Receivables Turnover Ratio Defined Formula, Importance, Examples, Limitations

Net credit sales equals gross credit sales minus returns (75,000 - 25,000 = 50,000). Average accounts receivable can be calculated by averaging beginning and ending accounts receivable balances ( (10,000 + 20,000) / 2 = 15,000). Finally, Bill's accounts receivable turnover ratio for the year can be like this. As you can see, Bill's.

9 Tips to Improve Your Accounts Receivable Turnover Enkel

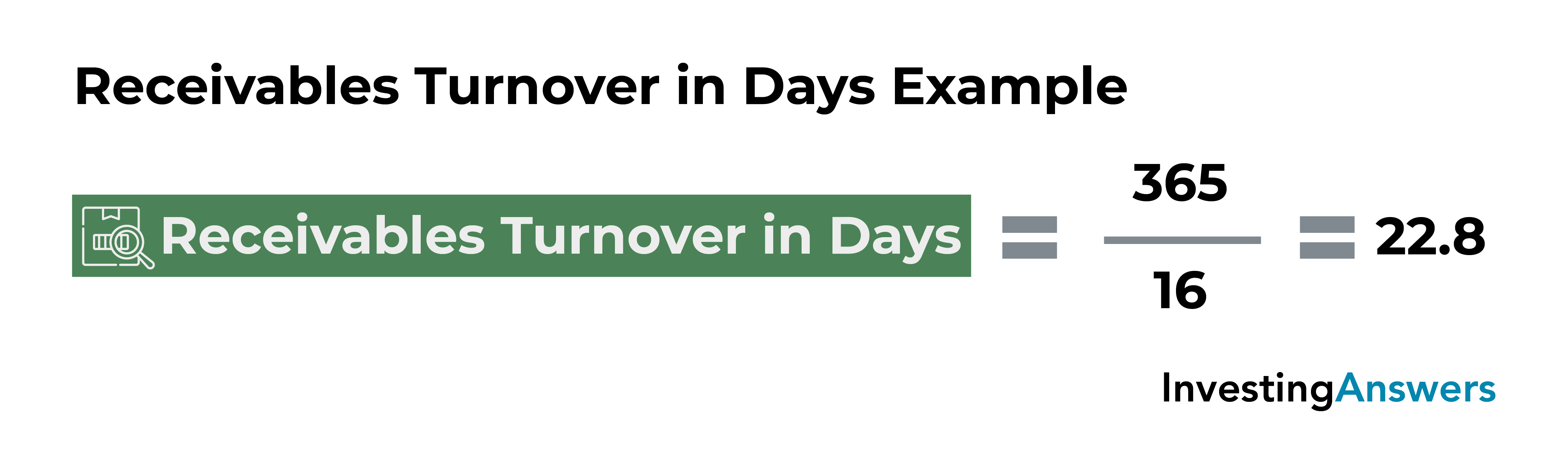

Accounts Receivable Turnover (Days) (Year 2) = 325 ÷ (3854 ÷ 360) = 30,3. Accounts Receivable Turnover in year 1 was 28,5 days. It means that the company was able to collect its receivables averagely in 28,5 days that year. In year 2 this ratio increased, indicating that the company needed 30,3 days to collect its receivables.

