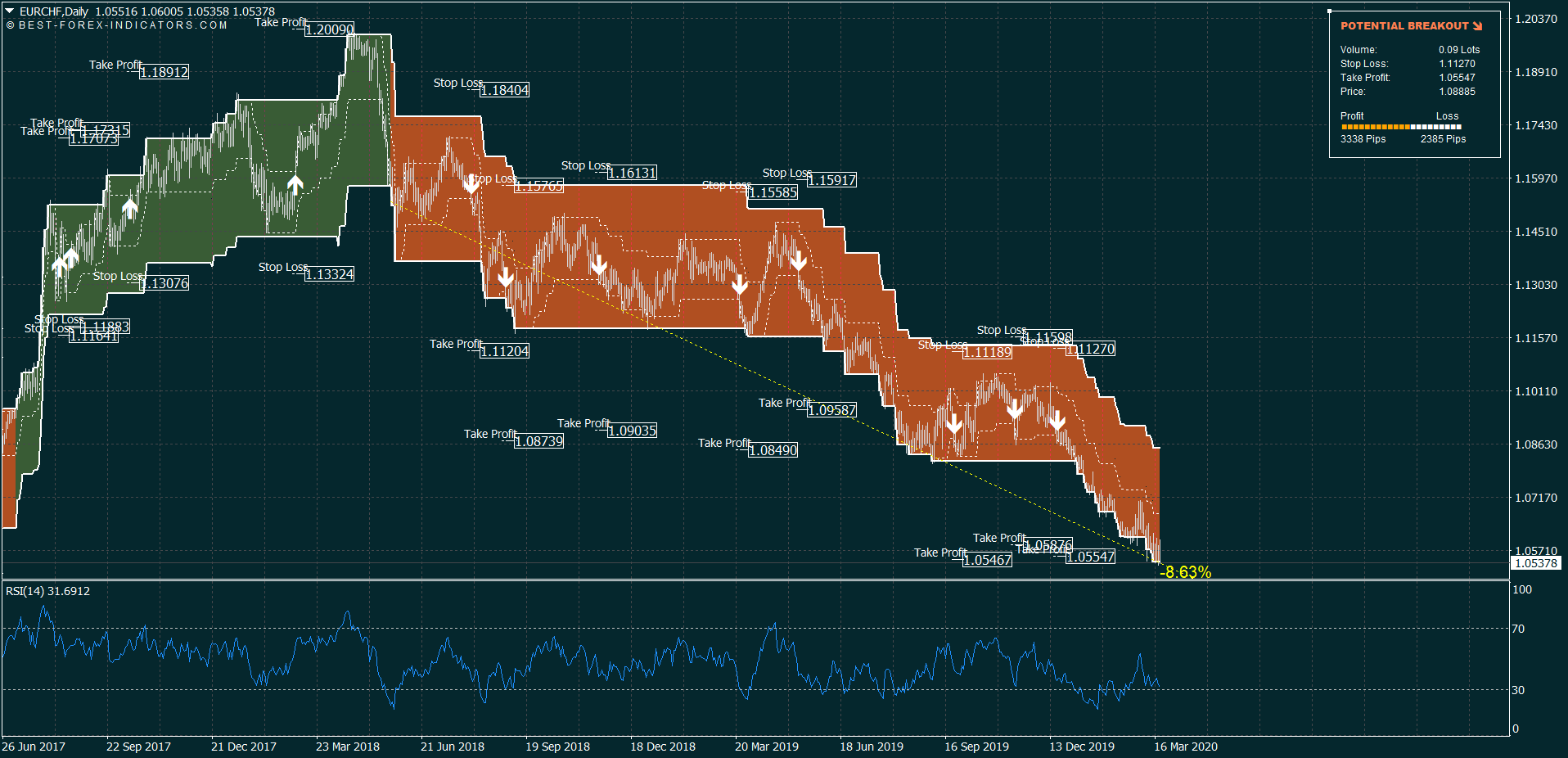

Breakout Trading Strategy: The Trend Trading Breakout. Here's the deal: In a strong trend, the price tends to stay above the 20-period Moving Average. So if you're waiting for a pullback, then you'll be disappointed as the market continues making new highs — without you.