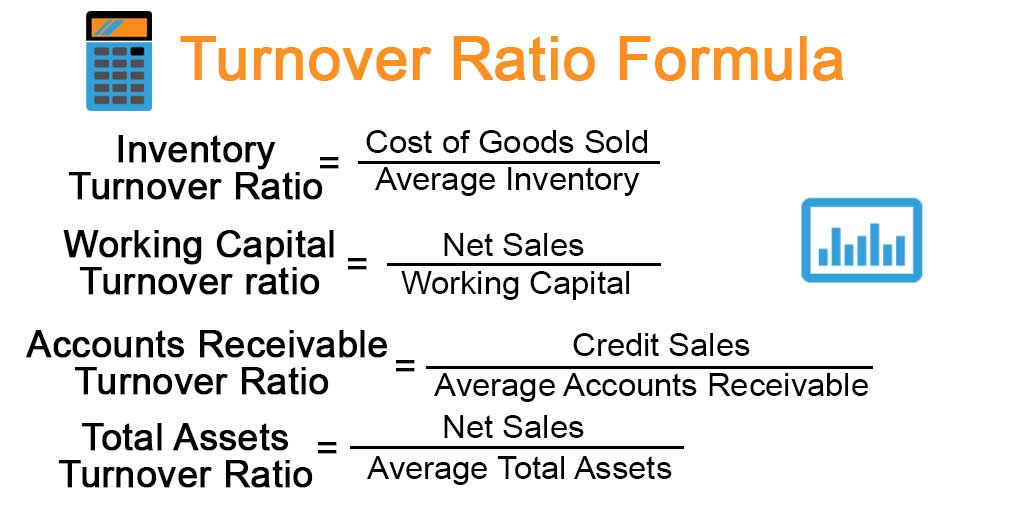

Turnover Ratio Formula Example with Excel Template

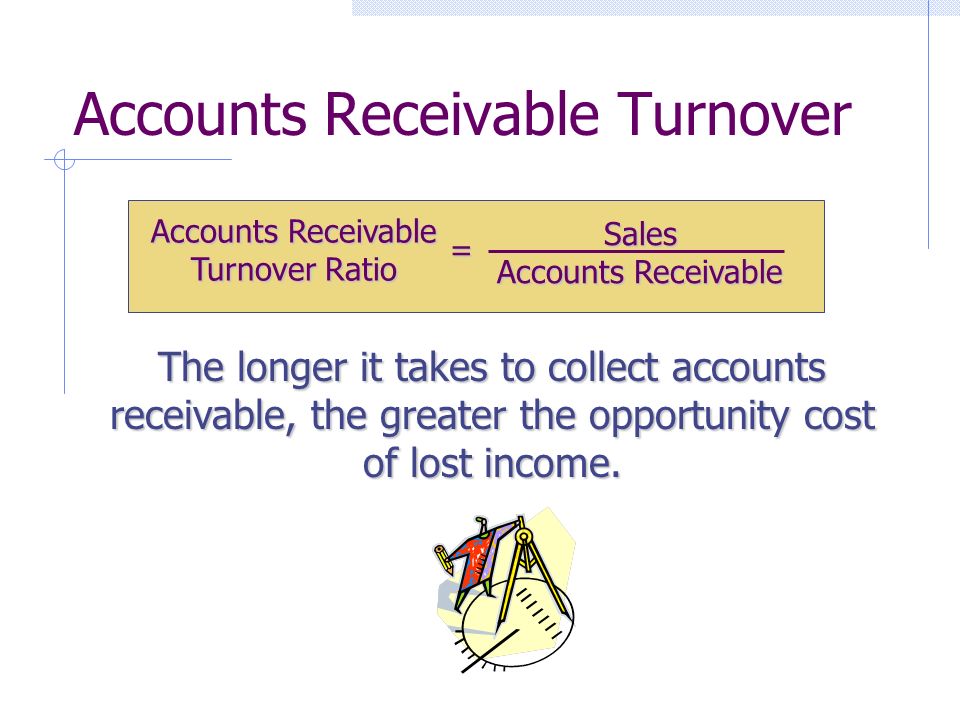

Table of Contents. The accounts receivable turnover ratio is a simple metric that is used to measure how effective a business is at collecting debt and extending credit. It is calculated by dividing net credit sales by average accounts receivable. The higher the ratio, the better the business is at managing customer credit.

Receivables Turnover Formula and Ratio Calculation

Accounts Receivable Turnover Ratio = $100,000 - $10,000 / ($10,000 + $15,000)/2 = 7.2 . In financial modeling, the accounts receivable turnover ratio is used to make balance sheet forecasts. The AR balance is based on the average number of days in which revenue will be received. Revenue in each period is multiplied by the turnover days and.

Understanding Accounts Receivables Turnover Ratio

Jawaban : 1. Perhitungan Piutang Rata-rata. 2. Perhitungan Rasio Perputaran Piutang. Seperti kasus perhitungan diatas bisa Anda ketahui nilai rasio perputaran piutang (receivable turnover ratio) yaitu sebesar 8 kali. Baca Juga : Penjelasan Lengkap Return On Investment (ROI) dan Perhitungannya.

Accounts receivable turnover ratio What you need to know Billtrust

This tutorial explains how the accounts receivable turnover ratio works, including its meaning, formula, calculations, and interpretation. Furthermore, using.

Accounts Receivable Turnover Get the allImportant Details Here!

Receivables Turnover Ratio: The receivables turnover ratio is an accounting measure used to quantify a firm's effectiveness in extending credit and in collecting debts on that credit. The.

Accounts Receivable Turnover Ratio Definition, Formula & Example

Accounts Receivable Turnover Ratio = $100,000 - $10,000 / ($10,000 + $15,000)/2 = 7.2 . In financial modeling, the accounts receivable turnover ratio is used to make balance sheet forecasts. The AR balance is based on the average number of days in which revenue will be received. Revenue in each period is multiplied by the turnover days and.

Accounts Receivable Turnover Ratio Accounting Play

Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable. The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner. It is one of the most important measures of collection efficiency.

20 Key Financial Ratios InvestingAnswers

Key Takeaways. Improving accounts receivables turnover enhances cash flow by expediting the conversion of credit sales into cash. Swift collection of outstanding payments reduces the time funds are tied up in unpaid invoices. This accelerated cash inflow allows for timely reinvestment or debt reduction, potentially lowering interest expenses.

:max_bytes(150000):strip_icc()/receivableturnoverratio-8f6c3aac6494463a8e6cdd011e236fbe.jpg)

Receivables Turnover Ratio Defined Formula, Importance, Examples, Limitations

Step 3: Divide. Once you have these two values, you'll be able to use the accounts receivable turnover ratio formula. You'll divide your net credit sales by your average accounts receivable to calculate your accounts receivable turnover ratio, or rate. As a reminder, this ratio helps you look at the effectiveness of your credit, as your net.

Receivable Turnover Ratio Definition, and Formula Finance Strategists

The accounts receivable turnover ratio is an efficiency ratio that measures the number of times over a year (or another time period) that a company collects its average accounts receivable. Dividing 365 by the accounts receivable turnover ratio yields the accounts receivable turnover in days, which gives the average number of days it takes.

Receivables Turnover Formula and Ratio Calculation

Accounts Receivable Turnover Explained. The accounts receivable turnover or debtor's turnover ratio is a measure of maintaining accounts which clarifies an organization's efficiency in providing debt and collecting those debts. In general terms, 7.8 is considered a good accounts receivable turnover ratio.

Accounts Receivable Turnover Ratio Formula & Interpretation

The accounts receivable turnover ratio, or debtor's turnover ratio, measures how efficiently a company collects revenue. Your efficiency ratio is the average number of times that your company collects accounts receivable throughout the year. An average accounts receivable turnover ratio of 12 means that your company collects its receivables.

𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐑𝐞𝐜𝐞𝐢𝐯𝐚𝐛𝐥𝐞 𝐓𝐮𝐫𝐧𝐨𝐯𝐞𝐫 𝐅𝐨𝐫𝐦𝐮𝐥𝐚 𝐒𝐭𝐞𝐩 𝐛𝐲 𝐒𝐭𝐞𝐩 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐨𝐧 Accounting Drive

The accounts receivable turnover ratio, also known as the debtors turnover ratio, indicates the effectiveness of a company's credit control system. Much like the inventory turnover ratio, the accounts receivable turnover ratio shows how many times debtors are extended credit that they fully repay each year. It is calculated as shown below.

Understanding Accounts Receivables Turnover Ratio

To calculate their accounts receivable turnover ratio, they divide net credit sales ($500,000) by the average accounts receivable ($125,000) and end up with the number four. Company "B" also has $500,000 in net credit sales for the year, but its average accounts receivable equals $50,000. When their net credit sales ($500,000) are divided.