The Complete Guide to Breakout Trading

A breakout trader is a person who uses a specific trading strategy to buy or sell financial securities such as stocks, currencies, or commodities. A breakout trader focuses on identifying securities that have broken through significant levels of support or resistance with increased volume. The goal of a breakout trader is to capture potential.

The 3 Types of Breakouts in Trading SurgeTrader

Breakout trading is a common technique used by traders of all experience levels. In this article, we'll explain what breakout trading is, offer some tips for breakout trading, and show a simple strategy a trader can use as a basis to start trading breakouts.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Anatomy_of_Trading_Breakouts_Jun_2020-04-b83064c68c16499b8d92602a438bc58f.jpg)

The Anatomy of Trading Breakouts

What is an intraday breakout? When you zoom in, using the 1-hour timeframe or lower, you'll be trading intraday. The breakout principles are the same in any timeframe. Sometimes there are unique intraday opportunities around specific assets, times, etc. For example, you can build an intraday breakout trading strategy around Chinese stock indices.

:max_bytes(150000):strip_icc()/breakouttradingexampleSHOP-913b9bb07a204623931266dcb898c679.jpg)

Breakout Trader Overview, Types, Example

Breakout trading is a popular strategy used by traders in the financial markets to capitalize on significant price movements. It involves identifying key levels of support and resistance and taking advantage of breakouts, where the price breaks through these levels, indicating a potential trend reversal or a continuation of an existing trend.

Breakout Trading Strategy Used By Professional Traders

Changing Traders' Lives By Teaching Them How To Earn Consistent Cashflow. 816 Ligonier Street #405 Latrobe, PA 15650. (724) 374-8352. [email protected]. Legal Disclaimer. In today's article, we're going to talk all about the best breakout trading strategy used by professional traders to trade breakouts.

Breakout Trading Strategy Quick Guide With Free PDF

A breakout strategy aims to enter a trade as soon as the price manages to break out of its range. Traders are looking for strong momentum and the actual breakout is the signal to enter the position a nd profit fro m the market movement that follows. Traders may enter the positions in the market, which means they will have to closely monitor the.

BREAKOUT TRADING STRATEGY It's so easy! 🔥📈 YouTube

What is Breakout Trading? 樂. Breakout trading is possible when a specific movement in the price of a stock has occurred. This can either be an upward movement, indicating that the asset has moved above the resistance area or a downward movement, indicating that the asset has left the support area.. Traders generally believe that when the price of an asset suddenly spikes, that this is the.

Breakout Trading Simple Introduction for Beginners BestForex

The idea with breakout trading is to enter a trade just as a stock's momentum is picking up and it's breaking new highs. The last thing you want to do is jump in too late and stay for too long because of FOMO. Stick to a trading plan. A good trading plan will include an entry/exit strategy and trading goals.

The Complete Guide to Breakout Trading

Intraday breakout trading is a dynamic strategy that is widely embraced by traders seeking to profit from short-term price fluctuations within a single trading day. This breakout strategy hinges on identifying and capitalizing on significant price movements, particularly when an asset's price breaks either the highest or lowest level it has.

Best Breakout Trading Strategy (MUST KNOW) YouTube

A breakout is the movement of the price of an asset through an identified level of support or resistance.. He has been a professional day and swing trader since 2005. Cory is an expert on stock.

How to Take Advantage of The Breakout Trading Strategy

Over 6.2 million reviews have been published on Checkatrade. Book a Guaranteed Checkatrade tradesperson, and your projects are covered for 12 months. Recommendations you can rely on.

What is a Breakout Trading Strategy & How to Trade It? / Axi AU

Breakout trading is a strategy used by active investors to take advantage of significant price moves in the early stages of a trend. A breakout occurs when the price of an asset moves above a resistance level or below a support level with increasing volume. This strategy can signal future volatility expansions and major price trends if managed.